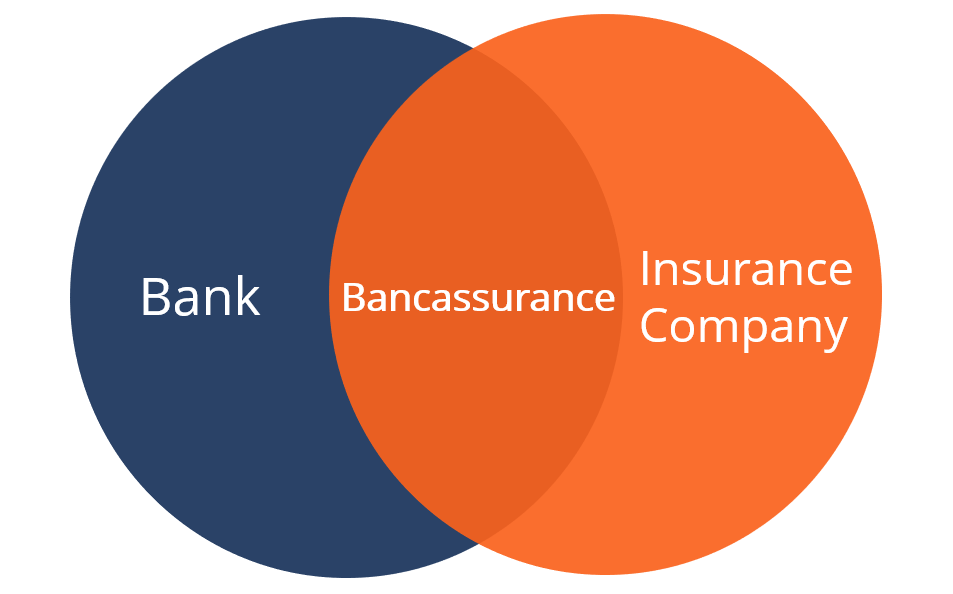

Bancassurance is the selling of insurance products via banks. Banks sell various types of bancassurance products and earn revenues. The concept of bancassurance originated in […]

Author: Disha Mody

Taxes Collected by Central Government – Definition, Types

Introduction In India, taxes are collected by the central and state government as per the Constitution of India. Tax is a source of income for […]

Reinsurance Advantages – Definition, Advantages, Indian POV

Introduction Reinsurance, insurance for insurers, helps insurance companies to reduce the obligation of paying large claim amounts via some agreement of transferring risks to other […]

Capital Gains Tax on Inherited Property

Capital gains tax on inherited property arises when the receiver of such property sells it. On receiving an inherited property, no capital gains tax applies […]

Taxes Collected by the State Government

The constitution of India gives and allocates powers to the central and state government to collect taxes in India. Moreover, as per article 265 of […]

Capital Gains Exemption

Profits arising from the transfer of capital assets like equity shares, immovable property, etc., are known as capital gains. There are two types of capital […]

Alternative Minimum Tax in India

The government charges alternative minimum tax (AMT) in India at 18.5% + 15% surcharge + 4% health and education cess. The alternative minimum tax is […]

Short-Term Capital Gains Tax on Shares

Capital gains are profits arising out of the transfer of capital assets like securities, units of mutual funds, immovable property, precious stones, goodwill, etc. Gains […]

44AD of the Income Tax Act – Definitions, Importance, uses

Section 44AD of the income tax act is about a presumptive taxation scheme. As per the income tax act, a person carrying out a business […]

Long-Term Capital Gains Tax on Shares

Capital Asset includes movable and immovable, tangible and intangible, right, and securities (equity, bonds, etc.). Gains from such assets on its transfer are taxable under […]