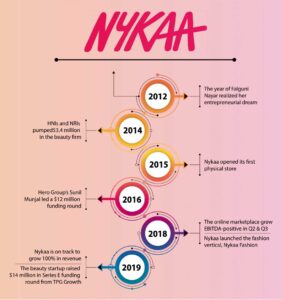

Nykaa is a personal, beauty-care, lifestyle products company. FSN E-commerce company is the parent company of Nykaa. There is euphoria in the bull market, motivating new-age companies to come out with their IPO. The valuations are like never seen before, and the appetite for good management and businesses is enormous.

Nykaa’s valuations have doubled so far, and it saw a robust response on the first day of its subscription. The issue was subscribed 1.6 times on the first day, with retail investors applying for 3.5 times the issue size open for them.

The price band is ₹1085-1125. There is a ₹630 crore primary issue and 41.97 million shares offer for sale (OFS). Lighthouse Funds, TPG growth, many other HNIs, will exit from the company.

Nykaa is expecting to raise ₹5352 crore, which is 21 times its FY21 revenue and at a valuation of more than ₹55,400 crores.

Nykaa is expensive because it is profitable, but the issue is faring well. Instead, Nykaa increased the size issue by 20% after filing DRHP with SEBI. The grey market premium is ₹605-610 per share, indicating that it will get listed at ₹600 more than the upper price band.

Nykaa’s valuation

Nykaa does not have a direct comparable peer, making it difficult to compare and value the business. With the evolving dynamics and high potential growth of new types of business, it becomes difficult to tag the valuations of such businesses as cheap, fair or expensive.

Nykaa is in the transformation stage –entering into the lifestyle segment. The only thing in favour of Nykaa’s IPO is- it is one among the few lucrative e-commerce businesses.

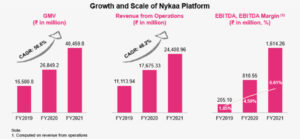

According to estimates, the CAGR (Compound Annual Growth Rate) – the average annual growth of the rate of return from investment, will be around 35% of its sales and 65% in Ebidta with double-digit margins. Investors should apply for Nykaa’s IPO.

The EV/GMV (Enterprise value to Gross Merchandize Value, representing the portion of enterprise value in its total sales) is 12.6 times its sales of FY21 and 4.7 times EV/GMV of its FY24 sales, offering a long-term value.

The price-to-earnings ratio, price-to-book value ratio, and all new metrics to measure valuations are promising. Besides the business opportunities and the potential of the company to grow, the IPO market euphoria has ramped up the valuations.

The company was planning its IPO at $3 billion, but now it aims at $7.4 billion.

Brokers views on Nykaa’s IPO

Broking firms are optimistic about the prospects of the IPO, and the company’s potential has displayed a strong investors’ interest.

But retail investors need not go all at a time. They should start with a limited amount and not think it is as free money on the table while playing with the new-age businesses. The dynamics are unpredictable and can evolve anytime.

Nykaa’s anchor book saw a subscription of ₹ 2396 crore. Almost 20 mutual fund companies invested through the anchor route. A few names of the companies are – BEST Investment Corporation, Canada Pension Plan Investment Board, Fidelity Funds, Government of Singapore, etc.

The cosmetic vertical has many opportunities, and the fashion vertical has cutthroat competition. Nykaa addresses a niche market, creating barriers for others to enter.

The only challenge is valuation- one needs to hold the shares for long. The valuations are expensive.

Nykaa’s move beyond beauty

The core business of Nykaa, personal and beauty care, can create 75-80% of its total Gross Merchandise Value (GMV).

Nykaa needs to grow and expand its business in various categories. It has been doing this in two ways.

Firstly, Nykaa Fashion, launched in 2018, sells premium designer wear. This business has seen tremendous growth, and it has developed in a bunch of categories like kids wear, lingerie, home décor, etc.

The fashion business of Nykaa has picked up in the past few quarters without having any first-mover advantage. The absence of first movers made them think about how to differentiate their products and businesses. The average order value of Nykaa is ₹ 3977.

Lifestyle and fashion categories are bigger than personal and beauty care, but it has a lot of competitors, especially from Walmart-owned Flipkart, Myntra, Reliance Retail, Tata group, etc.

Nykaa Fashion needs to hold on to its premium inventory, higher-order value, higher-paying customers, etc., to gain a competitive advantage.

Nykaa is better for brands as it provides curated and well-organized fashion brands under one roof. One needs to be a mass scale brand like Biba or W or a seller manufacturing bulk design.

Indian apparel brand Rustorange listed its brand on Nykaa and is getting good traction. The average selling price matches with Nykaa’s and is higher than other brands in the market.

Secondly, Nykaa is looking forward to entering into new categories such as tech accessories and nutraceuticals.

Recently, Nykaa bought a majority stake in Dot & Key, a personal care brand, from existing shareholders for ₹ 46.9 crores. IKWI, a sub-brand of Nykaa under which it sells nutraceuticals like vitamin tablets.

Challenges faced by Nykaa

There is an opportunity to grow in the digital wellness space. But it requires a lot of time and effort to educate the consumers and build the nutraceuticals brand online. The online penetration of this segment is growing. Nykaa is earning 40-45% of the revenue from this segment, and most of the income is from first-time consumers.

With the rise of e-pharmacy, existing competitors in this segment like Tata Sons and Reliance Industries are potential threats to Nykaa. According to records and experts, non-prescription products such as nutraceuticals bring less than 20% of revenue to the business. Even the large companies are not investing much time and effort to scale up their business from this segment.

Nykaa is also looking to expand its new category, Nykaa Man, with non-FMGC products such as tech accessories like earphones, smartwatches, etc. But for brands such as boAt, Nykaa Man is still growing. It does not match the level of Flipkart and Amazon, considering they are competing to grab more share in the e-commerce segment.

Conclusion

Nykaa’s valuations are risky. New-age businesses are heading towards stock markets, blurring the gap between old economy sectors and technology.

Nykaa’s listing will be at a rich premium, but its ability to transit from e-commerce will be crucial for investors.

Nykaa focuses on fashion, men’s grooming, accessories, wellness, and lifestyle. But the competition in this segment is intensifying, especially from conglomerates.