In 2020, Apple became the most valuable publicly traded company in the world, and its market cap crossed 2 trillion US dollars. Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The company’s products include iPhone, Mac, iPad, and Wearables, Home and Accessories. Apple’s five software platforms — iOS, iPadOS, macOS, watchOS, and tvOS — provide seamless experiences across all Apple devices and empower people with breakthrough services including the App Store, Apple Music, Apple Pay, and iCloud.

Apple was founded in 1976, and it revolutionized the industry and the world by introducing the Apple 2 Home Computer. When founder Steve Jobs died in 2011, everyone was doubtful about how well Tim Cook, the new CEO would do. Apple continued to do very well and in August 2018, it reached the 1 trillion dollar market cap. If you would have invested $10,000 in Apple in 1980, today, you would have been a millionaire!

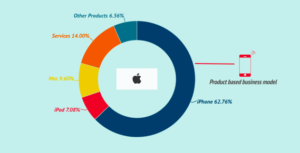

Apple’s business model is mainly based on the sales of tech products. However, it cannot be understood from that standpoint alone. Apple is both software and hardware, which is also what makes it successful. No doubt the iPhone is an icon of our days, but the iPhone is also a device that works pretty well thanks to its software. If we look at Apple’s growth for 2020, it was primarily driven by segments such as Wearables, Home, Accessories Devices (products like AirPods and Apple Watch) and Services as well. Therefore, as of 2021 Apple has a diversified business model.

Except for a few bumps along the way, most recently caused as a result of the Trade War between US and China, Apple has seen an upward movement. Initially, covid-19 hit many hubs in China, where a lot of Apple products are manufactured. However, the pandemic made technology even more essential, due to work from home and online school, and Apple saw an 11% increase in its revenue. There are many reasons and strategies responsible for its success, such as:

SIMPLICITY

Apple’s motto has always been simplicity. They do not talk about their features, instead, they focus on the benefits and usability of its products and services. For example, when it launched its iPod, the product was technically just an MP3 player with 5 gigabytes of storage. However it was marketed as “1000 songs in your pocket”, which would make the audience think about making their own playlists and listening to it wherever they went. Its focus on simple details such as designing a perfect product packaging that opens at a constant velocity, neither too slow, nor too fast, or an Apple pen that stops rolling when the logo is on top.

LOCK-IN ECOSYSTEM

How many people do you know that bought an iPhone and went back to using an android smartphone? Probably very few instances. Apple has created such an ecosystem using its special MacOS and iOS softwares that once a person buys their first iPhone, their only decision is which iPhone will they buy next. This is primarily why Apple doesn’t compare its products with other companies, rather it just specifies what new features will be there from its last model. They treat their products to be a class apart from other brands. This is an important aspect of Apple’s business model.

PROFITABILITY

Apple has only 20% of the smartphone market, but 66% of the profits made by smartphones. A major reason for this is that for every phone that they sell, they save $30-$50 that Android makers have to pay to Qualcomm. Thus by making their own low cost chips and having their own softwares, they make their products not only different, but highly profitable. Moreover, a majority of its manufacturing is set up in China and they cut cost by making use of the various tariff exemptions that imports normally have to pay.

SUBSCRIPTION-BASED SERVICES

Subscription-based services are becoming increasingly popular because they are a source of steady and predictable income. Such services only have to be sold to users once, and if the service satisfies the users, it forms a source of continuous income. Apple’s subscription based services are-

- Apple Arcade

- Apple TV+

- Apple Music

- New+

- iCloud

These services along with the $50 software upgrade adds up to $90 a month per user and a $2160 for two years. Hence this is increasingly becoming an important source of income and a characteristic feature of Apple’s business model.

iOS 14 AND iPHONE SE

In order to capture the middle income groups with a steady and rising income and lure them away from Android, Apple introduced its most affordable iPhone, the iPhone SE. Apple felt the need for users to switch from Android to the Apple ecosystem, which is why it also introduced iOS 14, which was different from its previous softwares and included features that it had never before, such as-

- App Drawers

- Option to change default browser

- Picture-in-picture mode

POTENTIAL

MacBooks and Mac desktops have only 10% of the total market share, which means that it has a lot more potential to expand its reach. Recently, Apple announced that it will not be purchasing chips from Intel and Amd any longer. Instead, it is working on producing its own chip. This chip is likely to be cheaper and here make the new devices more efficient and cheap. Apple has come a far way in its product improvement. iPad has transformed from just a big iPhone to a computer with its own iPadOS operating system. The Apple Watch has become more than just an iPhone accessory to an independent smart watch with its own App Store.

FUTURE

Apart from creating a better Mac, Apple is currently working on new creations and R&D such as an Apple Headset/Glasses. Augmented reality is coming soon in the future. These new products that are being developed will have smart capabilities on your face in front of your eyes. Apple has always focused on, and kept “innovation” as its motto, and its future seems to be limitless.

Thus, in conclusion, Apple’s business model is divesified and broken down into products and services. Even though the iPhone sales still represented 54% of the overall sales for 2019, the company also offer services and subscriptions which are growing substantially. The services business has a high marginality, even higher than the products business of Apple. This makes it interesting for Apple to keep pushing its growth in the coming years. As Apple’s sales of iPhone slew down substantially in 2020 compared to 2019, the company also pushed more on tech accessories (AirPods particularly) which offset and were the fastest growing business segment (41% growth compared to 2019). The accessories business has become a unit of over $24.4 billion and growing.