Introduction

Every business needs funds to support its various needs. Businesses need funds to acquire assets like land, plant, and machinery. But that’s not all that a business needs funds for. Some amount of funds is required to manage the day-to-day operations of a company. It includes paying employees’ salaries, procuring raw materials, and paying utility bills. The capital needed to address these operating expenses is called Working Capital.

Working Capital (WC), is the difference between a company’s current assets and current liabilities. It is a good indicator of a business’s liquidity and short-term financial health and its ability to utilize its assets efficiently.

Types of working capital

The different types of Working Capital are – Permanent Working Capital, Regular Working Capital, Reserve Margin Working Capital, Variable Working Capital, Seasonal Variable Working Capital, Special Variable Working Capital, Gross Working Capital, and Net Working Capital.

Main components of working capital

The four main components of working capital are:

- Account Receivables

- Trade Payables

- Inventory

- Cash & Bank Balances.

Sources of Working Capital

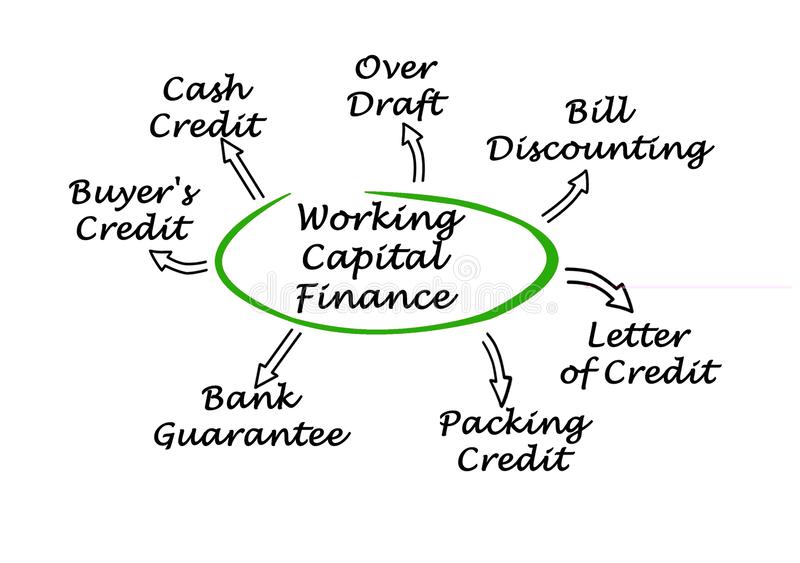

SHORT TERM SOURCES OF WORKING CAPITAL

Short-term sources of capital may further be divided into two categories – Internal Sources and External Sources.

The short-term internal sources of working capital include provisions for tax and dividends. Some of the primary sources of short-term external sources of working capital are listed below:

- Loans from Commercial Banks: Businesses, mostly MSMEs, can get loans from commercial banks with or without offering collateral security. There is no legal formality involved except creating a mortgage on the assets. Repayment can be made in parts or lump sum at the time of loan maturity. They get these loans at concessional rates; hence it is a cheaper source of financing for them.

- Public Deposits: These are the fixed deposits accepted by a business enterprise directly from the public. This source of raising short-term and medium-term finance was very popular in the absence of banking facilities. As per the Companies Act 1956, companies can advertise their requirements and raise money from the general public against issuing shares or debentures. The best of this source of financing is that it is simple and cheaper.

- Indigenous Bankers: Private moneylender and other country bankers used to be the main sources of finance prior to the establishment of commercial bank. Now a day with the development of commercial banks they have lost their monopoly. But even today some business houses have to depend upon indigenous bankers for obtaining loans to meet their working capital requirements.

- Trade Credit: Companies generally source raw material and other items from suppliers on credit. The amount payable to these suppliers is also treated as a source of working capital. Usually, the suppliers grant their buyers a credit period of 3 to 6 months. Thus, they provide, in a way, short-term finance to the purchasing company.

- Bill Discounting: Just as business buys goods on credit, they offer credit to their buyers. The credit period may vary from 30 days to 90 days and sometimes extends, even up to 180 days. During this period, the company funds get blocked, which is not good. Instead of waiting that long, sellers prefer to discount these bills with a bank or NBFC. The financial entity charges some amount as commission, called ‘discount’ and makes the balance payment to the sellers.

- Bank Overdraft: Some banks offer their esteemed customers and current account holders a facility to withdraw a certain amount of money over and above the funds held by them in their current account with the bank. The bank charges interest on the amount overdrawn and the period it is withdrawn. The overdraft facility is also granted against securities. The bank sets this limit and is subject to revision anytime, depending upon the customer’s creditworthiness.

- Advances from Customers: One effortless way to raise funds to meet the short-term requirement is to ask customers for some payment in advance. This advance confirms the order and gives much-needed cash to the business. No interest is payable to the customer for this advance. Even if any business pays interest, it is very nominal. Hence, this is one of the cheapest sources of raising funds to meet companies’ short-term working capital requirements.

LONG-TERM SOURCES OF WORKING CAPITAL

When the companies require funds for more than one year, it makes sense to go for long-term sources, as they are generally cheaper than short-term sources. The external sources of long-term sources of working capital are listed below:

- Share Capital: The Company may raise funds by offering the prospective shareholders a stake in their business. The response depends on several factors, including the company’s reputation, the perceived profit potential, and general economic condition. In return, the company offers dividends to their shareholders, which along with the floating cost, is treated as the cost of sourcing. However, the company is not legally bound to pay this dividend. Also, no rule prescribes how much dividend is to be given. All this makes this a very cheap source of working capital. But, in reality, most companies do not use this for meeting their working capital needs.

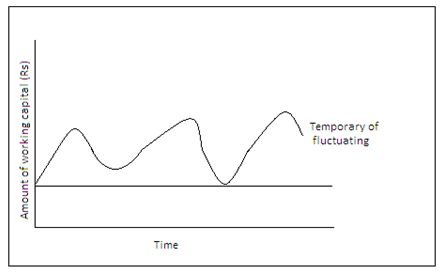

- Long-term Loans: Also called Working Capital Loans, these long-term loans may be temporary or long-term. The long-term here is generally 84 months (7 years) or more. This loan is not taken for buying long-term assets or investments and is used to provide working capital to meet a company’s short-term operational needs. Experts advise using long-term sources for permanent needs and short-term sources for temporary working capital needs.

- Debentures: Like shares, debentures also include generating money from the general public, financial institutions, and other companies. However, unlike shares, in the case of debentures, the company has to declare the interest they will pay to their lenders openly. The company is legally bound to pay the agreed interest. So, here, if the funds are unused or even if the company runs into losses, they have to pay the lenders.

Conclusion

To the extent that the explicit costs of short-term financing are less than the long-term financing, the greater the proportion of short-term debt to total debt, the higher is the profitability of the firm.