Credit cards can help unlock exclusive benefits such as discounts, cashback, and reward points when booking flights. Travel is a significant expense for many, so using the right credit card for flight bookings can make a huge difference. In this article, we’ll explore the best credit cards for flight tickets in India in 2024, providing detailed information on benefits, application processes, required documents, and more. Unlock the best credit cards for flight tickets in India.

Why Use Credit Cards for Flight Ticket Bookings?

Credit cards offer several advantages when booking flights, including:

- Reward Points: Most credit cards give you reward points on flight bookings, which can be redeemed for free tickets, upgrades, or other travel benefits.

- Discounts & Offers: Credit cards offer exclusive travel-related discounts, including airfare and baggage fees.

- Travel Insurance: Some cards include travel insurance that covers trip cancellations, delays, lost baggage, and other issues that might arise during your travel.

- Lounge Access: Premium credit cards often provide access to domestic and international airport lounges, making your travel experience more comfortable.

Top 10 Credit Card Offers for Flight Tickets in 2024

Here are the best credit cards that offer unique benefits for flight bookings in India:

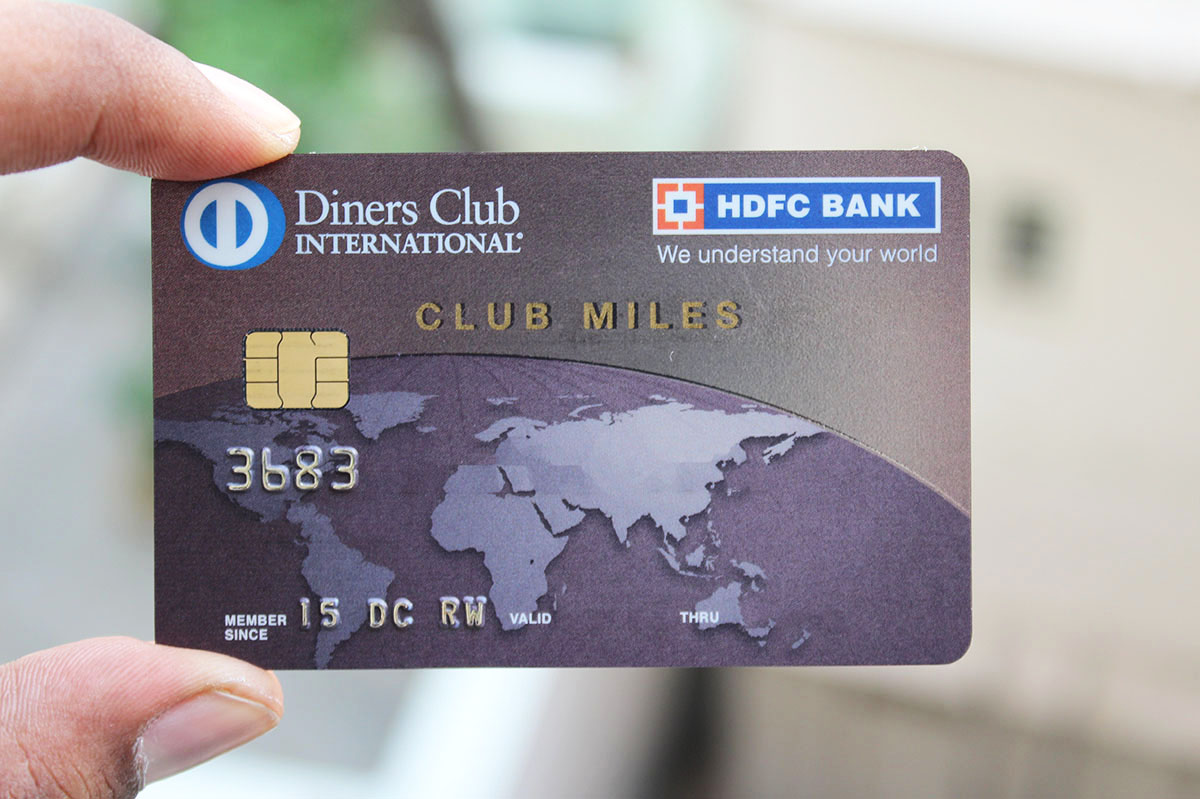

HDFC Bank Diners Club Miles Card

- Benefits:

- 5x reward points on flight bookings and travel-related expenses.

- Complimentary access to over 1,000 airport lounges worldwide.

- 2 complimentary airport lounge visits per quarter.

- Best for: Frequent travelers and luxury cardholders.

- How to Apply: Apply online through the HDFC Bank website or visit a branch.

- Required Documents: Proof of income, address, and identity.

Axis Bank Vistara Signature Credit Card

- Benefits:

- 3 Club Vistara points per ₹200 spent on flight tickets.

- Welcome voucher for a free economy flight ticket.

- Complimentary lounge access.

- Best for: Travelers flying with Vistara Airlines.

- How to Apply: Apply online or visit Axis Bank branches.

- Required Documents: KYC documents, proof of income, and PAN card.

SBI Card Elite

- Benefits:

- 2x reward points on all air travel bookings.

- 1 complimentary domestic lounge visit per quarter.

- Access to premium concierge services for travel bookings.

- Best for: Premium travelers who seek added convenience.

- How to Apply: Apply via SBI’s official website or at SBI branches.

- Required Documents: Income proof, identity proof, PAN card.

ICICI Bank Coral Credit Card

- Benefits:

- 2 reward points for every ₹100 spent on travel.

- Offers discounts and cashback on flight ticket bookings.

- Complimentary movie tickets and dining offers.

- Best for: Budget-conscious travelers.

- How to Apply: Online application is available on ICICI’s official website.

- Required Documents: Address proof, income proof, identity proof.

Citi PremierMiles Card

- Benefits:

- 10 miles for every ₹100 spent on flight bookings.

- Miles can be redeemed for flights across 1,000 airlines.

- Complimentary access to 600+ airport lounges worldwide.

- Best for: Frequent flyers looking for extensive airline benefits.

- How to Apply: Apply online through Citibank’s website or by visiting a branch.

- Required Documents: PAN card, address proof, income proof.

American Express Platinum Travel Credit Card

- Benefits:

- Earn 1.25 Membership Rewards points for every ₹50 spent on flight bookings.

- 3 complimentary lounge visits per year.

- Discounted airfares and hotel bookings are available through Amex Travel.

- Best for: High spenders and luxury travelers.

- How to Apply: Apply on the American Express website.

- Required Documents: PAN card, identity proof, income proof.

IndusInd Bank Pioneer Heritage Credit Card

- Benefits:

- 4 reward points per ₹150 spent on travel.

- Discounted and priority access to flight booking offers.

- Complimentary lounge access at airports.

- Best for: First-time travelers looking for a balance of benefits.

- How to Apply: Apply online or in person at an IndusInd branch.

- Required Documents: KYC documents and proof of income.

RBL Bank World Safari Credit Card

- Benefits:

- 3x reward points on flight bookings.

- Complimentary travel insurance and concierge services.

- Discounted booking offers with travel partners.

- Best for: Those who travel both domestically and internationally.

- How to Apply: Apply online via RBL’s website.

- Required Documents: PAN card, proof of identity, proof of income.

Kotak Mahindra Bank Privy League Signature Credit Card

- Benefits:

- 4 reward points per ₹150 spent on travel bookings.

- Access to premium airport lounges.

- Offers exclusive travel and holiday packages.

- Best for: Luxury travelers and business professionals.

- How to Apply: Online or at Kotak Mahindra Bank branches.

- Required Documents: Identity proof, address proof, income proof.

Bank of Baroda Prime Credit Card

- Benefits:

- 1% cashback on flight bookings.

- Discounts on hotels and travel bookings.

- Complimentary airport lounge access.

- Best for: Everyday travelers looking for an easy-to-use card.

- How to Apply: Apply through the Bank of Baroda’s website.

- Required Documents: KYC documents, proof of income, and PAN card.

How to Apply for a Credit Card for Flight Ticket Bookings

The process of applying for a credit card generally involves the following steps:

- Research & Compare: Based on your needs (rewards, discounts, benefits), compare credit cards from different banks to choose the best one for flight bookings.

- Check Eligibility: Ensure you meet the card’s eligibility criteria, such as minimum income, credit score, and age requirements.

- Submit Application: Apply through the bank’s official website mobile app or visit a branch.

- Document Submission: Submit required documents such as income proof, address proof, identity proof, and PAN card.

- Approval Process: After reviewing your application and documents, the bank will approve or decline your application.

- Card Issuance: If approved, your card will be mailed to you, and you can start using it for flight bookings.

What to Consider Before Applying

- Interest Rates: If you plan to carry a balance on the card, understand the interest rate the bank charges.

- Annual Fees: Some premium cards may charge high yearly fees. Ensure the benefits justify the cost.

- Reward Redemption: Check how you can redeem reward points or miles and see if there are any restrictions or blackout periods.

- Additional Benefits: Look for other perks, such as lounge access, travel insurance, and concierge services, to enhance your travel experience.

Comparison Table: Top Credit Cards for Flight Tickets

Credit Card Reward Points Lounge Access Welcome Benefits Annual Fee

HDFC Bank Diners Club Miles Card 5x points 1,000+ lounges Access to 1,000+ lounges ₹2,500

Axis Bank Vistara Signature Card 3 points/₹200 4 visits/yr Free flight voucher ₹3,000

SBI Card Elite 2x points 1 visit/quarter Exclusive offers and perks ₹4,999

Citi PremierMiles Card 10 miles/₹100 600+ lounges Free miles conversion ₹3,000

Amex Platinum Travel Card 1.25 points/₹50 3 visits/yr Discounted airfare ₹5,000

Frequently Asked Questions (FAQs)

Q. What are the benefits of using a credit card for flight bookings?

A. Credit cards offer rewards points, discounts, complimentary lounge access, and travel insurance when booking flights. They also allow you to earn miles or points that can be redeemed for future travel.

Q. Can I use credit card reward points to book flight tickets?

A. Yes, most credit cards allow you to redeem reward points for flight bookings with partnered airlines or travel platforms.

Q. Are there any hidden charges when booking flights with credit cards?

A. Some credit cards may charge a processing fee or forex conversion fee for international flight bookings. Always check the terms before booking.

Q. How can I earn more points when booking flights?

A. Use credit cards that offer higher reward points on travel-related expenses. You can earn bonus points for booking with specific airlines or travel portals.

Q. Is there a limit on how many flights I can book using my card?

A. No specific limit exists to how many flights you can book with your credit card, but the benefits (such as reward points or discounts) may be capped based on spending thresholds or yearly limits. Be sure to check the terms and conditions of the card you’re applying for, as some cards may limit earning rewards for certain purchases like air travel.

Q. Can I use my credit card to book international flights?

A. Yes, you can use your credit card to book international flights, and some credit cards even offer additional benefits like travel insurance, foreign exchange markup fee waivers, or bonus miles for international travel. Be sure to inquire about any international charges or forex fees that may apply.

Q. How can I redeem my reward points from flight bookings?

A. The reward points earned from flight bookings can typically be redeemed through your credit card’s rewards program for future travel bookings, upgrades, hotel stays, or even as cashback. Redemption can be done directly on the airline’s website or via the card issuer’s partner platforms, like travel portals or booking agencies.

Q. Do I need a high credit score to apply for a travel credit card?

A. A good to excellent credit score can increase your chances of approval, but some travel credit cards are also available for people with fair credit. However, premium cards that offer more lucrative travel benefits often require a higher credit score and a stable income.

Final Thoughts

Compare the best credit cards for flight tickets in India. Get rewarded with travel perks, air miles, discounts, and more in 2024. Credit cards offer fantastic opportunities to earn rewards, access exclusive offers, and enjoy convenience when booking flights. Choosing the right credit card for your travel needs can save you money on tickets, upgrades, and ancillary travel services. Whether you’re a frequent traveler or someone planning a vacation, there’s a card that can meet your needs.

Before applying, review the rewards structure, annual fees, interest rates, and other benefits to select the best option. Also, remember the additional perks, such as lounge access, insurance, and discounts, which can significantly improve your travel experience.

If you’re looking to maximize your travel benefits in 2024, these top 10 credit cards for flight tickets in India offer great value and the potential for significant savings on air travel.