Investment phenomena are not only about putting money into a commodity for its inflationary increment. the concept also involves social sciences. Here, I want to talk about psychology in the investment industry.

Investors Psychology

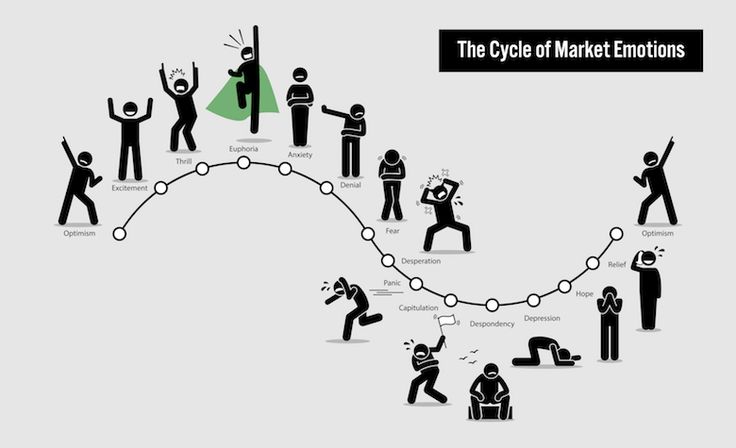

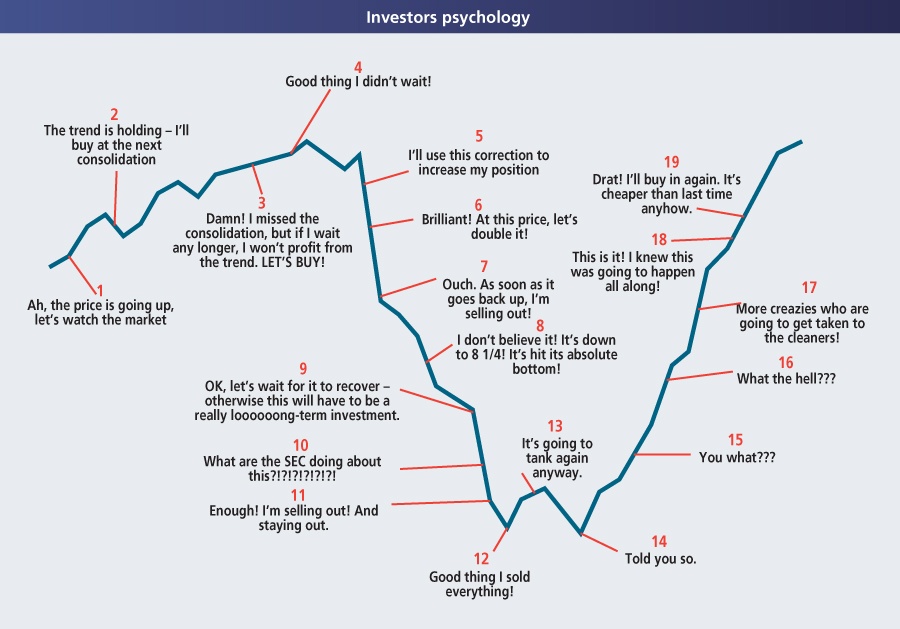

Many market commentators routinely throw around concepts such as ‘Fear and Greed’ and how instrumental they are in the behavior of individuals and markets as a whole. While both fear and greed play a role in individual and mass behaviors, they are part of a much larger set of attitudes and emotions that affects our investing decisions.

I am an investor with a mix of growth/value stocks, high-dividend and traditional dividend stocks. While I do not first consider psychological factors before making an investment, I do try to be aware of how specific traits and tendencies might affect my investment decisions. Whether this awareness helps my investing decisions or not is of course difficult to measure.

Behavioral finance is a relatively new field that seeks to combine behavioral and cognitive psychological theory with conventional economics and finance to provide explanations for why people make irrational financial decisions.

Cognitive psychologists Daniel Kahneman and Amos Tversky are considered the fathers of behavioral economics/finance. Since their initial collaborations in the late 1960s, this duo has published about 200 works, most of which relate to psychological concepts with implications for behavioral finance. In 2002, Kahneman received the Nobel Memorial Prize in Economic Sciences for his contributions to the study of rationality in economics.

Kahneman and Tversky have focused much of their research on the cognitive biases and heuristics (e.g., approaches to problem solving) that cause people to engage in unanticipated irrational behavior. Their most popular and notable works include writings about prospect theory and loss aversion.

Psychology of Personal Finance

From an individual perspective, financial psychology encompasses practices related to managing one’s financial life ,that is, personal finance and draws heavily from areas including developmental, social, cognitive, and consumer psychology.

The individual side focuses on how we make decisions about saving, spending, and investing. As an example, consider the way you made your last significant financial decision, perhaps the purchase of a car or home. From a purely economic perspective, there is a “right” answer in terms of the most advantageous financial response to your decision. This economic “right answer” is not always chosen. Because we are influenced into decisions by others (social psychology), we have expectations or schemes for what we want our lives to look like today (developmental psychology), and we have biases in our decision making (cognitive psychology). All of these psychological variables (and many more!) may lead us away from the most financially advantageous answer when considering how we spend our money.

From a client-advisor standpoint, financial psychology includes aspects of the academic fields of financial planning, therapy, counseling, and coaching. The CFP Board defines client psychology as the biases, behaviors, and perceptions that impact client decision-making and well-being.

Psychology of Stock Market Trading

Trading psychology refers to the emotions and mental state that help dictate success or failure in trading securities. Trading psychology represents various aspects of an individual’s character and behaviors that influence their trading actions. Trading psychology can be as important as other attributes such as knowledge, experience, and skill in determining trading success. Conventional characterizations of emotionally-driven behavior in markets ascribe most emotional trading to either greed or fear.

Morgan Housel’s : Psychology of Money

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel.

- “The premise of this book is that doing well with money has a little to do with how smart you are and a lot to do with how you behave.”

- “Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know. I call this soft skill the psychology of money.”

- “Luck and risk are both the reality that every outcome in life is guided by forces other than individual effort.”

- Life isn’t any fun without a sense of enough. Happiness, as it’s said, is just results minus expectations.

- If something compounds—if a little growth serves as the fuel for future growth—a small starting base can lead to results so extraordinary they seem to defy logic. It can be so logic-defying that you underestimate what’s possible, where growth comes from, and what it can lead to.

- There are a million ways to get wealthy … but there’s only one way to stay wealthy: some combination of frugality and paranoia.

- A lot of things in business and investing work this way. Long tails—the farthest ends of a distribution of outcomes—have tremendous influence in finance, where a small number of events can account for the majority of outcomes.

- The ability to do what you want, when you want, with who you want, for as long as you want, is priceless. It is the highest dividend money pays.

- No one is impressed with your possessions as much as you are.

- Spending money to show people how much money you have is the fastest way to have less money.

- Building wealth has little to do with your income or investment returns, and lots to do with your savings rate.

- Do not aim to be coldly rational when making financial decisions. Aim to just be pretty reasonable. Reasonable is more realistic and you have a better chance of sticking with it for the long run, which is what matters most when managing money.

- The correct lesson to learn from surprises is that the world is surprising. Not that we should use past surprises as a guide to future boundaries; that we should use past surprises as an admission that we have no idea what might happen next.

- Margin of safety—you can also call it room for error or redundancy—is the only effective way to safely navigate a world that is governed by odds, not certainties. And almost everything related to money exists in that kind of world.

- Long-term planning is harder than it seems because people’s goals and desires change over time.

- Everything has a price, but not all prices appear on labels.

- Beware taking financial cues from people playing a different game than you are.

- Optimism sounds like a sales pitch. Pessimism sounds like someone trying to help you.

- Stories are, by far, the most powerful force in the economy. They are the fuel that can let the tangible parts of the economy work, or the brake that holds our capabilities back.

The above pointers are just key sentences from every chapter of the book. I ,personally want everyone reading article, to read and absorb the beneficiaries of this book.

Conclusion

Trading is something beneficiaries want to learn to reduce their dependency on traders. The difference is that traders understand the psychology behind it and that makes a big difference because social sciences manages to create a picture which can have different perspectives. That’s why psychology plays an integral part in any business.