Introduction

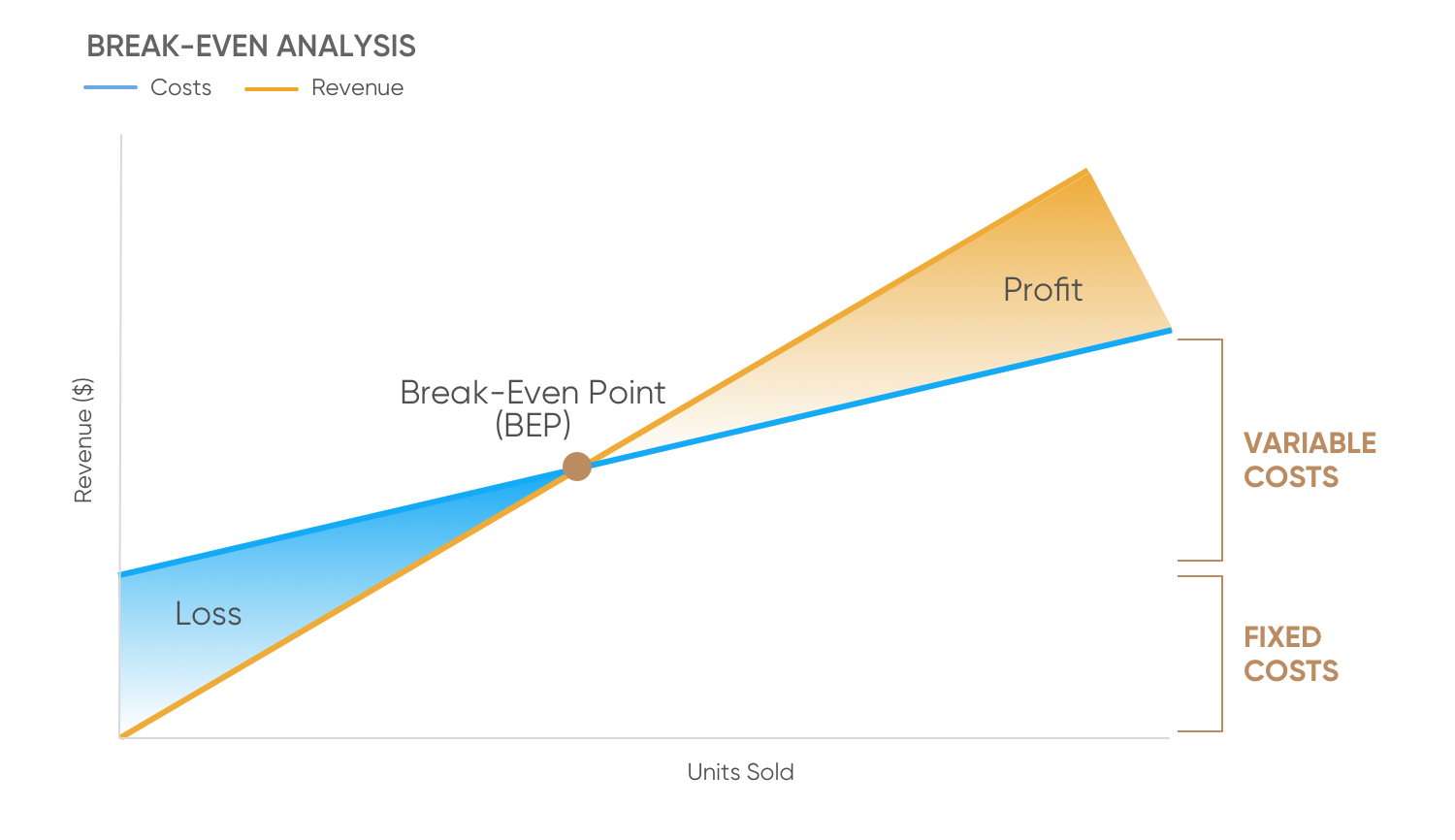

A break-even analysis is an economic tool that is used to determine the cost structure of a company and to understand equilibrium.

The break-even analysis is used to examine the relation between the fixed cost, variable cost, and revenue. Usually, an organisation with a low fixed cost will have a low break-even point of sale.

The analysis is based on the relationship:

Profit = revenue – total cost

R – TC

At breakeven, there is no profit or loss, hence,

revenue = total cost or, R = TC

It is to be noted that +ve sign is used for both the revenue and the costs. If we are to use

–ve sign for costs and +ve sign for revenue, then the above relationships become:

Profit = R + TC and R + TC = 0 at breakeven.

With revenue and costs given in terms of a decision variable, the solution yields the

break-even quantity for the decision variable.

Cost & Revenue

Costs, which may be linear or non-linear, usually include two components:

Fixed costs (FC) – Includes costs such as buildings, insurance, fixed overhead, equipment

capital recovery, etc. These costs are essentially constant for all values of the decision

variable.

Variable costs (VC) – Includes costs such as direct labour, materials, contractors, marketing, advertisement, etc. These costs change linearly or non-linearly with the decision variable, e.g. production level, workforce size, etc. For the analysis to be followed here, the variation will generally be assumed to be linear.

Then, total cost, TC = FC + VC

Revenue also changes with the decision variable. Again, for the analysis, the variation will

generally be assumed to be linear.

Calculation of Break-Even Analysis

The basic formula for break-even analysis is driven by dividing the total fixed

costs of production by the contribution per unit (price per unit less the variable

costs).

Contribution Margin

Break-even analysis also deals with the contribution margin of a product. The excess

between the selling price and total variable costs is known as contribution margin.

For an example, if the price of a product is Rs.100

total variable costs are Rs. 60 per product

fixed cost is Rs. 25 per product

the contribution margin of the product is Rs. 40 (Rs. 100 – Rs. 60).

This Rs. 40 represents the revenue collected to cover the fixed costs. In the calculation of the contribution margin, fixed costs are not considered.

Benefits of Break-even analysis

1. Catch missing expenses: When you’re thinking about a new business, it’s very much possible that you may forget about few expenses. Therefore, if you do a break-even analysis you have to review all your financial commitments to figure out your break-even point. This analysis certainly restricts the number of surprises down the road.

2. Set revenue targets: Once the break-even analysis is complete, you will get to know how

much you need to sell to be profitable. This will help you and your sales team to set more

concrete sales goals.

3. Make smarter decisions: Entrepreneurs often take decisions in relation to their business

based on emotion. Emotion is important i.e. how you feel, though it’s not enough. In order

to be a successful entrepreneur, your decisions should be based on facts.

4. Fund your business: This analysis is a key component in any business plan. It’s generally a requirement if you want outsiders to fund your business. In order to fund your business, you have to prove that your plan is viable. Furthermore, if the analysis looks good, you will be comfortable enough to take the burden of various ways of financing.

5. Better Pricing: Finding the break-even point will help in pricing the products better. This tool is highly used for providing the best price of a product that can fetch maximum profit

without increasing the existing price.

6. Cover fixed costs: Doing a break-even analysis helps in covering all fixed cost.

Uses of Break even analysis

1. Starting a new business: If you wish to start a new business, a break-even analysis is a must. Not only it helps you in deciding, whether the idea of starting a new is viable, but it will force you to be realistic about the costs, as well as guide you about the pricing strategy.

2. Creating a new product: In the case of an existing business, you should still do a break-even analysis before launching a new product—particularly if such a product is going to add a significant expenditure.

3. Changing the business model: If you are about to the change your business model, like,

switching from wholesale business to retail business, you should do a break-even analysis.

The costs could change considerably and this will help you to figure out the selling prices

need to change too.

Appraisal of Break-Even Analysis

- The main advantage of break-even analysis is that it points out the relationship between cost, production volume and returns.

- It can be extended to show how changes in fixed cost-variable cost relationships, in commodity prices, or in revenues, will affect profit levels and break-even points.

- Break-even analysis is most useful when used with partial budgeting or capital budgeting techniques. The major benefit to using break-even analysis is that it indicates the lowest amount of business activity necessary to prevent losses.

Limitations of break-even analysis include:

• It is best suited to the analysis of one product at a time;

• It may be difficult to classify a cost as all variable or all fixed;

• There may be a tendency to continue to use a break-even analysis after the cost

and income functions have changed.