A Succession certificate is issued to the successor of a deceased individual who has not prepared a will. It establishes the legitimacy and authenticity of the successor. The succession certificate gives the successor the authority over the deceased person’s debts and securities. The holder of the certificate can make debt payments or transfer the securities of the deceased person.

It gives the successor the right to inherit movable properties of the deceased person like shares, bonds, etc. The purpose of issuing a succession certificate is to protect the parties to whom the deceased person was liable to make payments. It ensures that all the debts are made in good faith.

The successor is also eligible to receive the interest or dividend on the securities. He can also transfer the securities of the deceased person. Hence, whatever payments that the successor makes or receives on the behalf of the deceased person are valid and legal. However, the certificate does not make the successor the owner of securities or the legal heir.

The district judge of the relevant jurisdiction issues the succession certificate. To obtain the certificate, one should prepare and file a petition in the relevant district court. Here, the relevant jurisdiction is where the deceased person originally resided at the time of his death. If one is not able to find such a place, then the relevant jurisdiction is within which the property of the deceased individual is found.

How to obtain a succession certificate

There are four steps for obtaining a succession certificate:

- Prepare a Petition- Firstly, the applicant needs to prepare, verify and sign a petition. Then, one should submit the petition to the relevant jurisdiction after paying the court fees. The petition must include- the time of death, residence or property details, and details about relatives and family members of the deceased person. Additionally, one should also include the rights of the petitioner and the absence of any obstructions while granting the certificate.

- Submission to Court- Secondly, the judge will call for a preliminary hearing for the petition filed by the applicant to issue the succession certificate. If the petition gets approval, then the district judge will decide upon a date for the final hearing of the same. He will also send a final hearing notice to whomsoever he thinks is significant.

- Grant of Certificate- Thirdly, after all the hearings with the concerned parties, the district judge decides whether the supplicant is eligible to receive the certificate. If the judge is satisfied, then he shall grant the succession certificate to the applicant.

- Submission of bond- Lastly, the district judge may ask the applicant to submit a bond with one or more securities to compensate against any losses arising out of the use or misuse of the succession certificate. Moreover, the judge might grant an extension in respect of any security or liability not mentioned earlier in the application.

Also, when there is more than one applicant for the succession certificate of the same deceased person, then the judge will decide on the successor (i.e., who will receive the succession certificate) based on the interest of the applicants and various other factors.

Difference between legal heir and succession certificate

Firstly, one issues a legal heir certificate to identify the living heirs of the deceased person. Whereas, a succession certificate establishes the authenticity of the heirs and gives them authority to inherit debts to protect the creditors.

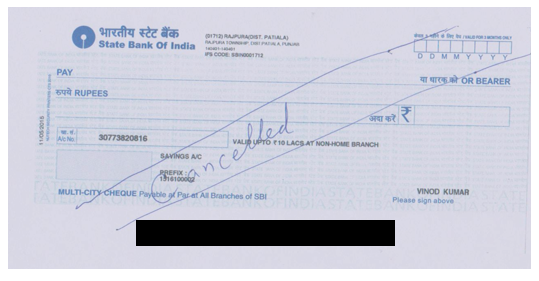

Secondly, the succession certificate’s purpose is to transfer securities and debts of the deceased like shares, bonds, bank accounts, etc. On the contrary, the legal heir certificate’s purpose is to collect ex-gratia payments like pension funds, etc. and the property of the deceased individual.

Then, the district judge present in the jurisdiction of the deceased person during his death issues the succession certificate. On the contrary, the revenue officer of taluq issues a legal heir certificate.

Further, a legal heir certificate helps to claim the amounts due to the deceased. It is a proof of relationship with the legal heir. A succession certificate helps in the transfer of dividends of the securities. It may involve the transfer of ownership too.

The documents required to issue a succession certificate are- the name of legal heirs and family members, details of dents and securities of the deceased, NOC or verbal verification from family, death certificate, and Aadhar card of the parties involved, service certificate. Moreover, for issuing a legal heir certificate one requires the following documents- death certificate, service certificate, pensioner payment slip, Aadhar card of family members with their relationships.

To conclude, members first try to apply for a legal heir certificate. If not approved, then they go for a succession certificate. It is an alternative to a succession certificate because of its easy and fast procedure.

Revocation of Succession Certificate

One can revoke an issued certificate if:

- The procedure for obtaining the certificate was defective.

- Further, one issues the certificate fraudulently.

- One conceals material information or facts for issuing the certificate.

- Moreover, the certificate was obtained via untrue allegations.

- Then, when the certificate becomes useless due to certain circumstances.

- Lastly, if another competent person deals with the debts and securities of the same deceased individual applies for the certificate.

Case laws

Firstly, the case of Srinivasa vs Gopalan concludes that whether the debt belonged to the deceased person or not, the application for a succession certificate remains unaffected.

Secondly, the case of Muthia and Ramnatham concludes that the issue of the certificate gives the grantee the right to recover the payment due to the deceased and the grantee should discharge the debt on good terms.

Lastly, the case of Ganga Prasad and Saudan concludes that Section 381 of the Act protects the debtors and provides them indemnification during losses as they have to be paid in good faith.

Conclusion

A succession certificate helps the legal heirs of the deceased claim movable properties when there is no will. But this is not the most relevant document to administer and dispose of the property. For this, an administration letter is significant. The procedure to issue the administration letter is the same as the succession certificate.