The 2022 Conflict between Ukraine-Russia Witnessed an economic Downturn on the global economic Front.

Introduction

The economic impact of the 2022 Russian invasion of Ukraine began in late February 2022, in the days after the Russian Federation recognized two break-away Ukrainian republics and commenced a war in Ukraine. The subsequent economic sanctions have targeted large parts of the Russian economy, Russian oligarchs, and members of the Russian government. Russia has responded with sanctions of its own. Both the conflict and the sanctions have had a strongly negative impact on the world economic recovery during the ongoing COVID-19 recession. As a result of its war, estimates of a 30-year economic setback are projected for Russia.

The World Bank is now predicting Ukraine’s economy will contract by up up 45% in 2022. Critical export routes via Ukraine’s Black Sea ports in Mariupol and Odessa have been cut off. Mariupol has been razed by Russian bombardment and Odessa is effectively under blockade by Russian naval forces. Before the war, these routes accounted for half of Ukraine’s total external trade and 90% of the grain trade.

Ukraine is a major exporter of wheat, a mainstay of the economy, but the government has banned the export of grains and other staples as it seeks to ensure food security for more than 6.5 million people who are displaced within the country.

Over the medium term, the damage to production and export capacity coupled with a loss of human capital are expected to have lasting economic and social repercussions.

One of the keys to planning a military campaign is to take into account the type of terrain the war will take place on. The frontlines of the Ukraine conflict underline how important this is – they are mainly defined by rivers and other land-based obstacles. To progress, Russian forces need to negotiate their way across or around these natural barriers. But if they approach the problem head on, they will not have the luxury of making these crossings unopposed.

The National Bank of Ukraine suspended currency markets, announcing that it would fix the official exchange rate. The central bank also limited cash withdrawals to ₴100,000 per day and prohibited withdrawal in foreign currencies by members of the general public. The PFTS Ukraine Stock Exchange stated on 24 February that trading was suspended due to the emergency events. On 10 April 2022, Bloomberg News service reported that the Ukrainian economic growth for 2022 is likely to suffer a sharp decline estimated at a 45% decrease in annual performance as a result of the Russian invasion.

Supply Chain Effects

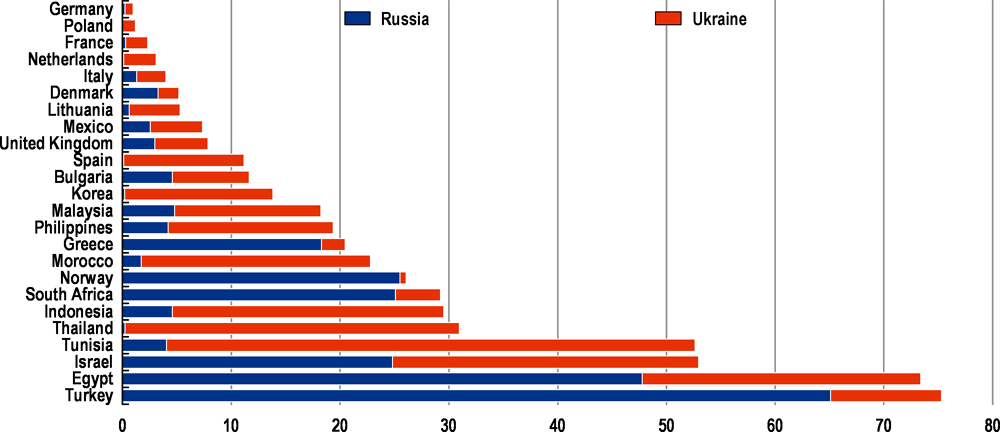

Supply chain chaos due to Russia’s key role in energy and commodity trade could fuel global inflation. At the time of the invasion, Ukraine was the fourth-largest exporter of corn and wheat, and the world’s largest exporter of sunflower oil, with Russia and Ukraine together responsible for 29% of the world’s wheat exports and 75% of world sunflower oil exports. On 25 February, the benchmark Chicago Board of Trade March wheat futures contracts reached their highest price since 2012, with the prices of corn and soybean also spiking. The head of the World Food Programme, David Beasley, warned in March that the war in Ukraine could take the global food crisis to “levels beyond anything we’ve seen before”. A potential disruption to global wheat supplies could exacerbate the ongoing hunger crisis in Yemen, Afghanistan and East Africa.

Wheat prices surged to their highest prices since 2008 in response to the 2022 attacks. At the time of the invasion, Ukraine was the fourth-largest exporter of corn and wheat, and the world’s largest exporter of sunflower oil, with Russia and Ukraine together responsible for 27% of the world’s wheat exports and 53% of the world’s sunflowers and seeds. Surging wheat prices resulting from the conflict have strained African countries such as Egypt, which are highly dependent upon Russian and Ukrainian wheat exports, and have provoked fears of social unrest.

Conflict and lack of trust, they surmise, will undercut investment and trade and unleash a general retreat from international interdependence. Others see Russia’s efforts to open channels for trade with India and China as harbingers of a new multipolar order.

Russia is reeling under dramatic economic sanctions. Though energy trade continues, Russia has been effectively cut off from global financial system. The ruble exchange rate may have nominally recovered to its prewar level. But the actual market value of the Russian currency is anyone’s guess. There no longer is a free market in rubles or in Russian financial assets. The Kremlin will be lucky if output contracts by only 10 percent this year. The withdrawal of Western companies from Russia has compounded the shock. And even if a cease-fire is reached, the prospects for Russia’s long-term development are dark indeed.

Conclusion

As the world braces to deal with the economic impact of Russia’s invasion, it should be remembered that the one action that will limit the damage and most importantly, stop the human suffering in Ukraine, is an immediate end to the war.