Introduction

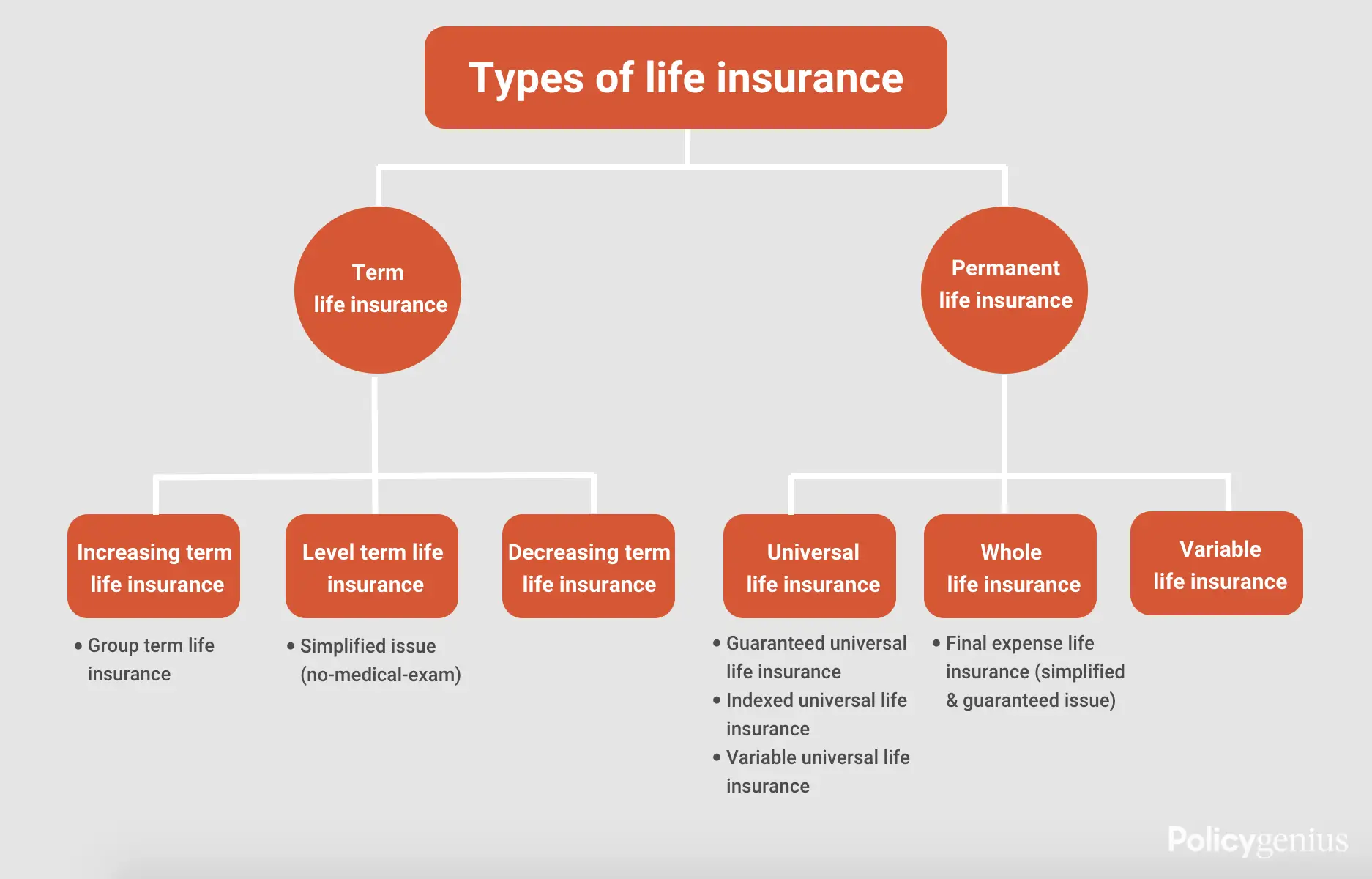

A life insurance plan is a contract between an insurance policyholder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium after a set period or upon the death of an insured person. The following are the types of life insurance available in India:

- Term insurance

- Term insurance with return of premium

- Unit Linked Insurance Plans

- Endowment plans

- Moneyback policy

- Whole life insurance

- Group life insurance

- Child Insurance Plans

- Retirement Plans

1. Term Insurance Plan

The term insurance plan is one of the most sought-after types of life insurance policies in India. This is one of the life insurance policy in India that you can buy for a specific period of 10, 20, 30 or more years, hence the name.

While some other insurance policy offer maturity benefits, term insurance does not. It is one reason why term insurance, being the best insurance policy in India, is comparatively cheaper than other types of life insurance schemes.

Term insurance is pure life cover, unlike other types of life insurance policies which have a saving component.

2. Term Insurance with Return of Premium

A term insurance plan is amongst the types of life insurance policies that provides a death benefit but no maturity benefit.

If you live a healthy lifestyle, the probability that you will outlive the best insurance policy in India you have bought also increases. For you, among the many life insurance types, a term insurance with return of premium is one of the best insurance policy in India, which also give you maturity benefits.

It is one of the types of term insurance plans that give back the premiums you pay on surviving the policy period. Besides, you can easily calculate premium for term insurance using an online term insurance calculator.

When you calculate premium for term insurance, you get a clear understanding about your unique requirements, explore rider options, and also choose your policy term. Doing so helps you ensure that you are investing in the most suitable types of life insurance policies for yourself and your family.

If you want to support long term goals in life, for example, you could opt for a whole life insurance, and the factors to be considered here will be different. Keep in mind that your age and personal needs determine the most needed types of life insurance policies.

3. Unit Linked Insurance Plan (ULIP)

You may face a dilemma in life about choosing between any of the two options – investment or insurance.

A ULIP is one of the types of life insurance policies in India that fulfill both these aspects. Amongst different types of life insurance, it is the one that offers life cover along with investment opportunities. Being one of the types of life insurance, it has a lock-in period of five years, which makes it a long-term investment instrument that comes with risk protection. ULIPs also allow you to balance your funds as per market dynamics.

4. Endowment Policy

Endowment policies are one of the types of life insurance policies that provide you with the combined benefit of life insurance and savings. Along with giving you the life cover, these types of life insurance help you save money regularly over a period to get a lump sum at maturity.

What makes them one of the most useful types of life insurance policies is that they help fulfill long-term goals in life. You will also get the maturity amount if you survive the policy tenure.

Endowment policies, being one of the most appropriate types of life insurance plans, also help you create a financial cushion for your family to meet various financial objectives in life.

5. Moneyback Policy

The purpose of investing in the insurance policy in India for your loved ones can be to create wealth over an extended period. However, most of the types of life insurance do not provide any provision to get funds before their tenure ends. It is where a moneyback policy plays a vital role in solving the problem of liquidity.

As the name suggests, moneyback policies are one of the popular types of life insurance policies in India that give money back regularly.

It pays a percentage of the assured sum throughout the policy tenure, unlike other life insurance plans that offer no returns till maturity.

6. Whole Life Insurance

As a insurance policyholder, you get the benefits depending on the type of insurance policies you have chosen. What distinguishes a whole life insurance plan from other life insurance types is that it provides insurance coverage to the insured for the entire life, up to 100 years of age.

Typically, the death benefit, under a whole life insurance, is payable to the beneficiary in the case of the untimely demise of the policyholder. On the other hand, you are eligible to receive a maturity benefit under a whole life insurance policy if you cross 100 years of age.

Another significant feature of such whole life insurance plans is that some offer the option to pay premium for the first 10-15 years while you get the benefits for the entire life.

7. Group Life Insurance

Just like group health insurance, group life insurance is one of the types of life insurance policies that covers a group of people under one master policy. Such life insurance types are generally provided as part of an employment benefit.

A unique feature of these types of life insurance products is that you will get the insurance cover if you remain a part of the group. It is different from the individual types of life insurance plans in which the coverage continues throughout the chosen policy tenure.

8. Child Insurance Plans

When it comes to life insurance types, a child plan is an investment+insurance plan that helps you meet your child’s financial needs. A child insurance plan will help you create wealth for your child’s future needs like education.

You can start investing in these plans from the birth of your child. You get the flexibility of investing your hard earned money into several funds on the basis of your financial condition and goals in mind.

9. Retirement Plans

Retirement Plans are amongst the types of life insurance policies that provides financial security and help you with wealth creation after your retirement. With Retirement Plan, you will get a sum of money as pension in the vesting period.

In case of your untimely demise during the policy term, your nominee will get the death benefits. Retirement Plans comes with death benefit as well as vesting benefit providing protection to you and your family members.

Conclusion

| Life insurance type | Duration | Death benefit | Premium | Cash value |

|---|---|---|---|---|

| Term life insurance | 10 to 30 years | Fixed | Level* | No |

| Whole life insurance | Life | Fixed | Level | Yes; guaranteed |

| Universal life insurance | Life | Adjustable | Flexible | Yes; guaranteed |

| Variable life insurance | Life | Variable | Level | Yes; not guaranteed |

| Burial insurance | Life | Fixed | Level | No |

| Group term life insurance | 1 year | Fixed | Level | No |