Maruti Suzuki is an automobile manufacturing company based in New Delhi, India. It was founded in 2001 and was owned and controlled by the government until 2003. Later it was sold to a Japanese automaker, Suzuki Motor Corporation. The company has a market share of 42.53% in the passenger vehicle segment in India. Currently, Maruti Suzuki is listed on Indian stock exchanges- NSE & BSE. The target audience is people between the age group of 30-35 years. Half of Nexa customers belong to this age group. Let’s have a look at Maruti Suzuki’s business model.

Products

Current car models offered by the company are as follows:

| Type | Models |

| Hatchback | Alto |

| S-Presso | |

| Wagon R | |

| Celerio | |

| Swift | |

| Baleno | |

| Ignis | |

| Sedan | Dzire |

| Ciaz | |

| SUV | Vitara Brezza |

| S-Cross | |

| MPV/Van | Ertiga |

| Eeco | |

| XL6 |

Services

Maruti Suzuki has an extensive service network. It has crossed the 4000-outlet mark in India and is present in over 198 cities. It had added 208 service workshops in 2020. Most of the service centers work on a franchise model.

1. Nexa

In 2015, Maruti launched its new dealership network for its premium cars, named New Exclusive Automotive experience (NEXA). Baleno, S-Cross, XL6, Ignis, and Ciaz are sold through NEXA outlets. The company reached a milestone of selling 1.5 million cars across the country and is the third-largest automobile retailer in India.

2. Maruti Insurance

Maruti Suzuki offers insurance products and services from top-notch insurance companies like ICICI Lombard, New India Assurance, Iffco-Tokio, Bajaj Allianz and National Insurance. It offers near cash-less accident repairs. Moreover, one gets charged only for applicable depreciation and compulsory excess. There is a separate category for electrical and metal parts. There is a fair and transparent settlement. One can avail of the benefits of quality repairs by expert technicians and towing facilities. There is zero deduction for salvage and no processing charges. All the services are provided at the doorstep, ensuring convenience to customers.

3. Maruti Suzuki Driving School

The driving schools are modelled on international standards. One learns to go through practical as well as classroom sessions. Before driving, learners are trained on simulators. The initiative aimed to bring down the accident rate in India. They have +1400 expert trainers who are well equipped to provide world-class services.

4. Maruti Smart Finance

It is a one-stop solution to help customers meet their financial needs. A digital platform where a customer can view, compare and apply for loans. They can also track their loan application on a real-time basis. It has tied up with various banks like SBI Bank, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Sundaram, ABN Amro Bank, etc.

5. Maruti Suzuki Leasing

It is a mobility service allowing corporates to lease cars from Maruti Suzuki for field staff and logistical requirements. Retail leasing provides personalized car leasing solutions for entrepreneurs and self-employed workers. Along with leasing, insurance cover and effortless maintenance is also provided. Zero down payment, constant upgrades, no resale risk and vale added benefits make it more attractive.

Key Partners

- Shareholders

| Holders | % Shareholding |

| Promoters | 0% |

| Banks and Mutual funds | 7.34% |

| Public | 3.26% |

| Financial Institutions | 7.95% |

| Foreign Promoters | 56.73% |

| Foreign Institutions | 23.60% |

| Others | 1.48% |

2. Manufacturers of parts and components – Maruti Suzuki has set up two manufacturing plants in India- in Haryana (Gurgaon and Manesar) and Gujarat. Collectively the plants produce 22,50,000 vehicles annually (1.5 million from two Haryana plants and 7.5 lakhs from Suzuki Motor Gujarat). All the plants are wholly-owned subsidiaries of Maruti and supply the entire production.

3. Maruti Suzuki has 1391 dealers across 490 cities in India like Mumbai, Delhi, Chennai, Kolkata, Pune, etc.

4. Maruti Suzuki has collaborated with SMC (Suzuki Motor Corporation) for technical support. The company was earlier known as Maruti Udyog Ltd when owned by the government. Later, SMC became the formal Joint Venture partner and license holder of the company.

5. TDSG, a Lithium-ion battery manufacturer, has jointly set up with SMC, TOSHIBA corporation and DENSO to supply batteries to Maruti Suzuki.

6. Recently, Maruti Suzuki has become the official sponsor of IPL where it will promote its novel Vitara Brezza compact SUV.

Financials

| (As of 18th February 2022) | |

| Open | 8,550.00 |

| Previous Close | 8,552.45 |

| Volume | 3,85,273 |

| Value (Lacs) | 33,014.43 |

| Beta | 0.72 |

| High | 8,645.95 |

| Low | 8,520.05 |

| UC Limit | 9,407.65 |

| LC Limit | 7,697.25 |

| 52 Week High | 9,050.00 |

| 52 Week Low | 6,400.00 |

| TTM EPS | 107.42 |

| TTM PE | 79.77 |

| Sector PE | 81.19 |

| Book Value Per Share | 1,737.97 |

| P/B | 4.94 |

| Face Value | 5 |

| Mkt Cap (Rs. Cr.) | 2,58,855 |

| Dividend Yield | 0.53 |

| 20D Avg Volume | 9,36,945 |

| 20D Avg Delivery (%) | 35.8 |

The carmaker reported a net profit of ₹ 1011 crores, down by 47.9% YOY, against a profit of ₹ 1941.4 crores last year. But the net profit was above the estimations of ₹ 896.7 crores. The profits were lower despite the company’s cost reduction efforts. The lower sales volume due to chip shortage and high commodity prices affected the results. The revenue stood at ₹ 22,187 crores marginally lesser than in the same quarter last year which was ₹ 22,236 crores. The operating EBIT margin was 4.1% in Q3FY22 against 6.7% in Q3FY21. The gross profit margin was down to 4.6% from 8.7% on a YOY basis.

The company sold 4.30 lakh units in this quarter as compared to 4.95 lakhs in the same quarter last year. There was robust demand but the orders could not be fulfilled due to global electronic components shortage. There were 2.4 lakh pending orders. But the company forecasts better Q4 results as the chip shortage situation is improving. The production capacity will rise but won’t reach full capacity.

There was rise in exports by 66% in Q3FY22 on a YOY basis.

Management team

| Name | Designation |

| Ajay Seth | Chief Financial Officer |

| D S Brar, Lira Goswami, Maheswar Sahu, R P Singh | Independent Directors |

| Hisashi Takeuchi, Shigetoshi Torii | Joint Managing Directors |

| Kenichi Ayukawa | Managing Director & CEO |

| Kenichiro Toyofuku, O Suzuki, Kinji Saito, T Suzuki | Directors |

| R C Bhargava | Chairman |

SWOT Analysis

Strengths

- Maruti Suzuki is the largest passenger vehicle car company in India with approximately 42% share.

- More than 12,000 employees work at Maruti Suzuki.

- It has a diversified product portfolio catering to different segments of the society, good advertising and promotional strategies, and self- competing brands.

- It has the largest distribution network and after-sales service centres.

- The brand value of the company is strong in the second-hand car sector.

- It offers a varied range of services like finance, insurance, etc.

- It has won several awards in the automobile segment.

- The company exports more than 50,000 units of automobiles annually.

Weakness

- The quality of the products is less than its competitors like Volkswagen, Hyundai, etc.

- The company faces a lot of government intervention.

- The young generation is attracted to foreign brands.

- The recent strikes by labours show that the relations between the management and employees are not on good terms.

Opportunities

- LPG version of Wagon R is a good move.

- The company has started with R&D for electric cars, allowing manufacturing fuel-efficient cars.

- The Cervo 600 has the potential to tap the middle-income segment, a competition to Nano.

- The export capacity is helping the company to get an international presence.

Threats

- The market share is falling due to a large number of foreign players.

- China intends to join the Indian automobile segment.

- The rising fuel prices, supply chain constraints, chip shortage, and high commodity prices will hurt the company’s revenues.

- The increasing use of public transport like taxis, buses, etc is another problem.

Competitors

- Honda Motors

- Toyota Motor Corporation

- Nissan Motors

- Hyundai Motors

- Fiat

- Mitsubishi Motors

- Chevrolet

- Tata Motors

- Skoda Auto

- Volkswagen

- Ford Motor Company

- Volvo

Current news

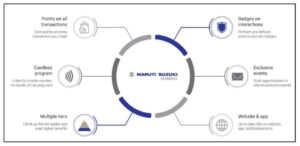

Loyalty Rewards Programme

Last year the company launched a loyalty rewards programme for its passenger vehicle customers. The programme offers a range of benefits on the purchase of an additional car, Maruti insurance, services, customer referrals, etc. Customers can reach up to the tier ladder of the loyalty programme to avail special offers.

The rewards can be redeemed against the purchase of accessories, extended warranty, insurance, genuine parts, driving schools, after-sales services, etc. The customer gets classified as a member, silver, gold, and platinum. The customers will even get badges as rewards, giving them a chance to unlock exclusive benefits. The program is completely digitized.

Partnership with Quiklyz

Maruti Suzuki has partnered with Quiklyz by Mahindra Finance for its vehicle subscription program. Quiklyz will offer a white plate subscription wherein the vehicle is registered under the user’s name but hypothecated to the subscription partner.

In 2020, the company had launched a subscription programme where customers could select a vehicle without owning it for multiple tenures against a monthly rental. They are constantly upgrading the programme according to the customers’ feedback and suggestions.

Quiklyz partnered with Maruti Suzuki to provide an unmatched subscription service for the entire range of Maruti Suzuki portfolios.

Electric Vehicles space

Maruti Suzuki will not launch Electric vehicles in India before 2025 because of less demand. Moreover, the outsourcing costs of various EV components like batteries, charging infrastructure, and electric supply add up to the company’s cost.

With the rise in fuel prices, the company aims to focus on its CNG offerings. They wish to sell at least 10,000 EVs every month after its launch. The car with higher demand is more saleable. All Maruti models launched have had a significant demand in the market.

It hasn’t given up on the plan of launching EVs, but the timeline needs to be decided. The launch will depend on market conditions. The pricing of batteries and charging infrastructure is difficult to predict.

The company had plans to launch an electric vehicle in 2020. But decided to have a commercial launch due to a lack of government and infrastructure support.

Conclusion

To sum up, the company still has two lakh pending orders for CNG vehicles. The supply chain constraints and the electronic component shortage has hit the profits irrespective of the robust demand. Additionally, even after the government’s PLI scheme to launch electric vehicles, the company’s plans won’t change. The timeline will get decided by its parent organization- Suzuki in Japan.