Introduction

The concept of insurance is built around 7 principles. These are the pillars on which insurance stands upon.

To ensure the proper functioning of an insurance contract, the insurer and the insured have to uphold the 7 Principles of Insurances mentioned below:

- Utmost Good Faith

- Proximate Cause

- Insurable Interest

- Indemnity

- Subrogation

- Contribution

- Loss Minimization

Let us understand each principle of insurance:

Principle of Utmost Good Faith

The fundamental principle is that both the parties in an insurance contract should act in good faith towards each other, i.e. they must provide clear and concise information related to the terms and conditions of the contract.

The Insured should provide all the information related to the subject matter, and the insurer must give precise details regarding the contract.

Example – Jacob took a health insurance policy. At the time of taking insurance, he was a smoker and failed to disclose this fact. Later, he got cancer. In such a situation, the Insurance company will not be liable to bear the financial burden as Jacob concealed important facts.

Principle of Proximate Cause

This is also called the principle of ‘Causa Proxima’. This principle applies when the loss is the result of two or more causes. The insurance company will find the nearest cause of loss to the property. If the proximate cause is the one in which the property is insured, then the company must pay compensation. If it is not a cause the property is insured against, then no payment will be made by the insured.

Example –

Due to fire, a wall of a building was damaged, and the municipal authority ordered it to be demolished. While demolition the adjoining building was damaged. The owner of the adjoining building claimed the loss under the fire policy. The court held that fire is the nearest cause of loss to the adjoining building, and the claim is payable as the falling of the wall is an inevitable result of the fire.

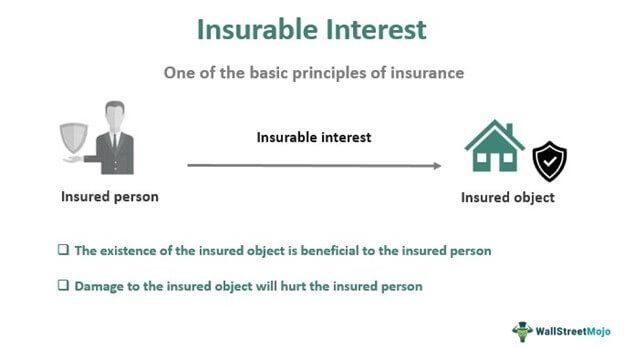

Principle of Insurable interest

This principle says that the individual (insured) must have an insurable interest in the subject matter. Insurable interest means that the subject matter for which the individual enters the insurance contract must provide some financial gain to the insured and also lead to a financial loss if there is any damage, destruction or loss.

This principle states that the insured has a legal right to insure the subject matter of insurance because of the financial interest he has on the subject matter.

Example – the owner of a vegetable cart has an insurable interest in the cart because he is earning money from it. However, if he sells the cart, he will no longer have an insurable interest in it.

To claim the amount of insurance, the insured must be the owner of the subject matter both at the time of entering the contract and at the time of the accident.

Principle of Indemnity

This principle says that insurance is done only for the coverage of the loss; hence insured should not make any profit from the insurance contract. In other words, the insured should be compensated the amount equal to the actual loss and not the amount exceeding the loss. The purpose of the indemnity principle is to set back the insured at the same financial position as he was before the loss occurred. Principle of indemnity is observed strictly for property insurance and not applicable for the life insurance contract.

Example – The owner of a commercial building enters an insurance contract to recover the costs for any loss or damage in future. If the building sustains structural damages from fire, then the insurer will indemnify the owner for the costs to repair the building by way of reimbursing the owner for the exact amount spent on repair or by reconstructing the damaged areas using its own authorized contractors.

Principle of Subrogation

Subrogation means one party stands in for another. As per this principle, after the insured, i.e. the individual has been compensated for the incurred loss to him on the subject matter that was insured, the rights of the ownership of that property goes to the insurer, i.e. the company.

Subrogation gives the right to the insurance company to claim the amount of loss from the third-party responsible for the same.

Example – If Mr A gets injured in a road accident, due to reckless driving of a third party, the company with which Mr A took the accidental insurance will compensate the loss occurred to Mr A and will also sue the third party to recover the money paid as claim.

Principle of Contribution

Contribution principle applies when the insured takes more than one insurance policy for the same subject matter. It states the same thing as in the principle of indemnity, i.e. the insured cannot make a profit by claiming the loss of one subject matter from different policies or companies.

It is defined as The right of an insurer, following payment of a claim to take over the insured’s rights to recover payment from a third-party responsible for the loss. It is limited to the amount paid out under the policy.

Example – A property worth Rs. 5 Lakhs is insured with Company A for Rs. 3 lakhs and with company B for Rs.1 lakhs. The owner in case of damage to the property for 3 lakhs can claim the full amount from Company A but then he cannot claim any amount from Company B. Now, Company A can claim the proportional amount reimbursed value from Company B.

Principle of Loss Minimisation

This principle says that as an owner, it is obligatory on the part of the insurer to take necessary steps to minimise the loss to the insured property. The principle does not allow the owner to be irresponsible or negligent just because the subject matter is insured.

Example – If a fire breaks out in your factory, you should take reasonable steps to put out the fire. You cannot just stand back and allow the fire to burn down the factory because you know that the insurance company will compensate for it.

Conclusion

If these principles of insurance are well understood and implemented by all parties in the insurance industry. From the insurer to the insured through the intermediaries and the regulators, every party will realize that insurance is creating value to everyone as against the erroneous impression portrayed by the insuring public due to insufficient information at our disposal.