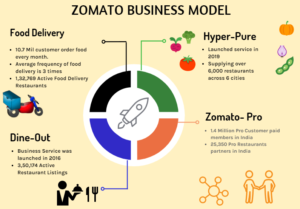

Zomato is an Indian restaurant search, discovery and an online food delivery service which currently operates in 10,000 cities in 25 countries including USA, India, Singapore and Brazil. It has connected with 1.2 million restaurants and has more than 80 million customers, 30 million photos and 10 million reviews on its platform. On 14 July 2021, Zomato officially went public and issued an IPO which was oversubscribed 38.2 5x. Today, it is valued at $5 billion dollars. Following is Zomato’s business model-

HISTORY

Back in 2008, Deepender Goyal and Pankaj Chadha started a website called FoodieBay.com. At that time, it was used to scan restaurant menus and reviews, which does now too, but it has expanded to so much more than that. In 2010, it changed its name to Zomato to avoid any legal issues with its last four letters coinciding with eBay. In 2015, the company got into the food delivery business and launched various other products such as Zomato Gold and Hyperpure. So far it has received the funding of 223.8 million $ or 1500 crore rupees and its biggest investor is InfoEdge Ltd. which has a share of 54%.

REVENUE/BUSINESSES

- Advertising – Zomato charges commissions from restaurants to be placed prominently on the feed. These restaurants get services such as ad banners, additional exposure as well as improve discoverability. Advertising has become one of the major sources of revenue and key to Zomato’s business model.

- Book – Via ZomatoBook, a person can book tables along with specifics such as which exact table. This helps restaurants to know beforehand how many people to expect, and to keep staff and inventory accordingly. Hence, restaurants pay for this service as well.

- Food delivery – Zomato is most well-known for its online food ordering. It charges commission from the restaurants on the basis of orders, which is generally 15 to 20%. However, food delivery contributes in a very small way to the company’s total income due to huge competition from Swiggy and the need to keep discounts to maintain customers.

- Base – Zomato offers a cloud-based POS system which helps small restaurants in their operations, which are managed on a single platform. This is ideal for restaurants which don’t have the budget to create their own software and system, as Zomato provides it to them at a cheaper cost.

- WhiteLabel – Zomato provides services such as white label under which they offer to develop a customised food delivery app for the restaurant. It also works with restaurants and cloud kitchens for consultancy services using the data it collects. These apps are low-cost and come with features such as push notifications, requisite licences and operational enablement for such restaurant partners.

- Trace – Zomato allows customers to trace and track their food delivery package and get the details of the food delivery partner.

IS IT PROFITABLE?

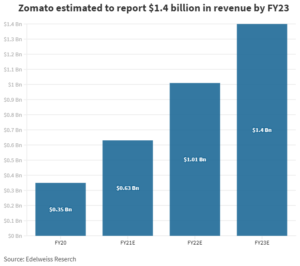

Up until last year, Zomato was losing a lot of money in terms of per unit delivery, but since it decided to file for an IPO, this unit economics has become positive. In 2020, Zomato was losing Rs.30.5 with every single order. This year it has become Rs.22.9 profit per order. Zomato earns revenues such as commissions from restaurants as well as advertising money. On the flip side, its costs include paying its delivery partners, running discounts and other variable costs.

Zomato’s commissions have increased from Rs.43.6 to Rs.62.8 per order this year. The problem here is that if more and more restaurants are being charged higher commissions, they are becoming increasingly dissatisfied with their partnership with Zomato. Its customer delivery charge has also gone up from Rs.15.3 per order last year to Rs.26.8 this year. If the delivery charges go up, customers will be ordering lesser food. Zomato’s costs have come down from Rs.21.7 last year to Rs.7.3, which means that on average Zomato has the decreased its discount. In India, discount is a huge driver, especially for food items and reducing these discounts, might reduce its customers. Zomato has also reduced the fee that it pays to delivery partners which has left them dissatisfied.

ADVANTAGE

Zomato’s main advantage is that it has all the data of thousands of restaurants and millions of consumers who have used Zomato to order food. Zomato knows exactly what dishes are in Hugh demand and in which areas. Additionally, Zomato also knows what is the optimal price for particular dish. Hence, they know what is the best time to sell a particular dish. For example, Zomato knows that in Kolkata, Biryani priced at Rs.150 will become a bestseller from November to December. This way, Zomato is sitting on a data gold mine and they can use it very easily to launch their own food chain, eventually undercutting the existing food chains and make millions in profits.

CLOUD KITCHEN – THE FUTURE

A cloud kitchen is in efficient restaurant which only gives out takeaway orders but has no dining space. It’s basically just a kitchen that takes online orders and gives it out for delivery. Why is this concept of a cloud kitchen a revolution in the making? This is because of its cost benefits over conventional restaurant. If you take a conventional 50 seater restaurant, it would require 6 lakhs of rental cost, 20 lakhs in rental deposit, 8 to 10 lakhs for licences, 8 to 15 lakhs for equipment, working capital which would include inventory, salary and electricity which would come up to about 20 lakhs. On the other hand, a cloud kitchen would reduce the need for space significantly and it would only cost about 50000-1 lakh for rent. Overall, expenses would go down by around 50% as compared to a conventional restaurant.

Cloud kitchens is a new concept in India, but there are a few successful cloud kitchens which use Zomato services. So, Zomato knows exactly which cloud kitchen is doing well and why. So, Zomato can open up its own cloud kitchen and list its products at the top with an aggressive pricing model to undercut its other cloud kitchens. This will maximise their profits and optimise their cost. Thus, it could be a perfect addition to Zomato’s business model.

In conclusion, Zomato’s business model is solid, it identified a spectacular pain point in the business ecosystem, and used it wisely to connect and bridge the gap between customers and restaurants by providing efficient technology application. Yes, it is true that it has cost Zomato a lot to acquire customers, but once that is done, and customers are hooked on to this service, Zomato might have a bright future.