Access to an airport lounge can significantly improve your travel experience by providing a comfortable and exclusive relaxing environment before your flight. For frequent travellers, one of the most valuable perks offered by many credit cards in India is complimentary lounge access to domestic and international airports. This benefit can significantly enhance the travel experience. Explore the best credit cards that provide exceptional airport lounge access perks. This guide will help you decide to improve your travel experience with more comfort and convenience.

Top 10 Credit Cards for Airport Lounge Access Credit Cards

SBI Elite Card

The SBI Elite Card is known for its wide range of benefits, making it a top choice for travel and leisure enthusiasts. Now, let’s delve into some of the features:

•Welcome Gift: Get a ₹5,000 e-Gift Voucher from top brands such as Yatra, Hush Puppies/Bata, Pantaloons, Aditya Birla Fashion, or Shoppers Stop.

• Complimentary Movie Tickets: Get ₹6,000 worth of free movie tickets per year, suitable for 2 tickets every booking, every month.

• Milestone Privileges: Receive 50,000 Bonus Reward Points annually, along with 10,000 bonus points for spending ₹3 lakhs and ₹4 lakhs.

• Elite Rewards: Unlike other transactions, where you will receive 2 reward points for 100, purchases made at restaurants, department shops, and grocery stores will give you 5X the reward points.

• International Lounge Access: Enjoy a complimentary Priority Pass membership valued at $99 and 6 complimentary airport lounge visits per calendar year outside India.

• Domestic Lounge Access: Enjoy 2 free domestic airport lounge visits every quarter within India.

• Club Vistara Membership: 9 Club Vistara Points for every ₹100 spent on Vistara flights.

• Trident Privilege Membership: Some benefits include a complimentary Red Tier membership to Trident Privilege, particular welcome points, and many other advantages.

• Lowest Forex Markup: Only 1.99% on international transactions.

• Exclusive Concierge Service: Reliable support for flower delivery, gift delivery, and online doctor consultation.

• Fees: One-time annual fee: ₹4,999 + Taxes.

HDFC Regalia Gold Credit Card

The HDFC Regalia Gold Credit Card is an excellent option since it has many valuable features and incentives you can use daily. Among this card’s many characteristics are the following:

Welcome Benefits:

• Free membership to Club Vistara Silver Tier and MMT Black Elite.

• ₹1,500 vouchers on quarterly spends of ₹1.5 lakh.

• Receive ₹5,000 in flight vouchers for spending ₹5 lakh per year, and an additional ₹5,000 voucher for spending ₹7.5 lakhs.

Reward Points:

• Earn 4 Reward Points on every ₹150 spent on retail transactions.

• Use your points to buy things, accommodations, and flights.

Lounge Access:

• Complimentary airport lounge access within India.

• When you fly outside India with a Priority Pass, you may enjoy a maximum of 6 complimentary lounge visits each calendar year.

Additional Features:

• Zero Lost Card Liability.

• 2% foreign currency markup on foreign currency spends.

• Revolving credit with a nominal interest rate.

Axis Bank SELECT Credit Card

The Axis Bank SELECT Credit Card is a premium offering that combines travel perks, lifestyle benefits, and rewarding features. Here’s what you can expect:

Welcome Benefits:

• 10,000 EDGE REWARD Points worth ₹2,000 on first card transaction.

• Flat ₹500 off per month on BigBasket purchases.

• ₹200 discount on Swiggy orders.

• Priority Pass members are eligible for up to 12 complimentary lounge visits per year at international airports.

• If you have made a total expenditure of ₹50,000 within the last 3 months, you will be entitled to 2 complimentary visits to the domestic lounge every quarter.

Annual Benefits:

• Priority Pass Membership renewal on annual spend of ₹3 lakhs.

• Offer renewal on BigBasket and Swiggy.

Milestone Benefits:

• Earn 5,000 EDGE points on spending ₹3 lakhs in a card anniversary year. When shopping abroad, you won’t need to think twice about foreign currency transactions

•Enjoy a complete waiver of the annual fee by spending ₹8 lakhs in a card anniversary year.

Rewards on Every Transaction:

• Earn 10 Axis EDGE points on every ₹200 spent.

• Earn 2X rewards per ₹200 on ‘Retail Shopping’ spends.

AU Zenith+ Credit Card

The AU Zenith+ Credit Card is a premium metal card for those who appreciate distinction and luxury. Here are some key features:

• Lowest Forex Markup: You won’t need to think twice about foreign currency transactions when shopping abroad.

• Lounge Access: Experience luxury with complimentary airport lounge access wherever you go.

• Movie Passes: Step out and enter cinematic worlds with movie passes.

• Golf Rounds: Swing into your ace game with golf rounds.

• Metal Card: The Zenith+ Credit Card exudes an air of sophistication, reflecting impeccable standards.

• Experience the benefits of our Grand Welcome Rewards program with a generous reward upon application.

• Remember, this card is designed for those who appreciate a luxurious lifestyle and offers a variety of enticing rewards.

Tata Neu Infinity HDFC Credit Card

Tata Neu Infinity HDFC Bank Credit Card is an impressive choice for those seeking a credit card with many benefits and rewards. Here are the key features:

• NeuCoins Rewards:

Earn 5% back as NeuCoins on non-EMI spends at Tata Neu and partner Tata Brands.

Get 1.5% back as NeuCoins on non-Tata brand spends and any merchant EMI transactions.

Earn 1.5% back as NeuCoins on UPI spends (including partner Tata Brands), capped at 500 NeuCoins per calendar month.

Earn extra NeuCoins by making Tata Neu UPI payments directly to your Tata Neu Account.

Note: NeuCoins won’t accrue for fuel spends, wallet loads, and innovative EMI transactions.

• Additional Benefits:

Zero lost card liability: Report any fraudulent transactions immediately to have zero liability.

Foreign currency markup: 2% cashback on purchases made in foreign currency.

Revolving credit: Available at a nominal interest rate.

• Lounge Access:

Using your Visa/RuPay card allows you to enjoy 8 complimentary domestic lounge access per calendar year, with 2 available each quarter.

Remember that this card is designed specifically for savvy shoppers and frequent travellers.

IDFC FIRST Select Credit Card

The Tata Neu Infinity HDFC Bank Credit Card is an impressive choice for those seeking a credit card with many benefits and rewards. Here are the key features:

• Earn 5% NeuCoins on non-EMI spends at Tata Neu and partner Tata Brands.

• Earn 1.5% NeuCoins on non-Tata brand spends and merchant EMI transactions.

• Earn 1.5% NeuCoins on UPI spends, capped at 500 NeuCoins per month.

• Additional NeuCoins on Tata Neu UPI payments are made directly to the Tata Neu Account.

• Zero lost card liability for fraudulent transactions.

• 2% foreign currency markup on foreign currency spends.

• Nominal interest rate revolving credit.

• 8 complimentary domestic lounge access per calendar year.

ICICI Bank Coral Credit Card

The ICICI Bank Coral Credit Card offers a wide range of benefits and features to cater to the needs of its users. Here are some key points:

• Earn reward points on transactions and additional points from Reward Partner Brands.

• Enjoy a 25% discount on a minimum purchase of two movie tickets per transaction on BookMyShow.

• Bookings are first-come-first-serve and subject to daily ticket availability.

• Enjoy lounge access at domestic airports.

• Enjoy a waiver on fuel surcharges.

• Ideal for low-maintenance credit score builders.

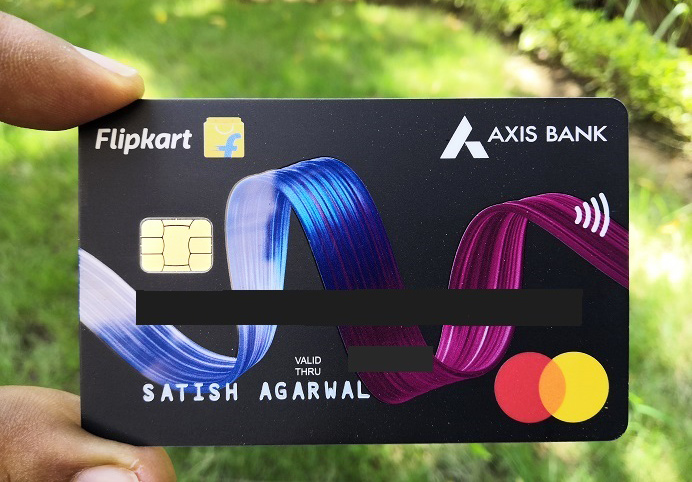

Flipkart Axis card

The Flipkart Axis Bank Credit Card is a fantastic choice for those who love shopping on Flipkart. Here are some key features:

• Offers 5% unlimited cashback on Flipkart spends.

• Offers 4% cashback on Preferred Merchants.

• Offers 1% cashback on other eligible categories.

• Provides 4 complimentary lounge visits to select airport lounges within India annually.

• Offers a 1% fuel surcharge waiver on fuel purchases at all fuel stations across India.

• Offers 15% off on dining at 10,000+ partner restaurants.

• Offers Rs. 500 Flipkart vouchers on the first transaction and a 50% instant discount on the first Swiggy order.

American Express The Platinum Card®

The American Express Platinum Card® is a premium travel rewards card offering various benefits and perks. Here are some key features:

• Welcome Offer: Earn 80,000 Membership Rewards® Points after spending $8,000 on eligible purchases within the first 6 months.

• Hotel Credits: Up to $200 in statement credits annually on select prepaid hotel bookings through American Express Travel.

• Digital Entertainment Credit: Up to $20 monthly statement credits for eligible purchases with participating partners.

• Walmart+ Credit: Up to $12.95 monthly statement credit for a Walmart+ membership.

• Offers free shipping, same-day delivery, and more.

IndusInd Legend Credit Card

The IndusInd Bank Legend Credit Card is a premium offering designed to elevate your lifestyle. Let’s explore its features:

• Offers Weekend Spends Rewards: Earn 2 points for every ₹100 spent on weekends.

• Offers a 1.8% discounted foreign currency mark-up and a 1% fuel surcharge waiver.

• Allows collection of reward points on all transactions.

• Offers luxury benefits: Complimentary stay vouchers at Oberoi Hotels and Montblanc.

• Provides postcard voucher-gram and airport lounge access.

• Offers privileges like priority pass membership, movie tickets, fuel surcharge savings, and annual reward points value.

Conclusion

Opting for credit cards with airport lounge access can significantly elevate your travel experience, granting you exclusive perks and amenities. Airport lounges offer a serene and cosy environment for frequent flyers and occasional travellers to unwind before their flight. When you compare the top credit cards in India, finding the perfect one that meets your travel needs becomes effortless. By selecting this option, you can enjoy seamless and luxurious travel. Make a well-informed decision and elevate your travel experience with the perfect credit card.

Enhance Your Travel Comfort with the Best Airport Lounge Access Credit Cards!