Introduction

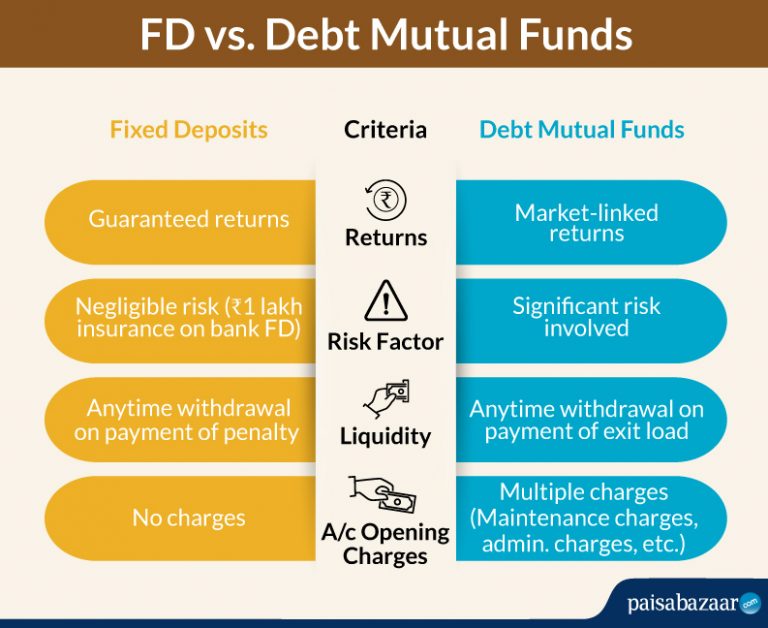

A debt mutual fund, popularly known as a fixed-income fund, invests a significant portion of your money in fixed-income securities like government securities, debentures, corporate bonds, and other money-market instruments. By investing money in such avenues, debt mutual funds lower the risk factor considerably for investors. This is a relatively stable investment avenue that could help generate wealth.

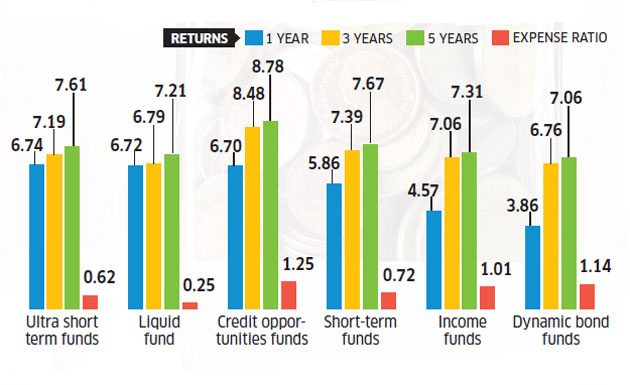

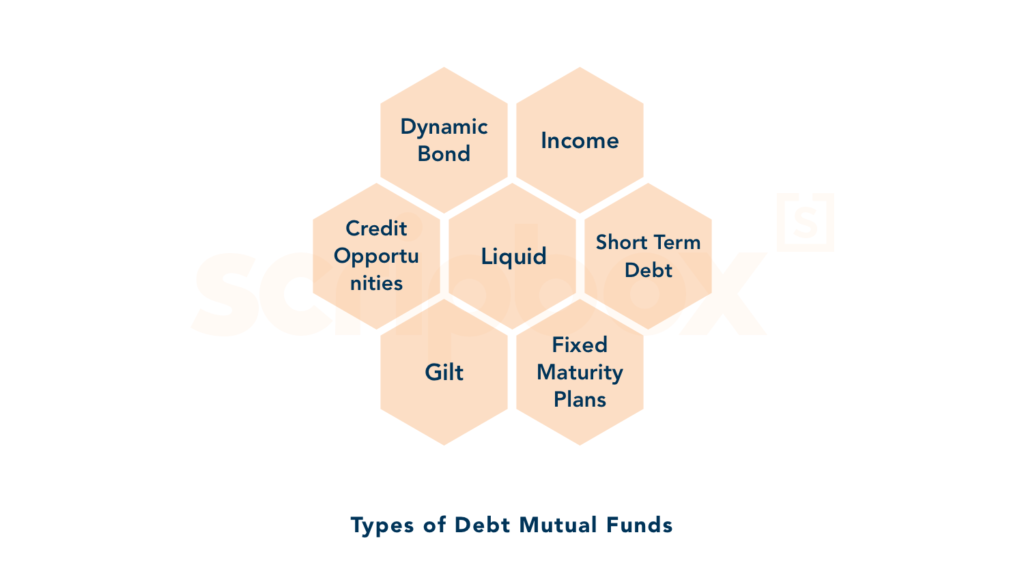

Types of Debt mutual Funds

1. Liquid funds:

As the name suggests, liquid funds are a type of debt mutual funds that are highly liquid. These funds invest in debt instruments with a maturity period of not more than 91 days. Investors can withdraw up to Rs.50, 000 as an instant redemption facility from liquid funds. These funds are considered to be among the least risky within mutual funds.

• Overnight Funds – invest in 1-day maturity papers (securities)

• Liquid Funds – invest in money market instruments maturing within 90 days

• Floating Rate Funds – invest in floating rate debt securities

• Ultra-Short Duration Funds – invest in debt securities maturing in 3-6 months

2. Short / Medium / Long Term funds:

Short-term debt funds come with a maturity period of 1-3 years. These funds are suitable for investors with a low-risk appetite because their prices are not much impacted by the change in interest-rate movements, also called as interest rate risk.

Medium term funds come with a portfolio maturity of 3-5 years and long term funds come with a maturity beyond 5 years. Medium and long term funds are relatively more risky than short term funds, mainly because the longer the tenure, the larger is the impact of interest rates on the portfolio. This is also known as duration risk or interest rate risk.

• Low Duration Fund – invest in securities maturing within 6-12 months

• Money Market Funds – invest in money market instruments with maturity up to 1 year

• Short Duration Funds – invest in securities 1-3 years maturity

• Medium Duration Funds – invest in debt securities with 3-4 years maturity

• Medium-to-Long Duration Funds – invest in debt securities with 4-7 years maturity

• Long-Duration Funds – invest in long maturity debt (over 7 years)

3. Dynamic bond funds:

In dynamic bond funds, the fund manager changes the maturity of the portfolio depending upon their forecast on interest rates. If the forecast is for rising interest rates, the maturity is shorter. If the forecast is for falling interest rates, the maturity is longer. These funds come with a fluctuating maturity period. They invest in instruments that have shorter (1-3 years) as well as longer (3-5 years) maturities. These funds are slightly more risky than short-term debt funds.

4. Fixed Maturity Plans:

Fixed Maturity Plans or FMPs come with a lock-in period. This period can vary based on the scheme you choose. You can invest in FMPs only during the initial offer period. After that, you cannot make further investments in this scheme. Many investors consider FMPs similar to FDs because both come with a lock-in period. However, unlike FDs, FMPs don’t promise fixed returns. However, FMPs are more tax efficient than FDs.

• Corporate Bond Funds- invest in corporate bonds

• Banking & PSU Funds – invest in debts of banks, PSUs, PFIs

• Gilt Funds – invest in Government bonds of varying maturities

• Gilt Fund with 10-years Constant Duration – invest in G-Sec with 10 year maturity

• Dynamic Funds – invest in Debt Funds securities across maturities Credit Risk Funds – invest in corporate bonds below highest rating.

Conclusion

If you are looking for relatively stable income as compared to equities and limited exposure to market risk, debt mutual funds are an option worth exploring. You can choose among the different types of funds such as liquid funds, ultra-short-term debt funds, fixed maturity plans and many others to invest basis your investment goals and time horizon.