Losses are hard to digest, but the Indian tax law provides benefits when a firm or company incurs losses. The provisions are Set Off and Carry Forward of Losses. Let’s look at what is Set Off and Carry Forward of Losses.

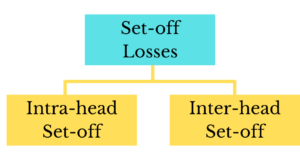

Set Off of Losses

Set Off of Losses means adjusting the current year’s loss with the profit or income of the current year. It is of two types:

Inter Source or Intra Head Set Off (Section 70)

When the losses from one source of income are set off against the income of another source of income, both the sources are from the same head of income.

For instance, one can set off the loss from house property A against the income from house property B.

There are some exceptions to Inter Source or Intra Head Set Off:

- Firstly, one cannot set off long-term capital losses against short term capital gains. However, one can set off short term capital losses against both short term and long-term capital gains. For instance, the short-term capital loss was one lakh, and the long-term capital gain was two lakhs. Hence, the total income under capital gains is ₹50,000. Another example, long-term capital loss is one lakh, and short-term capital gain is three lakhs. Now, one cannot set off long-term capital loss against short-term capital gain. Therefore, total capital gain is three lakhs and the long-term capital loss is carried forward. For example, long-term capital loss from security A is one lakh. The long-term capital gain from security B is two lakhs. One can set off long-term capital loss against long-term capital gain only. Therefore, the total capital income is one lakh.

- Secondly, one cannot set off losses from the speculative business against the profits of a normal business or profession. Speculative business losses are set off against speculative business profits only. Here, speculative business means trading securities via exchanges.

- Thirdly, one can set off losses from owning or maintaining a horse racing business against the income of that business activity only.

- Lastly, losses from a specified business mentioned in section 35AD are set off against the profits or income of another specified business only.

Inter Head Set Off (Section 71)

Loss from one income head is set off against the income or profits of another income head.

For example, one can set off the loss from house property against income from salary.

There are some exceptions to Inter Head Set Off:

- Firstly, one cannot set off losses from gains from business or profession against income from salaries.

- Secondly, one cannot set off the losses from capital gains against any other income heads.

- Thirdly, losses from speculative business, specified business, and horse racing are not set off against any other income heads.

- Lastly, one can set off the loss from house property against any income head with a maximum limit of two lakhs.

Carry Forward of Losses

Carry Forward of Losses means taking excess losses of the current year to the next years and adjusting them with the profits of the upcoming years. Following are some cases when one can carry forward the losses to the next year:

If losses from house property exceed two lakhs in the current year:

- In this scenario, one can carry forward the losses up to the next eight assessment years from the year of loss.

- Moreover, one can adjust the loss against income from house property only.

- Lastly, one can carry forward the loss even if the return on income for the year of loss is belatedly filed.

If one is not able to set off losses from speculative business in the current year:

- In this case, one can carry forward the losses up to the next four assessment years from the year of loss.

- Moreover, one can adjust the loss against income from speculative business only.

- Carry forward of losses is not possible if one does not file the return on income for the year of loss on the original due date.

- Additionally, it is not necessary to continue the business at the time of set off in the future years.

If one is not able to set off specified Business Loss under section 35AD in the current year:

- Firstly, it is not necessary to continue the business at the time of set off in the future years.

- Secondly, there is no time limit to carry forward losses from the specified business.

- Moreover, one can adjust the loss against income from specified business under section 35AD only.

- Lastly, carry forward of losses is not possible if one does not file the return on income for the year of loss on the original due date.

Specified Business Income includes:

- Setting up or operating a warehousing facility for an agricultural purpose or storing sugar only.

- Further, setting up or operating a cold chain facility or inland container freight station.

- Constructing or operating a two-star or above hotel in India.

- Then, constructing or operating a hospital with a minimum of 100 beds in India.

- Production of fertilizers.

- Moreover, constructing or developing housing projects for slum rehabilitation and affordable housing.

- Lastly, laying or operating cross country natural gas or crude or petroleum pipeline distribution network.

If one is not able to set off capital losses in the current year:

- In this scenario, one can carry forward the losses up to the next eight assessment years from the year of loss.

- Carry forward of losses is not possible if one does not file the return on income for the year of loss on the original due date.

- Further, long-term capital losses are set off against long-term capital gains only.

- Moreover, short term capital losses are set off against both short term and long-term capital gains.

If one is not able to set off losses from horse racing in the current year:

- In this case, one can carry forward the losses up to the next four assessment years from the year of loss.

- Moreover, carry forward of losses is not possible if one does not file the return on income for the year of loss on the original due date.

- One can adjust the loss against income from the horse racing business only.

If one is not able to set off losses from normal business in the current year:

- In this scenario, one can carry forward the losses up to the next eight assessment years from the year of loss.

- Moreover, one can adjust the loss against income from business or profession only.

- Carry forward of losses is not possible if one does not file the return on income for the year of loss on the original due date.

- Additionally, it is not necessary to continue the business at the time of set off in the future years.

Unabsorbed Depreciation:

- Unabsorbed Deprecation means the amount of unutilized depreciation that a person is unable to claim as an expense because of insufficient profit in the P&L account.

- One can set off such unabsorbed depreciation against any heads of income and carry forward the balance for any number of periods.