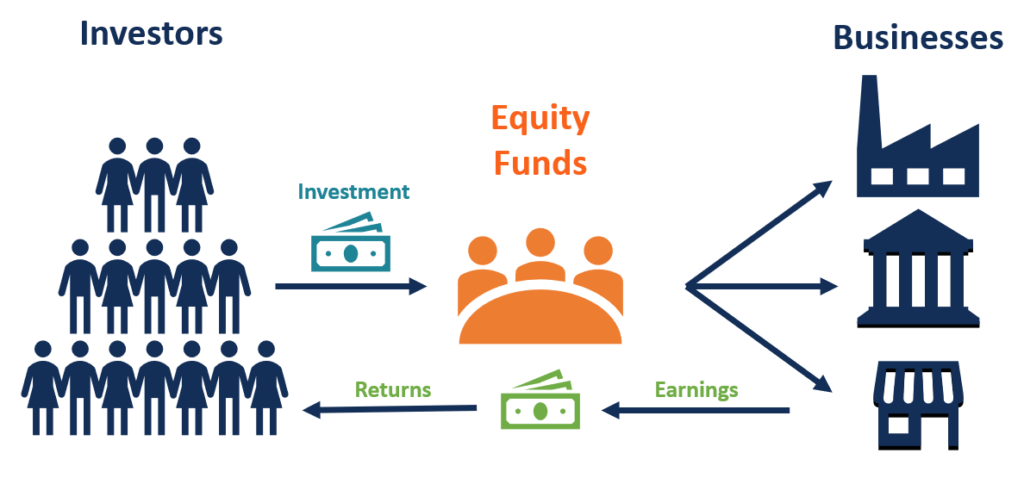

A mutual fund is a pool of money that is professionally managed by a Fund Manager. It’s a trust that takes money from a group of investors with similar financial goals and invests it in shares, bonds, money market instruments, and/or other securities. Mutual funds are of various types depending old various factors. One of the most popular emerging type of mutual funds in recent times are equity mutual funds. There are different types of equity mutual funds based on market capitalisation, investment style and sector.

Equity Mutual Funds

A mutual fund that invests predominantly in equity stocks is called an equity mutual fund. According to the SEBI Mutual Fund Regulations, an equity mutual fund scheme must have at least 65% of its investments in equity and equity related instruments. They are often referred to as Growth Funds. Equity mutual funds invest in stocks of companies across all types of market factorisation to generate higher returns. They are one the riskiest class of mutual funds and thus are capable of providing higher returns than debt and hybrid funds. Investing style or value oriented. Even though majority of the amount is invested in equity, the rest of it goes to debt and money market instruments. This is done primarily to reduce risk.

Are Equity Mutual Funds for you?

Your risk just profile, objectives and investment horizon determines your decision to invest in equity mutual funds. This is ideal when you have a long-term goal, as it gives the fund an appropriate amount of time to prevail over market fluctuations. Equity mutual funds are ideal for aspiring investors who want to gain insight into the stock market. There are many types of equity funds to match every risk profile and investment objective you may hav, such as a particular market sector, or a specific stock exchange, high or low risk, or even a specific interest group.

Types of Equity Mutual Funds

1.Based on Market Capitalisation

-

Large-Cap Equity Funds

Mutual funds invest in blue-chip companies that are among the top hundred rankings of the stock exchange according to their market capitalisation. The companies chosen are well- established and have been studied for a long period. Hence, the risk involved is low, but that also means that the return potential is low. LargeCap stocks are less volatile and hold of better in recessions. It is ideal for investors were looking for stability and safety in their investments. A few examples of large-cap equity funds in India are-

-Axis Bluechip Fund – Direct Plan – Growth

-Kotak Bluechip Fund – Direct Plan – Growth

-Canara Robeco Blue Chip Equity Fund – Direct Plan – Growth

-

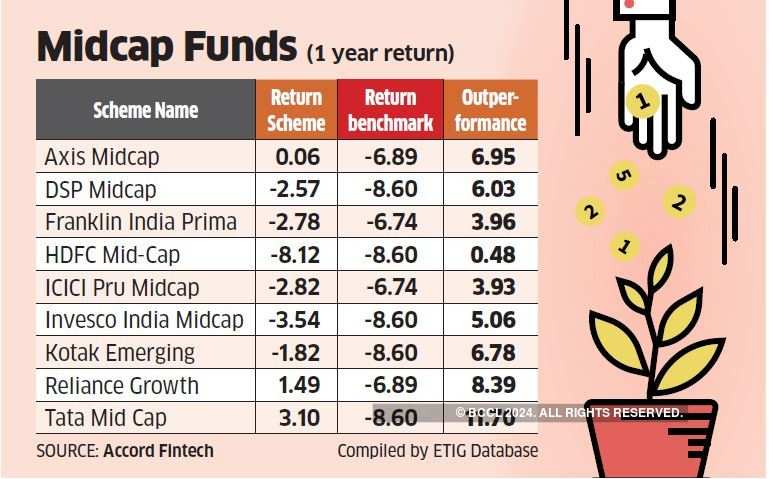

Mid-Cap Equity Funds

Mid-cap equity funds are those mutual funds that allocate more than 65% of the corpus into Mid-Cap companies. They have a market cap between Rs.500-Rs.10000 crores and are ranked from 101 to 250 in a stock exchange according to their market capitalisation. Companies are considered to be developing companies and are considered riskier than large cap stocks. However, they have a higher growth potential and are known to offer good returns. If you want to invest for long periods such as 7 to 10 years, this can be considered a suitable option, as they may be risky in the short run. Some examples of mid-cap equity funds in India are-

-PGIM India Midcap Opportunities Fund

-Axis Midcap Fund

-Edelweiss Mid Cap Fund

-

Small-Cap Equity Funds

These are those equity mutual funds which allocate more than 65% of the corpus to small-cap companies. Companies with a market cap of less than Rs.500 crores are considered small-cap. Although many small cap companies are young and have significant growth potential risk of failure is higher than large cap and mid-cap stocks. These companies rank below 250 on the stock exchange. It is a case of high-risk hide award. It is suitable for investors who are willing to take high risk and have a long investment horizon. Some of the best small-cap equity mutual funds in India are-

-Quant Small Cap Fund

-Kotak Small Cap Fund

-L&T Emerging Businesses Fund

-

Multi-Cap Equity Funds

These are invested across different market caps- large, mid and small. It helps the investor to create a diversified portfolio. Diversification makes the portfolio strong by preventing events that could affect a single sector, and hence reduces risk. There are different options of such flexi-cap funds providing different ratios of market caps. They are less risky as compared to a pure mid-cap or small-cap fund, but riskier than a pure large-cap fund. This is ideal for moderate risk takers as it provides likely higher returns than a large cap fund due to their exposure to mid-and small cap companies. Some of the best multi-cap equity mutual funds in India are-

-Quant Active Fund

-Mahindra Manulife Multi Cap Badhat Yojana Fund

-Baroda Multi Cap Fund

2.Based on Investment Style

Equity mutual funds can be actively managed or passively managed. For example, index funds and ETFs are passively managed. In an active fund, the market is scanned, research is conducted on companies, performance is examined and then the best stocks to invest are picked by the fund manager. On the other hand, in a passive fund, the fund manager builds a portfolio that mirrors a popular market index, for example Sensex or Nifty 50. Following are the types-

-

Sector Funds

These equity funds focus on particular sectors such as pharma, banking, FMCG, automobile, etc. Through this fund, a person can focus the investment corpus into particular industry or sector that he believes has excellent growth potential. Since the entire fund is focused on one sector, there is a high-risk, but also a high-return potential, in case there are favourable conditions and the sector performs well.

- Thematic Funds

This is similar to sector fund, but the thematic fund invests across a few sectors on a common theme. For example, steel, real estate, cement, power, etc. come under and infrastructure fund. This offers a slightly more diversified portfolio as compare to sector funds. Risk here is also very high but still less than that in sector funds.

-

Index Funds

These funds mirror a pre-existing financial stock market index such as the Sensex or Nifty. The aim is to generate similar returns as the chosen index. It falls under passive fund management, as mentioned before. Since they are passively managed, these funds are considered less-risky relatively. However, it might happen that the fund takes a hit if the market is bearish. This is ideal for conservative investors who want to invest long-term.

-

Focused Funds

These funds focus on limited Number of companies, that is, a maximum of 30 stocks. Here, the investor is giving more control as he can select a fund based on the equity in which it invests in. This fund is high-risk high-return since it focuses only on 20-30 stocks. It is suitable for those investors who want to actively take part in investing and increase their control over the mutual fund.

Hence, in conclusion, you are several different types of equity mutual funds for all types of investors. According to your risk appetite, financial goals, and time period it is up to you to decide which equity mutual fund to invest in to get the best returns.