Introduction

Investors come in various shades. Some prefer high-risk-high-reward investments, while others are more comfortable investing in low-risk, fixed-income investment options. For the latter category of investors, there are many types of government securities in India that may be ideal investment choices. They bear exceptionally low risk, and in addition to this, they also come with the advantage of guaranteed income or returns on investment. For risk-averse investors who seek low-risk investment products, there are different types of government securities available in the Indian financial markets. Government securities are called investment products issued by the both central and state government of India in the form of bonds, treasury bills, or notes.

Government securities or G-Secs are essentially debt instruments issued by a government. These securities can be issued by both the central government and the state governments of India with risk factor negligible. Let’s look at the given below:

I. Treasury Bills:

Treasury bills, also called T-bills, are short term government securities with a maturity period of less than one year issued weekly by the central government of India.

Treasury bills are short term instruments and issued three different types: 91, 182 or 364 days

T- bills do not pay interest because they are also called zero-coupon securities; instead, they are issued at a discount rate and redeemed at face value on the date of the maturity.

For example a 91 day T-bill with a face value of Rs. 200 may be issued at Rs.196, with a discount of RS. 4 and redeemed at face value of Rs. 200.

II. Cash Management Bills (CMBs):

Cash management bills are new securities introduced in the Indian financial market in 2010 by the RBI for temporary cash flow. CMB’s are similar to T-bills as for duration. However, one primary difference between both of these is its maturity period. CMBs are issued for less than 91 days of a maturity period which makes these securities an ultra-short investment option.

III. Dated Government Securities:

Dated G-Secs are also among the different types of government securities in India. Unlike T-bills and CMBs, G-Secs are long-term money market instruments that offer a wide range of tenures varying from 5 to 40 years. These instruments come with either a fixed or a floating interest rate, also known as the coupon rate. The coupon rate is applied on the face value of your investment and is paid to you on a half-yearly basis as interest.

There are around 9 different types of dated G-Secs currently issued by the government of India. These are listed below:

1) Capital Indexed Bonds

2) Special Securities

3) 75% Savings (Taxable) Bonds, 2018

4) Bonds with Call/Put Options

5) Floating Rate Bonds

6) Fixed Rate Bonds

7) Special Securities

8) Inflation Indexed Bonds

9) STRIPS

IV. State Development Loans:

State development loans are dated G-securities issued by the State government every 2nd week by negotiated Dealing System to meet their budget requirements.

SDL support the same repayment method and features a variety of investment tenures. But when it comes to rates, SDL is a little higher compared to dated government securities.

The major difference between dated government securities and state development loans is that G-Securities are issued by the central government while SDL is issued by the state government of India.

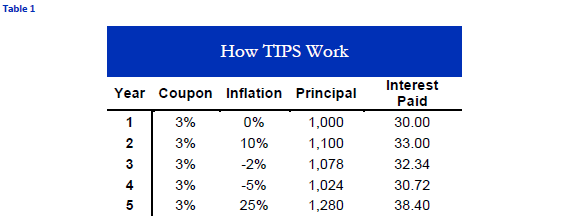

V. Treasury Inflation-Protected Securities (TIPS):

These are available based on 5, 10 or 30 year term periods. These securities deliver interest payments to all users every six months.

TIPS are similar to conventional treasury bonds, but it comes with one major difference. The same principle is issued during the entire term of the bond in a standard treasury bond.

However, the par value of TIPS will increase gradually to match up with the Consumer Price Index (CPI) to keep the bond’s principle on track with inflation.

VI. Zero-Coupon Bonds:

Zero-coupon bonds are generally issued at a discount to face value and redeemed at par. These bonds were issued on January 19th 1994.

The securities do not carry any coupon or interest rate as the tenure is fixed for the security. In the end, the security is redeemed at face value on its maturity date.

VII. Capital Indexed Bonds:

In these securities, the interest comes in a fixed percentage over the wholesale price index, which offers investors an effective hedge against inflation.

The capital indexed bonds were floated on a tap basis on December 29th 1997.

VIII. Floating Rate Bonds:

Floating rate bonds does not come with a fixed coupon rate. They were first issued in September 1995 as floating rate bonds are issued by the government.

Conclusion

Given that there are many different types of government securities in India, it’s easy to choose the best alternative for your portfolio. Since the investment tenure is one of the main points of difference between these G-Secs, you can choose the product that aligns best with your investment timeline. In addition to offering you guaranteed income or returns, investing in government securities also help you balance the risk factor in your investment portfolio.