Introduction

Government revenue is the money that is received by the government in form of taxes, other fees, fines, and other nontaxable sources. Indian government revenue follows the same definition and involves taxes and other non-tax sources. The size of the Indian economy is rapidly increasing – it is now the sixth biggest economy in the world. To fund the financial needs of a country as big as India is an overly complex process.

There are a variety of sources from which government can derive revenue. The most common sources of government revenue have varied in different places and time periods. Government revenue is distinct from government debt and money creation, which both serve as temporary measures of increasing a government’s money supply without increasing its revenue.

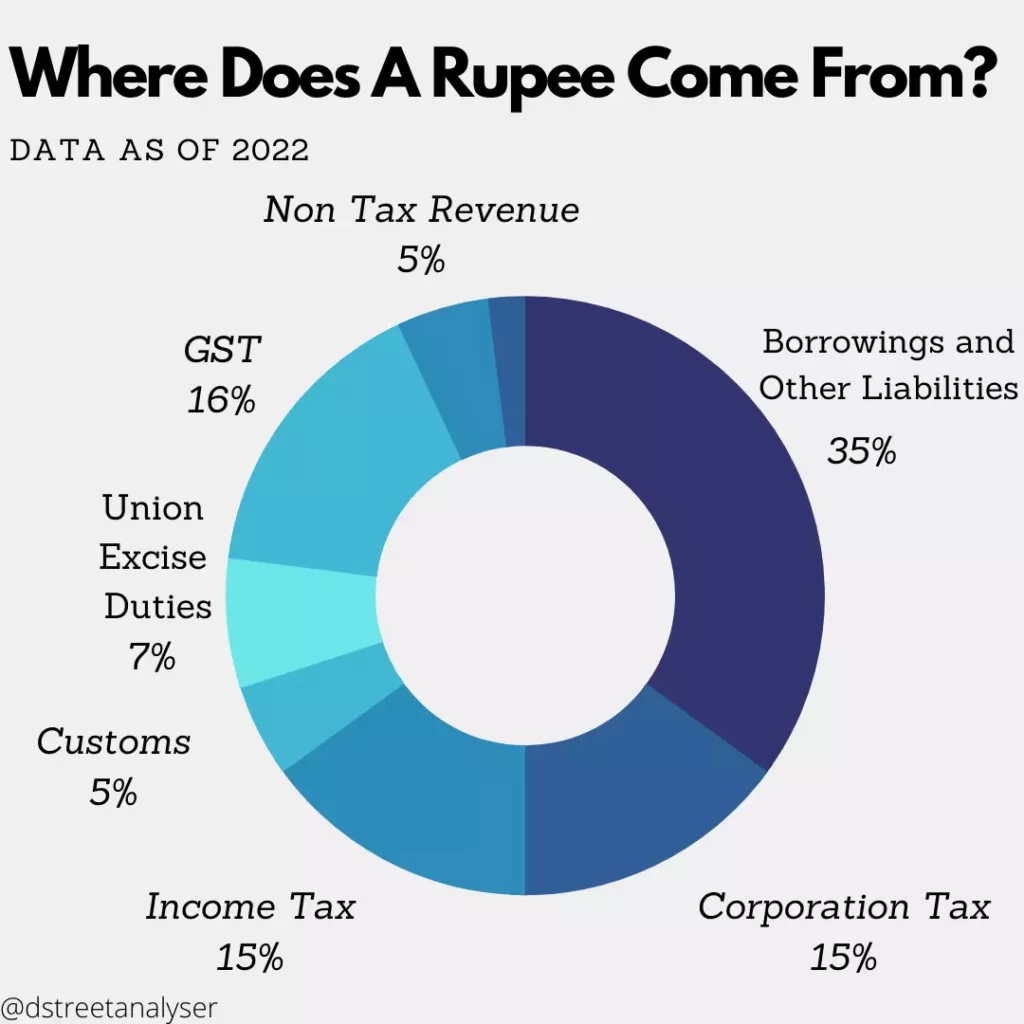

The Indian government’s main source of income is from Goods and Services Tax (GST) and income tax. Both forms constitute nearly 90% of the government’s total tax collection. It’s quite known that the GOI doesn’t rely only on direct taxes, so here we are, discussing about the sources of revenue for government of India.

Sources of Revenue

Borrowings and Other Liabilities

The money or loan which is taken by the government from within the country, from another country or from a national or international organization is known as borrowing.

GST

The Goods and services tax (GST) is the comprehensive indirect tax on goods and services which are consumed by the citizens of our nation or sold in the country.

There are different slabs as well for the different goods according to the utility, like 0%, 5%, 12%, 18% and 28%.

Income Tax

Income Tax is a tax which is paid to the government on the income of its citizens. Income tax includes money from salary earned, income from house property, profit from business, etc. Surprisingly, in India only 1% of the population pays the income tax.

Corporation Tax

Corporate Tax is also known as Company tax, it is collected on the Net Annual Capital of a company. Some private or public companies, societies, clubs, etc. pay the tax. It comes under the Companies Act, 1956. The corporate tax needs to be filed because corporates handle around a vast section of the money supply in the economy, making this section the most vulnerable to frauds.

Union Excise Duties

Union Excise Duties is charged on goods manufactured in India. it is a type of indirect tax. It comes under the Central Excise Tarif Act, 1985. The union taxes goes exactly to the union budgets to be supplied for union budgets.

Customs

Customs is a tax which is collected on import and export of goods. It is also charged on Mobiles for 10% Service Welfare Cess over and above. Popularly known as import export tax, which is levied to increase or decrease the products in trade.

Non-Tax Revenue

Non-tax Revenue is the tax which is collected by indirect sources. It includes interest receipts, the money which is given to different states as loan is paid, fines, penalties, etc.

Non-Debt Capital Receipts

Non-Debt Capital Receipts is the money which is made from the sale of old assets. It is received by the government.

Eg:- loans received from foreign government, net borrowing by government at home.

Current Trends

The Centre beat all its estimates of revenue collection in the financial year ended on March 31, aided by better indirect tax mop-up, strict compliance measures, and recovery in most sectors following the successive waves of the Covid-19 pandemic.

India’s gross revenue collection soared to a record high of Rs 27.07 trillion in FY22, while the tax-to-GDP ratio jumped to an over two-decade high of 11.7 per cent, the finance ministry said on Friday. The total mop-up was 34 per cent more than the Rs 20.27 trillion collected in FY21. In 2021-22, GST contributed over 57% to the total tax collection.

Conclusion

Indian Government revenue consists of many tax and non tax sources, which are directly involved in the reconstruction of the National budgets and other expenditures influencing the economy at its vast.