A mutual fund is a pool of money that is professionally managed by a Fund Manager. It’s a trust that takes money from a group of investors with similar financial goals and invests it in shares, bonds, money market instruments, and/or other securities. After subtracting appropriate fees and taxes, the income or profits created from this collective investment are proportionately distributed among the participants by determining a scheme’s “Net Asset Value” or NAV. Mutual funds are perfect for individuals who don’t have a large sum of money to invest or don’t have the time or interest to study the market but still want to increase their wealth. One can invest in mutual funds through SIP or in Lump sum. This article will state why SIP is better than Lump sum when it comes to mutual funds.

What is Lump sum?

An investment is said to be lump sum when the entire amount is invested at one go. It is a one-time investment that is usually made by people having substantial disposable amount in hand and a higher risk tolerance. Big players and investors usually invest in lump sum mutual funds when considering stocks that are related to long-term appreciation to earn higher returns. For example, if I have Rs.1,00,00 and invest the entire amount at one time in mutual funds, it is considered to be a lump sum investment.

What is SIP?

SIP or systematic investment plan is a kind of mutual fund where a fixed amount is invested at regular intervals, say once a month or once a quarter. In SIPs, investors do not have to worry that much about market volatility and the timing of entering the market. This is because the amount is invested throughout the year/s and the risk is balanced out. For example, if I opt for quarterly SIPs, the mutual fund will receive and invest the decided amount, say Rs.2500, every three months.

Why SIP is better than Lump sum

Mutual fund experts choose good stocks to invest our money. However, they do not wait for the correct time to do so, because they always want more and more money from investors. All times are not suitable for entering the market, so how do we know when is the correct time? If a lump sum investment is made when the market is high, returns might be bad for a couple of years. You are a few reasons why SIP is better than lump sum –

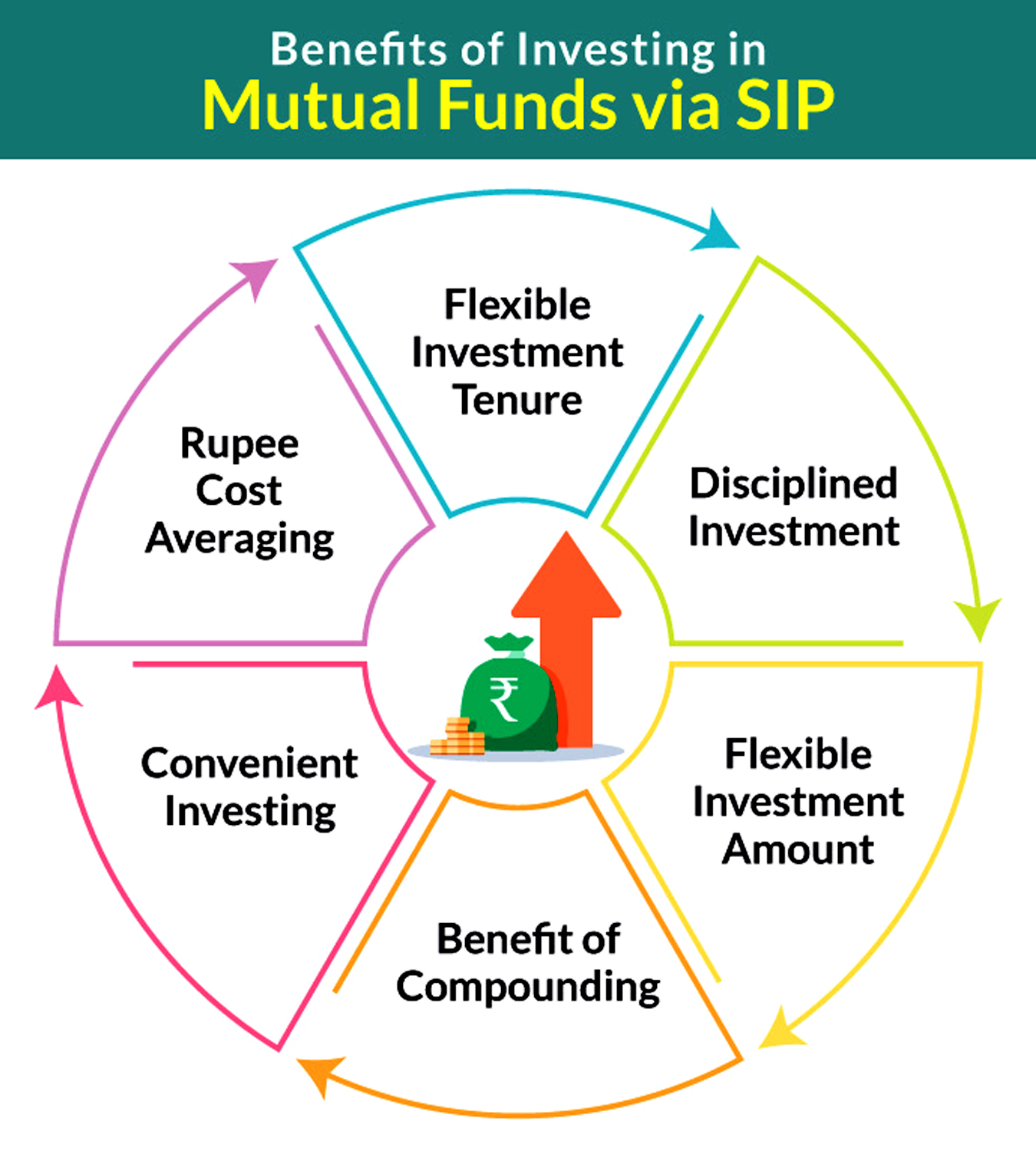

Rupee cost averaging

Investing spread over a period of time brings down the average cost of investing. Mutual funds are purchased during different market cycles while investing through SIP. More number of units are purchased in the market low to compensate for purchasing during a market high. This helps in tiding over market fluctuations and balancing out the cost.

Prevent the problem of Market Timing

Since a lump sum investment is a big commitment, it is important to know the correct timing to enter the market as it is most beneficial to invest during a market low. Entering during a market Hugh may lead to bad returns when the market crashes. However, SIPs allow us to enter the market during different market cycles. Hence, investors do not have to monitor the market as closely as required for lump-sum investments.

Flexibility

Unlike lumpsum, one can stop, pause, change the amount deposited in SIP. Moreover, you can also withdraw amount from the SIP if needed. There are no penalties applicable if one wants to pause or terminate the SIP in case of insufficient funds

Discipline

The SIP amounts are automatically deducted from our bank account every month or quarter, as per the chosen scheme, and transferred to the mutual fund scheme. This brings out the much-needed financial discipline and brings about the habit of investing.

Ideal for New Investors

An SIP mutual fund serves as a stepping stone for beginners into the world of investing. One can get exposure to various kinds of equities and can start investing with even a small nominal account. Over time, after studying the investment choices made by the experts, they can gain experience

Lower investment requirement

One can begin investing in SIP is with an amount as nominal as Rs.500 per month. However, in the case of lump sum investments, the legal minimum amount is Rs.1000, and most mutual funds let their lower limit at Rs.5000. Thus, SIPs appeal to salaried or fixed income earners. They can even use an SIP calculator to calculate their expected returns.

Power of Compounding

When payments are made in instalments, such as in SIPs, compounding plays a huge role. Interest is calculated not only on the principal amount, but also on the previous interest earned. This magnifies returns over time and helps to generate greater returns.

Better performance

According to the data collected from the past, SIP investments have earned consistently higher long-term returns as compared to lump sum investments.

Factors to Consider

Hence, due to the reasons mentioned above, SIP seems to be the obvious choice. However, there are a few factors that one should consider before choosing their investment route-

Amount

If one has a large amount at their disposal, they might consider a lump sum investment so that they do not end up spending the money instead. Alternatively, for a salaried person trying to save money and get better returns on it than offered by banks, SIP is more suitable.

Fund Type

For equity funds, a huge role is played by market volatility. The risk is high, which is why it is not wise to invest in lump sum. However, debt funds are not highly affected by market chains and are likely to give similar returns for both SIP as well as lump sum investments.

Market Timing

If the market is at a low, lump sum is likely to generate higher returns. If one is not able to identify cycles, that is, market highs and lows, an SIP is a better option as it distributes the risk.

In conclusion, choosing an SIP over lump sum is generally the way to go, subject to your personal requirements such as financial stability, income, investment goals and risk-taking capacity. That said, experts hold that SIPs are superior because they can help you tide over market fluctuations and are a good option even for investors who are beginners, since SIPs do not require constant monitoring of the financial markets.