Using credit cards for railway ticket booking offers many advantages for those who frequently travel by train. There are several benefits to enjoy, including cashback, reward points, and exclusive discounts on ticket bookings. These cards provide a convenient and cost-effective way to book your travel. This text highlights the benefits of these financial products for travellers, emphasising how they can save money and enjoy additional perks. It emphasises the value and convenience these products bring to make trips more budget-friendly and hassle-free.

What Is a Credit Card for Railway Ticket Booking?

Passengers travelling on Indian Railways are required to have valid photo identity cards. The list of acceptable identification documents is comprehensive, encompassing a variety of essential cards, including passports, voter ID cards, driving licenses, PAN cards, and more. Various authorities issue the documents, such as nationalised banks, public sector undertakings, and district administrations. The cards must meet the valid requirements and have a photo ID number issued by the Central/State Government, recognised schools/colleges, nationalised bank passports, and public sector undertakings.

IRCTC SBI Platinum Card

• A travel credit card created in collaboration with IRCTC.

• Offers 350 activation bonus Reward Points on the first transaction of ₹500 or more within 45 days of card issuance.

• Offers up to 10% Value Back as Reward Points on IRCTC transactions.

• Provides 4 complimentary railway lounge access annually at participating lounges in India.

• A 1% fuel surcharge has been eliminated for transactions between ₹500 and ₹3,000 at all petrol pumps in India.

• Offers 1% transaction charges on railway ticket bookings on irctc.co.in.

• Provides exceptional airline ticket bookings through IRCTC.

HDFC Bank Bharat Credit Card

• Offers 5% monthly cashback on travel bookings through IRCTC.

• Offers 5% monthly cashback on fuel expenses, with a 1% surcharge waiver.

• Offers 5% monthly cashback on grocery spending.

• Offers 5% monthly cashback on bill payments and mobile recharges.

• Provides a monthly cashback of 5% on purchases made through PayZapp, EasyEMI, and SmartBUY.

• Provides an opportunity to save up to ₹3,600 annually and enjoy a 1% fuel surcharge waiver.

• Redeem your Reward Points to reduce your statement balance.

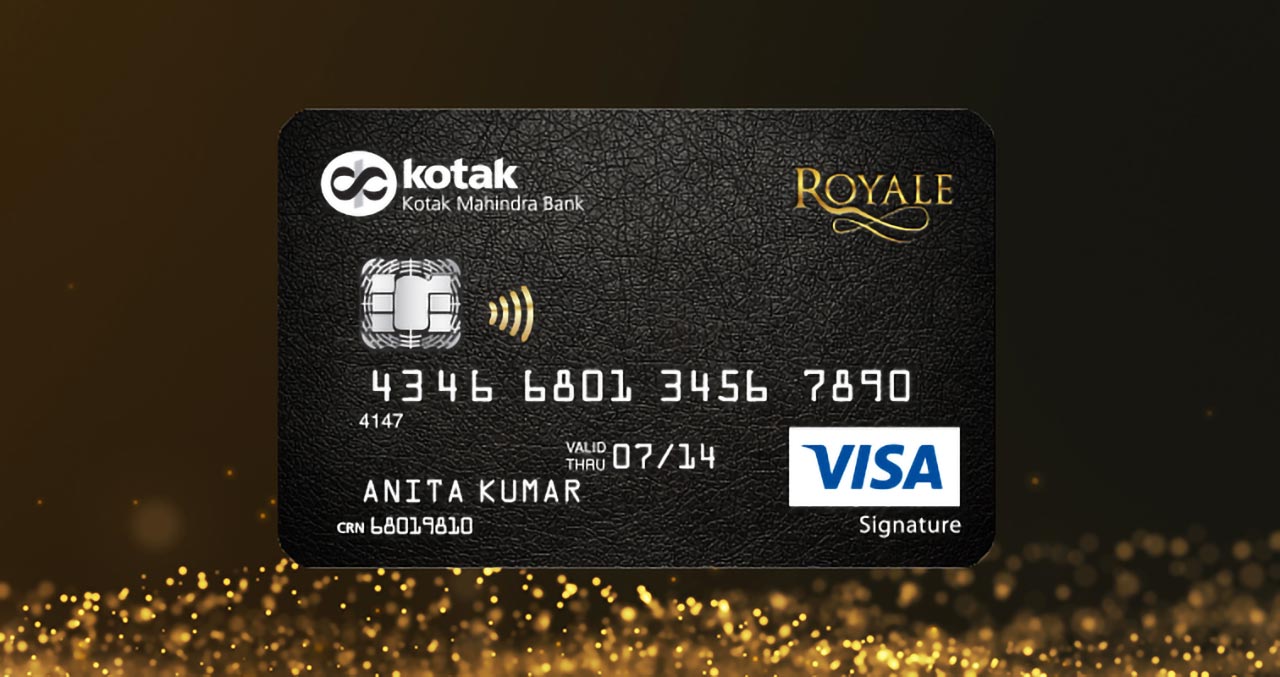

Kotak Royale Signature Credit Card

• Rewards Points: Earn up to 4 points for every ₹150 spent across all categories.

• Special Categories: 4 points are specifically for Hotels, Restaurants, Travel Agencies and tour Operators, Package Tour Operators, Airlines, and Air Carriers.

• Other Categories: 2 points for all other spends.

• Complimentary Lounge Access: Receive 2 free quarterly lounge visits at participating Dream Folks Lounges in India.

• Fuel and Railway Surcharge Waiver: Applicable on transactions between ₹500 and ₹3,000.

• Priority Attend: SMS “KASSIST” to 5676788 for immediate response.

• Add-on Card Benefits: Set spend limits and track spending separately.

• Offers dining privileges at the Taj.

Air India SBI Signature Credit Card

• Welcome Gift: 20,000 bonus reward points upon joining fee payment.

• Earn 4 points for every ₹100 spent and quickly convert them into Air India miles.

• Maximize Your Rewards: Get up to 30 points for every ₹100 spent on Air India tickets booked through airindia.com or the Air India mobile app.

• Experience the convenience of accessing over 600 airport lounges worldwide with the Priority Pass Program and Visa Lounge Access Program.

• Annual Fee: ₹4,999 with an anniversary gift of 5,000 reward points.

IRCTC BoB Rupay Credit Card

• Co-branded credit card by Bank of Baroda in collaboration with IRCTC.

• Provides reward points on IRCTC bookings, with a maximum of 40 points for every ₹100 spent.

• Provides up to 4 complimentary railway lounge visits per year.

• There is a 1% transaction charge waiver available when booking tickets through the IRCTC website or app.

• Annual fees: ₹500 for joining and ₹350 for renewal.

• Minimum income requirement: ₹3.6 lakh p.a. for salaried individuals and ₹4.8 lakh p.a. for self-employed individuals.

Advantages of Credit Cards for Railway Ticket Booking:

There are several advantages to using a credit card when booking railway tickets. Here are some compelling reasons to consider using credit cards for train ticket bookings:

Cashback & Rewards: The most significant incentive for using credit cards is enjoying cashback offers or reward points on every ticket purchase. This allows you to earn savings on rail travel.

Interest-free Credit Period: Using a credit card grants you an interest-free period of up to 50 days for your purchases, including train tickets. You can reserve your tickets now and pay later, ensuring you won’t have to worry about immediate interest charges. This provides a hassle-free travel planning experience.

Insurance Cover: Many premium credit cards offer complimentary travel insurance that covers ticket cancellations, delays, and unexpected incidents that may occur while you’re travelling.

Lounge Access: Some credit cards offer a touch of sophistication with complimentary access to railway lounges. This perk provides a truly indulgent experience, allowing you to fully relax and enjoy top-of-the-line amenities while waiting for your train. It’s a beautiful feeling to be genuinely cared for and valued, and this is precisely what you’ll experience with the right credit card.

For the best railway booking experience, choose a credit card that matches your travel needs and offers the features you care about. This method may allow you to control your trip spending and feel empowered.

Required Documents

• No need for photo identity card details during booking.

• Passengers must carry valid photo identity cards during travel.

• Required cards include:

– Passport

– Voter photo identity card from the Election Commission of India

– Driving Licence from RTO

– Pan Card from the Income Tax Department

– Photo Identity card with serial number from Central/State Government

– Student Identity Card from recognised school/college

– Nationalized Bank Passbook with photographs

– Credit Cards from banks with laminated photograph

– Unique Identification Card “Aadhaar” (m-Aadhaar, e-Aadhaar)

– Photo identity cards from public sector undertakings.

How you Can Save Using Railway Booking Credit Cards in India

• Direct Discounts on Bookings: These cards offer immediate discounts on ticket prices, resulting in significant annual savings for regular train travellers.

• Reward Points Accumulation: Every transaction linked to railway bookings allows cardholders to efficiently accumulate reward points, which can be redeemed for complimentary tickets, upgrades, or other travel benefits, making them feel resourceful.

• Complimentary Lounge Access: Some select cards provide a luxurious touch with complimentary lounge access, creating a peaceful waiting environment with Wi-Fi and refreshments, making the audience feel pampered and indulged.

• Zero Transaction Fees: These cards eliminate transaction charges associated with online ticket booking.

• Exclusive Offers and Deals: Cardholders may access unique discounts via collaborations with service providers, which elevate the travel experience.

• Fee Waiver: These cards waive the annual fee if users reach a specified spending limit.

• Avoid Late Payments: Punctual payments can help avoid late fees and additional charges, positively impacting credit score.

• Easy EMI Options: Some cards offer the option to convert railway ticket bookings into easy EMIs, making long journeys or luxury train experiences more financially manageable.

Conclusion

Selecting the appropriate credit cards for railway ticket booking can significantly improve your travel experience. We have a diverse selection of choices specifically tailored to meet the requirements of regular train passengers. These options provide financial incentives and special discounts. In addition, these cards offer a seamless booking process and a range of economic advantages, ensuring a hassle-free and enjoyable travel experience.