Introduction

In its Union Budget documents, the Centre shows the revenue deficit, the primary deficit and the fiscal deficit. Of them, the fiscal deficit is closely watched during the budget.

A fiscal deficit is a shortfall in a government’s income compared with its spending. The government that has a fiscal deficit is spending beyond its means.

A fiscal deficit is calculated as a percentage of gross domestic product (GDP), or simply as total rupees spent in excess of income. In either case, the income figure includes only taxes and other revenues and excludes money borrowed to make up the shortfall.

A fiscal deficit is different from fiscal debt. The latter is the total debt accumulated over years of deficit spending.

Components of Fiscal Deficit

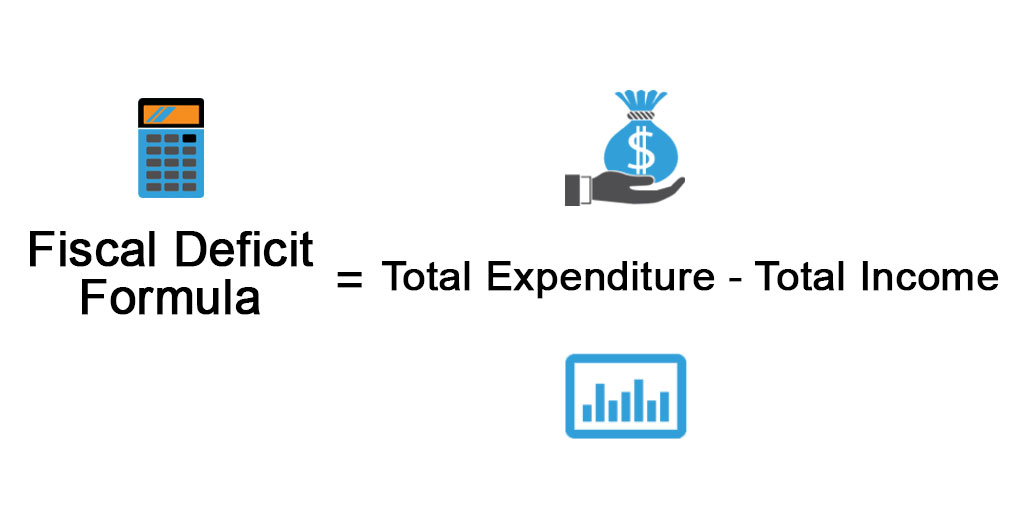

The fiscal deficit calculations are based on two components — Total receipts and Total Expenditure.

Receipts include tax revenue from corporation tax, income tax, GST, customs duties and non-tax revenues such as external grants, interest receipts, dividends and profits, and receipts from Union Territories, among others. Capital receipts like recoveries of loans and advances, disinvestment proceeds are also part of total income of the government.

We’ll now take a closer look at the components that make up the total income of the government in the form of revenue receipts and non-tax revenues.

- Components of revenue receipts a. Income tax b. GST and taxes of Union territories c. Custom duties d. Union excise duties e. Corporation tax

- Sources of non-tax revenues a. Interest received through loan recovery b. Receipts of union territories c. Dividends and profits d. External grants e. Other non-tax revenues

While expenditure carried out through various ministries are divided into two categories, capital and revenue. Interest payments are part of revenue expenditure and loans disbursed come under capital expenditure.

Fiscal Deficit = Total expenditure by the government (revenue and capital expenditure) – Total income of the government (loan recovery, revenue and non-revenue receipts)

For example, if the GDP of a country is ₹100 lakh crore and the difference between total income and expenditure is ₹10 lakh crore then the fiscal deficit is 10%.

Fiscal deficit is mainly financed through market borrowings. For this purpose, the government issues various instruments like Treasury Bills and Bonds.

Revenue Deficit refers to the excess of revenue expenditure over revenue receipts and Primary Deficit is measured as Fiscal Deficit less interest payments.

Officials privy to budget-making exercise recently told a news agency that the government was aiming for a less ambitious fiscal deficit of 6.3% to 6.5% of GDP for the next financial year due to the pandemic.

Every time the government borrows money for spending beyond its earning, it is covering up the shortfall in the income compared with its spending. This shortfall or gap between the two is called the fiscal deficit.

It can occur due to a major rise in the capital expenditure required for creating long term assets or providing financial assistance to poor farmers, labourers and other vulnerable sections of the society. The government finances these deficits by borrowing money from the capital markets. They can do this by issuing bonds or from the central bank.

A high fiscal deficit every year hints that the government has been spending beyond its means. Economists need to keep an eye on the fiscal deficits to determine how much the government is exceeding its income.

The income generated from all these sources is then spent on capital expenditure, revenue expenditure, payment of interest and grants-in-aid (for creating capital assets) by the government and is termed as total expenditure.

The Fiscal Deficit

A fiscal deficit is not universally regarded as a negative event. For example, the influential economist John Maynard Keynes argued that deficit spending and the debts incurred to sustain that spending can help countries climb out of economic recession.

Fiscal conservatives generally argue against deficits and in favor of a balanced budget policy.

In the United States, fiscal deficits have been occurring regularly since the nation declared independence. Alexander Hamilton, the first Secretary of the Treasury, proposed issuing bonds to pay off the debts incurred by the states during the Revolutionary War.

Record Fiscal Deficits

At the height of the Depression, President Franklin D. Roosevelt made a virtue of necessity and issued the first U.S. Savings Bonds to encourage Americans to save more and, not incidentally, finance government spending.

In fact, President Roosevelt holds the record for the fastest-growing U.S. fiscal deficits. The New Deal policies designed to pull America out of the Great Depression, combined with the need to finance the country’s entry into World War II, drove the federal deficit from 4.5% of GDP in 1932 to 26.8% in 1943.

After the war, the federal deficit was reduced and a surplus of $4 billion was established by 1947 under President Harry S. Truman.

The 2020 fiscal deficit of the United States was $3.1 trillion, roughly three times the size of the 2019 deficit.

In 2009, President Barack Obama increased the deficit to more than $1 trillion to finance the government stimulus programs designed to fight off the Great Recession. That was a record dollar number but actually was only 9.7% of GDP, far under the numbers reached in the 1940s.

In 2020, under President Donald Trump, the deficit reached $3.1 trillion for the entire fiscal year due to a combination of tax cuts and increased spending amid the COVID-19 pandemic and subsequent economic fallout.

The central government’s fiscal deficit for April to November 2021, the first eight months of the current fiscal year, narrowed to 46.2% of the annual budget target, helped by a rise in tax collections, official data showed recently.

In actual terms, the deficit stood at Rs 6.96 trillion at the end of November 2021 against the annual estimate of Rs 15.06 trillion, according to the Controller General of Accounts (CGA).

Rare Fiscal Surpluses

A budget surplus is a rare phenomenon and most countries continue to have a deficit. A high deficit at times also emerges if the government is spending on developmental works like construction of highways, ports, roads and airports. And it is a good sign.

Since World War II, the U.S. government has run at a fiscal deficit in most years.

As noted, President Truman produced a surplus in 1947, followed by two more in 1948 and 1951. President Dwight Eisenhower’s government had small deficits for several years before producing small surpluses in 1956, 1957, and 1960. President Richard M. Nixon had just one, in 1969.

The next federal surplus did not occur until 1998 when President Bill Clinton reached a landmark budget deal with Congress that resulted in a $70 billion surplus. The surplus grew to $236 billion in 2000. President George W. Bush benefited from a $128 billion carryover of the Clinton surplus in 2001.

Current National Trends

Finance Minister Nirmala Sitharaman on Wednesday said the projected fiscal deficit of 6.9 per cent for the current financial year is a “responsible” target as the government has tried to ensure a balance between keeping up expenditure and being fiscally prudent. Making an intervention during the discussion on the Union Budget 2022-23 in the Lok Sabha.

In the Budget speech, Sitharaman had also said the fiscal deficit in 2022-23 is estimated at 6.4 per cent of GDP, which is consistent with the broad path of fiscal consolidation announced by her last year to reach a fiscal deficit level below 4.5 per cent by 2025-26.

Conclusion

The fiscal deficit of a country is calculated as a percentage of its GDP and for the current financial year, the government expects the deficit at 6.8% of GDP.