Introduction

Liquid Funds are a type of Debt Funds that primarily invest in short-term money market instruments like treasury bills, commercial paper, etc. The article covers benefits, drawbacks, and factors to consider before investing in liquid funds.

Before jumping on the benefits and drawbacks of liquid funds, let’s understand their meaning.

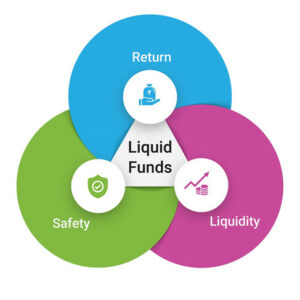

Liquid Funds are debt money market instruments. They provide liquidity and safety to investors’ funds. Hence, fund managers invest in debt instruments that mature in 91 days. The maturity of such funds is up to three months, according to the investment objective of investors. The short duration leads to less fluctuation in interest rates and makes the funds less vulnerable. Additionally, the value of the portfolio depends on the underlying security movement. Liquid Funds are the best option to park one’s idle money as they deliver high returns than regular savings bank accounts to risk-averse investors. They provide liquidity as a savings bank account but with higher returns. Moreover, they do not have a lock-in period.

Factors to consider before investing in Liquid Funds

- Risk- NAV fluctuation is the primary risk in mutual funds. However, in liquid funds, the NAV does not change frequently. The maturity is within three months. It prevents the NAV fluctuate frequently, with the changing underlying security. But they are not completely risk-free as the credit rating of the security might downgrade leading to a fall in NAV.

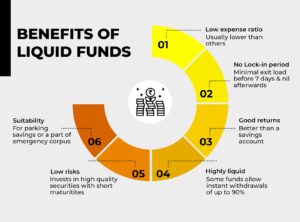

- Returns- On average, liquid funds deliver returns in the range of 7% to 9%, higher than a savings account. The returns might vary according to the market conditions, but historically they provide positive returns on redemption.

- Cost- The expense ratio, the amount one needs to pay to the manager to manage the investment, is very low. As per SEBI, the maximum limit of expense ratio is 1.05%. Hence, if the funds are held till maturity, the returns are higher than the expense ratio.

- Investment Horizon- The time duration is up to 91 days. The short period helps in realizing the full potential of the underlying securities.

- Financial Goals- Investors aiming to create emergency funds can go with liquid funds as they provide higher returns and are highly liquid.

- Tax on returns- Liquid Funds has a short-term maturity. Hence, they do not carry indexation benefits. The gains get added to the total income and taxed as per normal tax slabs.

Benefits of Liquid Funds

- Returns- Since the last decade, bank deposit returns are falling. Liquid Funds provide higher returns than bank deposits within the range of 7% to 9%.

- Minimal Risk- Liquid Funds aim to preserve capital and deliver consistent returns. The value of liquid funds is relatively steady as they have a short-term duration and are highly liquid. Moreover, the short period avoids credit rating swings.

- Redemption- Liquid Funds carry high liquidity, allowing investors to redeem their investments within a day or any day within the maturity period.

- Emergency Fund- Liquid Funds are an alternative to emergency funds as they help pay unexpected expenses. It also helps in parking excess earnings of an investor.

- Cost- Liquid Funds have a low expense ratio to manage the portfolio. Hence, the investment cost is low. It eventually increases the effective returns.

- No Lock-in Period- Liquid Fund investments are easily convertible in cash or cash equivalents. There is no lock-in period. Hence, one can redeem the investments wherever one wants till maturity. However, the transactions get processed after T+1 day from the redemption date if done after 2 p.m. For instance, if one redeems their investment on Friday at 2:30 p.m., the amount gets credited on Saturday till 10 a.m. Additionally, any withdrawal request before 2 p.m. gets processed on the same day.

- Exit Loads- Usually, debt funds come with high exit loads. On the other hand, liquid funds have marginal exit loads if the one redeems investment within seven days.

- Low-Interest Rate Risks- Liquid Funds have a short maturity. Hence, the interest rates do not heavily impact the underlying securities. Therefore, The NAV of liquid funds experience fewer fluctuations.

Drawbacks of Liquid Funds

Liquid Funds have a lot of benefits, but there are some drawbacks too:

- No Guarantee- Liquid Funds depend on the market movements. The safety of the principal is not assured completely. There are chances of capital erosion. For instance, in bank deposits, if one invests ₹10,000. On maturity, he gets the principal amount with interest. However, in the case of the liquid funds, the principal might get affected due to market changes which could lead to capital depreciation. Hence, credit rating is an essential factor of the debt instruments to consider before investing.

- Taxation- Liquid Funds do not carry indexation benefits as the investment is not for a long tenure. Hence, the gains on liquid funds get added to the total income and taxed according to the normal tax slab rates.

- Management Fees- Bank deposits do not carry a management fee because the bank holds one’s investment. They do not manage it. A liquid fund manager charges an expense ratio to manage one’s portfolio. However, the expense ratio of liquid funds is very low in comparison to other debt mutual funds.

Conclusion

To conclude, the benefits of liquid funds outweigh the drawbacks. They assure the safety of capital and liquidity. According to mandates, the fund managers park investors’ money in high credit-rated debt instruments with a maturity of up to 91 days. Hence, the NAV fluctuations are the least. The impact of the overall movement of interest rates is less on liquid funds. Hence, it is a low-risk instrument. Moreover, it is a better alternative to bank deposits. One can directly invest in a liquid fund via the fund house’s website or through investment apps like ETMoney. Investors can also invest via brokers. However, they charge a commission for the same. One must verify their Aadhar card details and complete the KYC (know your customer) process before investing in liquid funds. Also, one must mention the investment amount, method of investment (SIP or lump sum), and the investment period.