Travel credit cards provide many advantages that improve your trip. You might get travel insurance, visit airport lounges, and earn air miles. Many choices abound to enable you to identify the perfect travel credit card for India, improving your trip experiences. This page carefully investigates the best 15 travel credit cards from India. The article emphasises credit cards’ main advantages and characteristics, enhancing travel experiences by increasing convenience and rewarding value.

Let’s Explore the Top 15 Credit Cards in India for Travel

Axis Bank Atlas Credit Card

- Accelerated EDGE Mile earning on travel spends.

- Complimentary access to domestic and international airport lounges.

- Your reward points are worth Air Miles.

- 5 EDGE reward points per ₹100 on travel spends.

- 2 EDGE miles per ₹100 on other purchases.

- Travel Edge portal for flight and hotel bookings.

- 1:1 redemption ratio on the Travel Edge portal.

- 1:2 redemption ratio on airline and hotel partners.

- No concierge service.

- High forex markup fee.

American Express Platinum Travel Credit Card

- Travel vouchers worth up to Rs. 4,500

- Additional travel vouchers worth up to Rs. 7,500

- Complimentary access to airport lounges across India

- Complimentary membership to Priority Pass with a US$99 annual fee waiver

- 8 yearly free visits to airport lounges

- Taj Experiences E-Gift Card worth Rs. 10,000

- Earn 1 Membership Rewards Point for every Rs. 50 spent

- Redeem points for flights, hotels, experiences, or gift cards

- Transfer points to travel, hotel, and retail loyalty programs

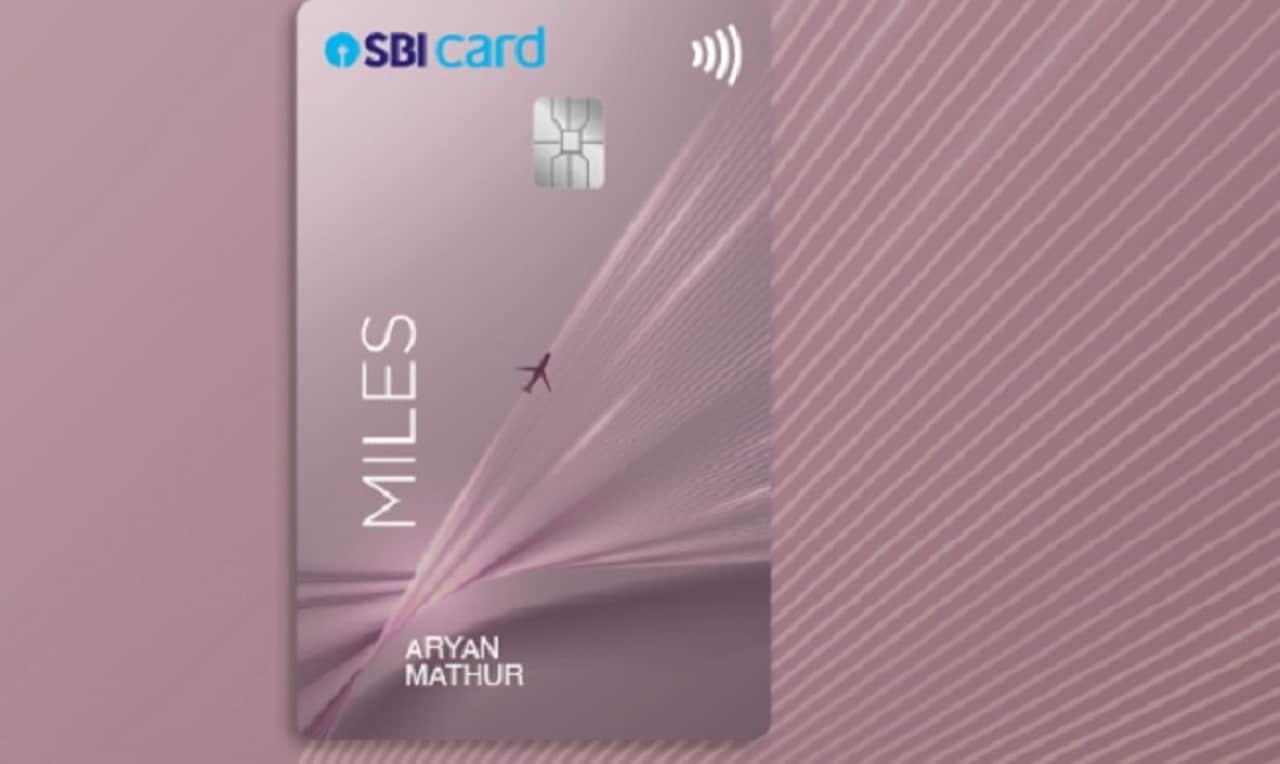

SBI Card Miles Elite

- Joining bonus of 5,000 travel credits

- 6 travel credits for every ₹200 spent on travel

- 2 travel credits for ₹200 spent on other purchases

- Complimentary Priority Pass membership

- 8 free visits to domestic airport lounges every year

- 6 complimentary international lounge visits

- Low foreign currency charge of 1.99%

- 1% fuel surcharge waiver

- Travel insurance

RBL World Safari Credit Card

- Joining fee of Rs 3,000 and a welcome gift of Rs 3,000

- Enjoy access to a wide range of domestic and international airport lounges

- Zero foreign currency markup fee

- Up to 5 travel points per Rs 100 spent

- Travel insurance cover worth up to USD 50,000

- Priority Pass membership

- Travel vouchers worth up to Rs 10,000

- 4 complimentary golf rounds per year

Air India SBI Signature Credit Card

- Joining fee of Rs 4,999 and a welcome gift of 20,000 bonus reward points and membership to Flying Returns

- Get a free Priority Pass lounge access program membership

- 8 complimentary domestic lounge access per year under the Visa lounge access program

- Up to 30 Flying Returns points for every INR 100 spent on Air India tickets

- Up to 4 Flying Returns points per INR 100 on other purchases

- 5,000 Reward point anniversary present annually

- Insurance cover worth Rs. 1 Lakh against a lost card

- Up to 1,00,000 bonus reward points annually

- Convert points into Air Miles

Air India SBI Platinum Credit Card

- Get 8 complimentary visits to domestic airport lounges each year

- Earn reward points that can be easily converted into Air India Air Miles

- When you book your Air India ticket with 100 rupees, you’ll get 15 reward points

- 5 reward points are earned for every 100 rupees spent on gift tickets purchased on Air India

- 2 reward points for every Rs. 100 spent on other purchases

- Insurance cover against lost card liability worth Rs. 1 lakh

- Welcome benefit of 5,000 reward points

- Annual benefit of 2,000 reward points on card membership renewal

- 1% waiver on fuel surcharge applicable on transactions

- Annual fee of Rs. 1,499

HDFC Bank RuPay IRCTC Credit Card

- Joining and annual membership fee of Rs. 499

- Complimentary railway lounge access every quarter

- 8 complimentary access to IRCTC Executive Lounges

- Earn 1 Cash Point for every Rs. 100 spent on retail purchases

- Get 5x Cash Points when you spend on IRCTC

- Spend-based waiver of the renewal fee

- 1% fuel surcharge waiver

- Amazon voucher worth Rs. 500 as a welcome benefit

- 5 reward points on each ₹100 spent on the IRCTC website and app

- An additional 5% cashback on train ticket purchases through HDFC SmartBuy

IRCTC Rupay SBI Credit Card

- Complimentary railway lounge access every year

- 4 complimentary access to IRCTC Executive Lounges

- Every Rs. 125 spent on retail purchases—including train tickets bought via the IRCTC Website or mobile app— earns one Reward Point

- Within 45 days of acquiring the automobile, make a first transaction of over Rs. 500 and get a nice welcome gift of 350 extra reward points

- 1% transaction charges waiver on your railway ticket booking through IRCTC

- Access to 4 domestic railway lounges every year (1 per quarter) through the Railway Lounge Program

- Book airline tickets at IRCTC at excellent prices

- Custom-made tour packages from adventure wildlife to leisure and pilgrimage across India from the IRCTC Website

IndiGo HDFC Bank Credit Card

- Free flight ticket worth Rs 1,500 as a welcome benefit

- Free 6E Prime addon, which includes services such as priority check-in, choice of seat, a complimentary meal and quicker baggage

- 5% rewards on IndiGo flights

- Complimentary access to domestic lounges (8 visits per year, 2 visits per quarter)

- Discounted Convenience Fee on IndiGo tickets of Rs.150 per passenger

- 2.5% rewards per Rs.100 spent on flights booking on IndiGo App/Website

- 1% reward per Rs.100 spent on all other spends

- Annual fee of Rs 500 to Rs 1,500

Axis Bank Vistara Signature Credit Card

- Joining and annual fee of ₹3,000

- Free voucher for a premium economy class ticket as a welcome bonus

- Free Club Vistara Membership

- Priority check-in

- Extra baggage allowance

- Reward rate of up to 4%

- 4 free tickets for meeting milestone spending

- Complimentary lounge access

- Get a Business Class ticket on milestone spends of ₹2.5 lakhs, ₹5 lakhs & ₹7.5 lakhs each

- Get a premium economy class ticket on milestone spends of ₹1.5 lakhs, ₹3 lakhs & ₹4.5 lakhs each

- Get an economy class ticket on milestone spends of ₹1.25 lakhs & ₹2.5 lakhs each

- 2 complimentary lounge access per quarter

Club Vistara SBI Card PRIME

- Joining and annual fee of ₹2,999 plus GST

- Complimentary premium economy ticket as a welcome benefit

- Complimentary Club Vistara Silver status

- 4 Club Vistara points for every ₹200 spent on retail purchases, including fuel transactions

- 9 Club Vistara points for every ₹100 spent on Vistara flights

- 1 class upgrade voucher on Tier Renewal

- Extra 5 kg baggage allowance

- Complimentary domestic and international lounge access

- Priority Pass membership

- Travel insurance benefits, including air accident cover and loss or damage of check-in baggage

- Cancellation insurance on Vistara flights

Club Vistara IDFC First Credit Card

- Joining fee of ₹4,999 + GST

- Complimentary Premium Economy Ticket Voucher and a One-class Upgrade Voucher on joining and renewal

- Complimentary Club Vistara Silver Membership with benefits like priority airport check-in, increased check-in baggage allowance, and priority waitlist clearance

- Priority baggage handling

- Trip cancellation insurance of up to ₹10,000 on two claims

- Air accident cover of ₹1 crore

- Personal accident cover of ₹10,00,000

- Lost card liability cover of ₹50,000

- Additional coverage for loss or delay of checked-in baggage, loss of passport and other documents, and flight delay

- 12 complimentary golf lessons and 4 complimentary rounds of golf every year

- 8 complimentary visits to domestic airport lounges and spas and 4 complimentary visits to international airport lounges yearly

- Zero mark-up on forex transactions

- Travel insurance benefits, including trip cancellation, air accident, and personal accident cover

Marriott Bonvoy HDFC Bank Credit Card

- Free Night Award as a welcome benefit, valid for one year

- Complimentary Silver Elite status

- 10 Elite Night credits per year

- Up to 3 bonus free night awards on reaching the target spending milestone

- 12 complimentary domestic and international lounge access per year

- 2 complimentary golf course access and golf lessons per quarter worldwide

- Air accident cover, credit shield, loss liability cover, and other insurance benefits

- Concierge services

- Zero liability on any fraudulent transactions made on your credit card after reporting it lost

- Ready for use at participating luxury hotels such as St. Regis, JW Marriott, Le Méridien, and Sheraton

ixigo AU Credit Card

- Joining fee of Rs. 999, which can be waived if the cardholder spends Rs. 1,000 within the first 30 days

- Renewal fee of Rs. 999, which can be waived if cardholder spends Rs. 1,00,000 in the previous year

- Up to 10% discounts on flight bookings

- Instant discounts on hotel bookings

- Discounts on bus tickets

- Complimentary railway lounge access

- Domestic and international airport lounge access

- Travel insurance benefits

- 20 reward points for every Rs. 200 spent on train bookings

- 10 reward points on online spends

- 5 reward points on offline spends

Standard Chartered EaseMyTrip Credit Card

- Joining and annual fee of Rs. 350, which can be waived if the cardholder spends Rs. 50,000 or more in a year

- 20% discount on domestic and international travel bookings on the EaseMyTrip platform without any minimum threshold

- 10X Reward Points on airline apps, outlets, websites, or standalone hotels

- Complimentary domestic and international lounge access

- Spend-based annual fee waiver, which allows avoidance of the renewal fee by spending a very nominal amount in the previous anniversary year

- Zero Liability Protection against a lost or stolen card

Conclusion

The ideal travel credit card selection can significantly enhance travel experiences, providing valuable rewards, perks, and conveniences. Travel credit cards in India offer a variety of benefits designed specifically for frequent travellers. These include air miles, access to airport lounges, and extensive travel insurance coverage. Choosing a card that suits your travel habits and financial needs can maximise your benefits and enhance your travel experience.

Best Travel Credit Cards in India: Maximize Your Travel Rewards!