Barry Ritholtz, an equity analyst, says that emotional resilience and discipline are necessary to make a trading strategy worth it. He studied how behavioral economics and data affects investors. He also suggested some investment tips and strategies investors can follow to maximize their wealth.

A globally diversified portfolio with asset classes less correlated to equities- like treasury inflation-protected securities, corporate bonds, and so on is the key to successful trading.

The portfolios with 60% equities and 40% fixed income will fall 26-28% when the market cuts in half, such as in 2008-09. If an investor cannot bear the 25% pullback in their portfolio value, he has no business owning stocks.

Capital preservation and risk management are on the top of the list. Investment success requires financial planning and wealth management.

To maintain a balance between short and long-term returns, risk management and a low-cost strategy helps investors handle periodic volatility.

These are some investment tips that will help you to invest wisely:

1. Hold onto your winners and cut losers short

Winners help to earn desirable returns if held for long. It allows compounding to occur with low tax and transaction costs. Similarly, cutting losers short makes investors intelligent and humble. It also takes investors away from non-performing stocks and compels them to accept their own mistakes, which are necessary for unlearning and learning a few aspects of markets.

2. Avoid making predictions

Investors should focus on making money rather than predicting what the future outcomes bring to them. Investors who are bad at guessing the results should also ignore other people’s forecasts.

The disaster happens when investors tweak their portfolios based on the predictions instead of understanding the market scenarios.

3. Study crowd behavior

Following the crowd behavior might sound ‘wrong’, but the investors who understand it have an advantage over others. Investing is not about picking up the best stocks or sectors. It is all about selecting what the crowd is going for.

Remember, the crowd is the market. The psychology is- higher prices attract buyers, and lower prices create sellers. Not following others instils a fear of missing out on a powerful rally. Moreover, fear of losses impacts the investors more than losing out on a rally.

4. Be a contrarian

At times the crowd is overly emotional or irrational. At such times investors should oppose the popular opinion and become contrarian. Stop betting with the herd when the crowd turns into an undisciplined mob. During this time, turn against the crowd when people follow one another without any rational decision.

People follow unconventional beliefs where they accept a particular social culture because they are uncomfortable with having a difference of opinion. Humans are social animals who like to work and cooperate with the members of their tribe.

There is a qualitative difference between the behavior of rational-minded investors and the panicked move of a mob. A true contrarian knows to differentiate between a mob and crowd, a market rally and bubble. But the tricky decision always remains – the timing.

5. Asset allocation

Asset allocation is more significant than stock selection. Selecting stocks is just a fun game, but asset allocation means creating wealth over the long haul. A decision investment will have a proper weighting of stocks, bonds, commodities, and real estate.

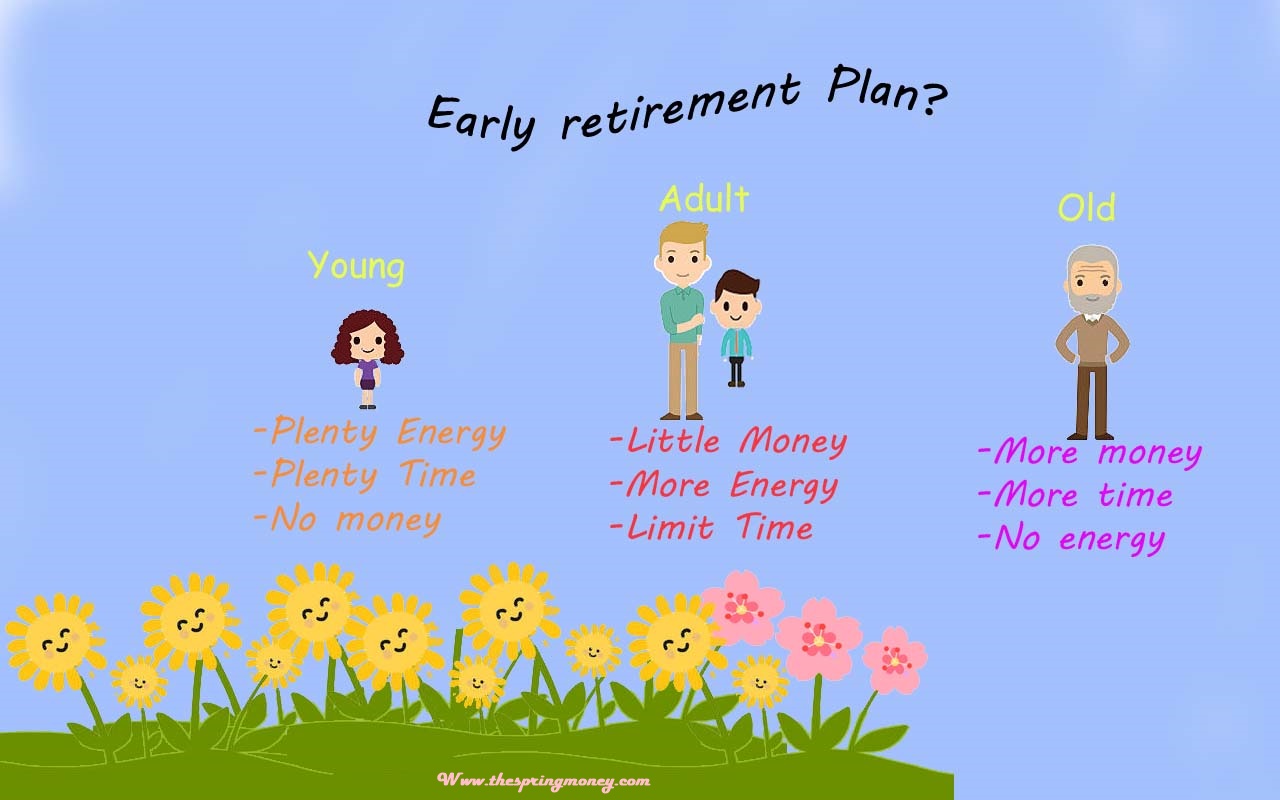

The weightage of stocks depends upon the income, age, risk tolerance, and retirement need of the investor.

6. Indexing

Do you invest in indices and then collect market-level returns or bet on stocks and time the market to beat the market indices?

According to records, 80% of the investor failed to outperform the benchmark. All those who outperformed the index earned less than a 2% jackpot. Hence, indexing is the preference of many investors.

7. Avoid psychological and cognitive errors

The most dangerous competitor of investors are not the other traders, institutional investors, and hedge funds, but they themselves. Most investors are overconfident about their abilities in trading stocks and timing the market.

We look after those things that sync with our thoughts and analysis and ignore facts that challenge our views. Investors get stuck between the extreme emotions of greed and fear.

Our psychological and cognitive errors bring us on the wrong path. Surprisingly, we are risk-averse traders rather than risk-takers. We ignore the long-term trends and overemphasize the recent trends.

8. Accept your mistakes

Admit if you made a bad investment. Ego or stubbornness will turn out as an expensive sin. The most effective solution is admitting the errors, fixing them, and moving on. Always learn from your mistakes and never repeat them. It is human to make mistakes but foolish to make those errors again. Instead, make new mistakes.

9. Study financial cycles

Once a specific approach has provided profits over the long term, reverse your thinking. The reversal of thinking becomes challenging and crucial if used for a long time.

Pay attention to history. The events move in long irregular cycles. A business cycle fluctuates between expansion and contraction periods where recoveries and recessions happen.

Similarly, there is a market cycle where boom and busts occur frequently. The bull market follows the bear market, and then the bear follows the bull market. Understand ‘This too shall pass.’ Nothing is constant, and something will change.

10. Stay away from the comfort zone

Many investors enter into a comfort zone, believing that a particular investment strategy will last forever. It is disastrous because many of the factors influencing market return change constantly. These inputs are profits, Fed’s actions, interest rates, technology, economy, tax policy, international affairs, and many more.

Upgrade your skillset. Be flexible and adaptive. Have intellectual curiosity- if you are not changing when everything else is, you are being left behind.

11. Reduce investing friction

Anything that reduces your total returns is friction in investing terms. The long-term effects of taxes, fees, and costs on your network will reduce your profits. Keep your taxes, expenses, costs, and fees low to improve returns and retain more assets over the long haul.

12. There is no free lunch

Investors are always tempted to get something for nothing. But remember there are no free lunches. The hot tip? The investments without tax research? High-yield junk bonds? Have too much cash? – The safety is just an illusion because cash won’t keep up with inflation.

There is no magic formula or secret hedge fund to make you wealthy.

Do your research before investing!

Conclusion

To sum up, make rational and unemotional decisions. Firstly, do your homework well. Secondly, spend time and learn the basics of investing to understand the challenges and opportunities in the investment world.

Lastly, the capital market makes the best probabilistic decision using incomplete information about future outcomes.