“If you don’t find a way to make money while you sleep, you will work until you die.” –Warren Buffett In today’s world, everyone is an investor. We constantly invest our time, money, and efforts into various activities and entities. However, when it comes to money, there are two types of investors- wolves and monkeys.

WOLVES AND MONKEYS

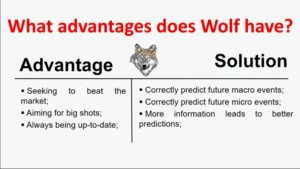

Wolves here, refers to people like Gordon Gekko of Wall Street who go by “Greed is Good “. These wolves try to beat the market, aim for big shots, are always up to date and have a “proven” strategy. On the other hand, monkeys seek to merely beat inflation, try to avoid big losses, invest periodically and generally have no idea what’s going on. Although it seems like the wolves would make better investment decisions, but that is not always the case. The major challenge for professional investors is predicting Macro events, because the world is full of random events. For example-

- In 2015, Volkswagen faced the Das problem, due to which its stocks fell bye 40% in just 2 weeks.

- Leicester City Football Club had a 1:5000 odds of winning, which is less than half the odds of Kim Kardashian becoming the US president, which is 1:2000. Yet, it won that year.

- Titanic, for which it was said – “Not even God himself could sink the ship”, sunk.

The concept of beating the market goes against the odds for the following reasons-

- Randomness plays a huge role

- Efficient future forecasting is impossible

- Stock “picking” does not generate additional value

HOW TO BEAT INVESTMENT MANAGERS

During 1980 to 2008 period, simple benchmark outperformed is 60% of actively managed funds. So, the question arises, how can a monkey beat the wolves of Wall Street? This is because monkeys adhere to, and should abide by the following –

- Mimic the market, instead of trying to beat it

- Don’t try to explore illusional in efficiencies

- Don’t try to chase one lucky shot, bet on the future of the whole world

- Since the future is unpredictable, diversify

- Buy as much as you can, as many countries, sectors, stocks as possible

- Buy – hold – forget, keep it very simple

There is a very high probability that over the long run, using simple strategy – following broadly diversified index – outperforms 90% of professional investment managers.

THE EXPERIMENT

An experiment was conducted where the stocks of all companies traded on the New York Stock Exchange were put up, and blindfolded monkeys were given darts to throw at the wall. The company’s names which the darts would land on would be the stocks bought and this portfolio would be held for the next two years.

Then, master portfolio managers and stock experts were brought in and they picked out stocks and made their own portfolios containing companies that they had researched and thought would do well.

The results showed that the monkey beat 90% of the experts. Was this because the monkey was smarter than the professionals? No. This is because any portfolio of 30 stocks randomly selected from the list of 1,000 stocks is bound to include mostly smaller companies. Since small companies outperformed big companies, the monkey portfolios beat the market.

However, it is important to note that where there is extra return, there’s usually extra risk. Portfolios that hold a higher concentration in small-cap stocks and value stocks have more risk than the market as a whole.

INVESTING PRINCIPLES

- Invest by facts not emotion. Never borrow and invest. For example, we might see our neighbor make a lot of money in a very short time and invest impulsively without knowing all the facts. We should avoid this and be rational.

- Buy good businesses, not cheap ones. Beginners often tend to buy cheaper stocks as they look more attractive however cheap does not always mean good, especially in the long run.

- Only buy stocks you understand. ‘Understand’ does not mean knowing all the specifics about the business, but understanding the economics of the business in the future. This is also called our circle of competence. For example, the Internet won’t affect or change a chewing gum company. A top chewing gum producing company will remain in the future.

- When you see a great opportunity, take it, especially if it’s in your circle of competence. We often regret a lot of the chances that we don’t take because of lack of confidence or fickleness. These losses don’t show in conventional accounting, however, the pinch can be felt by us.

- Don’t sell unless the business fundamentally changes or unless there is a chronic shortage of funds or very bad management in the company. When the market is bullish and the prices are high, we often tempted to sell, however historically, it is proven that more often than not, these prices will only go higher in the future. Hence we should resist from selling.

- Buy at a price below intrinsic value. Intrinsic value of a stock is its true value. This is calculated on the basis of the monetary benefit you expect to receive from it in the future. It is the maximum value at which you can buy the asset, without making a loss in the future when you sell it. Hence, it is advisable and rational to buy stocks only below intrinsic value.

- Diversify. investing in a single stock is very high risk because the market is uncertain. This is why it is advised not to put more than 10% of the total nest eggs in a single stock, because if you pick a single stock you are as dumb as a blindfolded monkey.

Hence, in conclusion, the monkeys from the experiment prove that investing in stocks is not very complex and can easily be done correctly by beginners, provided that they follow the key principles. One should know how much return they expect and how much risk they are willing to take and invest accordingly.