In today’s digital age, online shopping has transformed from a mere convenience into a daily necessity for many individuals. With the rise of e-commerce, choosing the right credit card can significantly enhance your shopping experience. Credit cards tailored for online shopping offer many benefits, including rewards programs, cashback incentives, exclusive discounts, and comprehensive security features, making them an essential tool for savvy shoppers. This comprehensive guide delves into the best credit cards available in India specifically designed for online shopping, illuminating their unique benefits, enticing rewards, and exclusive offers.

Advantages of Using Credit Cards for Online Shopping

- Rewards and Cashback: Many credit cards allow you to earn attractive rewards points or cashback for every online purchase, providing a financial benefit with each transaction.

- Exclusive Discounts: Cardholders often gain access to special promotions and discounts on leading e-commerce platforms, making it easier to save on online purchases.

- Secure Transactions: Credit cards typically have enhanced security features, such as fraud protection, ensuring your online transactions remain safe and sound.

- EMI Options: Certain credit cards can convert larger purchases into manageable Equated Monthly Installments (EMIs), allowing flexible repayment schedules.

- Purchase Protection: Many credit cards offer additional protection against defective or damaged products by including insurance features, giving consumers peace of mind.

Top 10 Credit Cards for Online Shopping in India

1. HDFC Bank MoneyBack Credit Card

– Rewards: Earn a substantial 5% cashback on online shopping transactions and 2% on all other purchases.

– E-Commerce Benefits: Enjoy exclusive discounts on platforms like Amazon, Flipkart, and more.

– Annual Fee: ₹500, which can be waived if you spend ₹50,000 annually.

– Best For: This card is ideal for regular online shoppers who appreciate cashback rewards.

2. SBI SimplyCLICK Credit Card

– Rewards: Obtain a generous 10% discount on online shopping with select e-commerce partners.

– Cashback: Receive 5% cashback on all online purchases.

– E-Commerce Benefits: Take advantage of special offers on platforms like Amazon and BookMyShow.

– Annual Fee: Just ₹499, waived off upon spending ₹1 lakh yearly.

– Best For: Perfect for those seeking significant discounts and cashback when shopping online.

3. ICICI Bank Amazon Pay Credit Card

– Rewards: Enjoy 5% cashback on purchases made on Amazon and 2% on other online expenses.

– E-Commerce Benefits: Access exclusive discounts and promotions on Amazon India.

– Annual Fee: ₹500, waived with annual spending of ₹1 lakh.

– Best For: Excellent choice for frequent Amazon shoppers who desire high cashback rates.

4. Citi Rewards Credit Card

– Rewards: Benefit from a remarkable 10% cashback on online shopping and 5% on other purchases.

– E-Commerce Benefits: Secure special discounts on leading sites like Flipkart and MakeMyTrip.

– Annual Fee: ₹1,000, which can be waived by spending ₹30,000 annually.

– Best For: Tailored for users looking to maximize cashback and discounts across various online platforms.

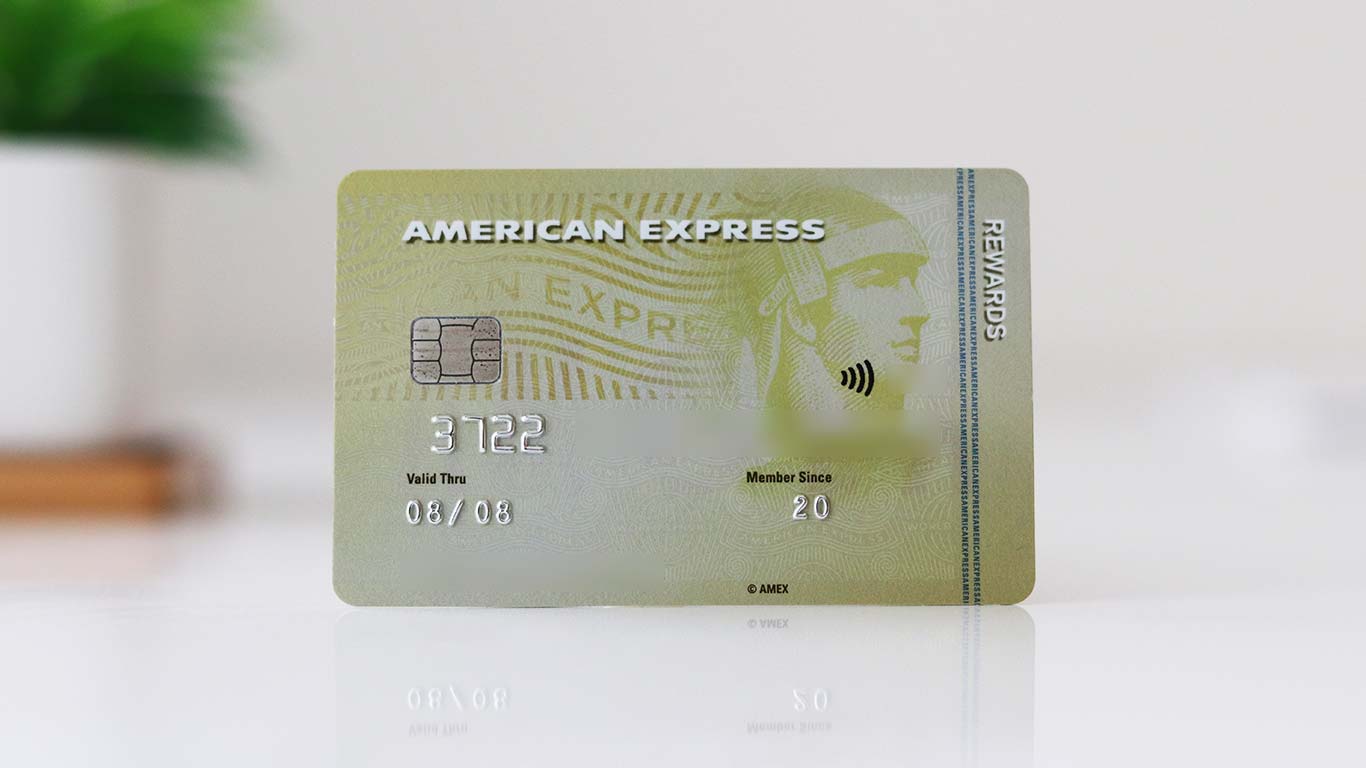

5. American Express Membership Rewards Credit Card

– Rewards: Gather 5% cashback on online purchases and 2% on all other transactions.

– E-Commerce Benefits: Access exclusive discounts on top e-commerce sites like Amazon and Myntra.

– Annual Fee: ₹1,000, waived off on spending ₹50,000 annually.

– Best For: Suitable for users pursuing premium rewards and exclusive shopping offers.

6. Axis Bank Flipkart Credit Card

– Rewards: Get 5% cashback on purchases from Flipkart and 2% on all other online shopping.

– E-Commerce Benefits: Enjoy additional discounts on Flipkart and Myntra.

– Annual Fee: ₹500, waived off upon reaching ₹2 lakh in spending annually.

– Best For: Perfect for frequent Flipkart users looking for high cashback and savings.

7. Standard Chartered Manhattan Platinum Credit Card

– Rewards: Earn 5% cashback on online shopping and 1% on other purchases.

– E-Commerce Benefits: Access exclusive deals on sites like Amazon and Flipkart.

– Annual Fee: ₹999, waived off on annual spending of ₹1.5 lakh.

– Best For: Ideal for those who want consistent cashback for online shopping and entertainment expenses.

8. RBL Bank Shopping Card

– Rewards: Enjoy an impressive 10% cashback on online shopping and 1% on other categories.

– E-Commerce Benefits: Benefit from exclusive offers on Amazon, Flipkart, and more.

– Annual Fee: ₹1,000, which can be waived upon spending ₹1.5 lakh annually.

– Best For: Suitable for users wanting high cashback and substantial rewards for online shopping.

9. HDFC Bank Regalia Credit Card

– Rewards: Earn 3% cashback on online shopping and 1% on all other transactions.

– E-Commerce Benefits: Enjoy special discounts on major e-commerce platforms.

– Annual Fee: ₹2,500, waived off after spending ₹3 lakh annually.

– Best For: Designed for high spenders who seek premium features and exclusive benefits.

10. Kotak Mahindra Bank PVR Gold Credit Card

– Rewards: Receive 5% cashback on online purchases and 2% on dining and other categories.

– E-Commerce Benefits: Enjoy discounts on movie tickets and exclusive offers from various e-commerce platforms.

– Annual Fee: ₹499, waived upon spending ₹1 lakh per year.

– Best For: Great for movie enthusiasts and online shoppers who also appreciate entertainment benefits.

This detailed overview helps you select the credit card that best suits your online shopping habits, maximizing rewards and enhancing your overall shopping experience.

Comparison Table

Factors to Consider When Choosing a Credit Card for Online Shopping

When selecting a credit card specifically tailored for online shopping, several essential factors can enhance your purchasing experience:

- Rewards and Cashback: Opt for credit cards with attractive rewards, such as high cashback rates or a points system that accrues benefits for every dollar spent online. These incentives can lead to substantial savings over time.

- Exclusive Discounts and Offers: It is essential to verify whether the card provides exclusive discounts or promotional offers on the e-commerce platforms you frequently use. These can include seasonal sales, flash deals, or members-only promotions that can significantly reduce your overall spending.

- Annual Fees: While some credit cards might carry an annual fee, many issuers waive this fee if you meet a specified spending threshold. It is crucial to assess whether the potential rewards and benefits outweigh the cost of the annual fee.

- Interest Rates: If you anticipate carrying a balance from month to month, take note of the card’s interest rates. Selecting a card with competitive or low interest rates can help minimize the overall cost of borrowing.

- Security Features: To safeguard your financial information during online transactions, prioritize credit cards with robust security measures, such as fraud protection and secure transaction technology, like One-Time Password (OTP) verification.

How to Apply for a Credit Card for Online Shopping

- Check Eligibility: Before applying, review the credit card’s eligibility criteria, which typically include your income level and credit score.

- Compare Credit Cards: Conduct thorough research comparing various credit cards. Look closely at the rewards programs, cashback opportunities, and additional benefits each card offers, tailoring your choice to your shopping habits.

- Apply Online: Most banks facilitate a smooth online application process. You can submit your application through the bank’s official website or utilize trusted third-party platforms like Paisabazaar for comparison.

- Document Submission: Prepare to provide the necessary documentation, such as proof of identity, proof of address, and details regarding your income, to support your application.

- Approval: Once your application is processed and approved, you will receive your credit card. With this card, you can begin to enjoy the various benefits it offers for your online shopping endeavors.

Conclusion

Selecting the right credit card can enhance your online shopping experience, providing benefits such as rewards, cashback, exclusive discounts, and added security. You can choose a credit card that perfectly aligns with your shopping preferences and behavior by carefully considering the abovementioned factors. Start the application process today, and make your next online shopping spree enjoyable and more rewarding!

FAQs

Q. What are the best credit cards for online shopping in India?

A. Some top credit cards for online shopping include the HDFC MoneyBack, SBI SimplyCLICK, ICICI Amazon Pay, Citi Rewards, and American Express Membership Rewards.

Q. How do I choose the best credit card for online shopping?

A. Focus on credit cards that offer high cashback rates, exclusive discounts, and low or waived annual fees.

Q. What are the benefits of using credit cards for online shopping?

A. Utilizing credit cards for online purchases allows you to earn rewards, obtain cashback, access exclusive offers, and enjoy enhanced security features.

Q. Can I get cashback on online purchases?

A. Absolutely! Many credit cards specifically offer cashback rewards for online shopping activities.

Q. How do I apply for a credit card for online shopping?

A. You can apply directly through the bank’s official website or use a reputable third-party comparison platform like Paisabazaar to facilitate your application.

Explore the various credit card options, examine their features in detail, and choose the one that best aligns with your online shopping habits!