There are two ways to learn about stock markets. Firstly, from stock analysis and financial knowledge and secondly, from observing successful investors. The top best investors in the Indian stock market are as follows:

Premji and Associates

Azim Premji, the owner of Premji and Associates, is one of the best investors in the Indian stock market. He was the chairman of Wipro Limited. The current portfolio value is ₹2,17,403 crores. He has holdings in three companies. Moreover, the top three stock preferences are software, automobile, and retail. He has invested in Wipro, Tube Investments, and Trent Ltd. Recently, he sold a part of his stake in Trent Ltd.

Radhakishan Damani

Another person among the best investors in the Indian stock market is Radhakishan Damani. He is the founder of DMart. He is known as Mr White and White. Moreover, he is the Retail King of India. The current portfolio value is ₹1,72,733 crores. Further, he has holdings in fourteen companies. The top sectors are retailing, food, beverages, tobacco, and cement and construction. The investments are in:

- Firstly, he has allocated 65% of the portfolio towards Avenue Supermarts

- Then, 32% towards VST Industries

- And he has invested 13% in Indian Cements

- Lastly, the remaining part of the portfolio has been invested in Sundaram Finance, United Breweries, Blue Dart, etc.

Recently, he sold a part of his investments- Mangalam Organics, Metropolis Healthcare, and United Breweries.

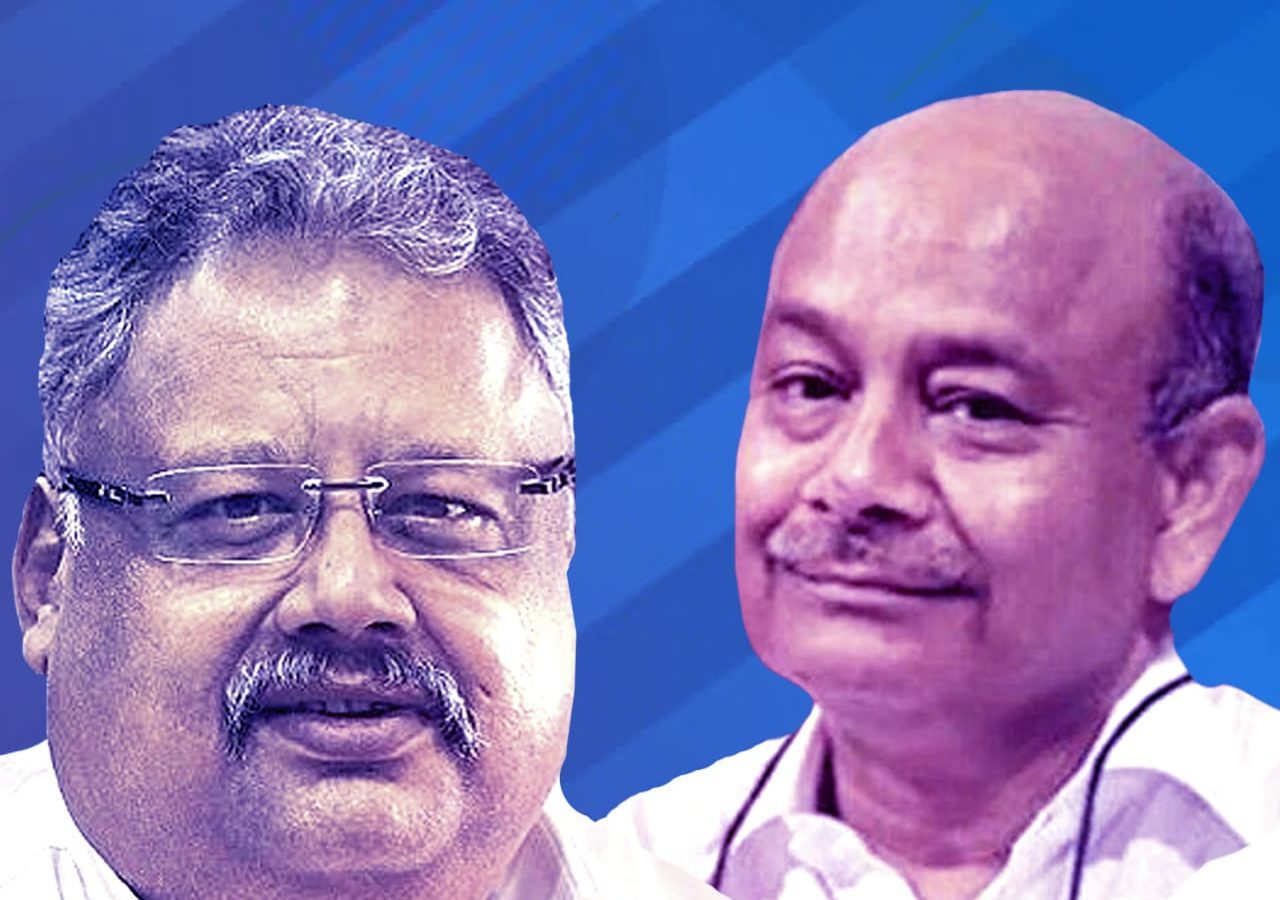

Rakesh Jhunjhunwala and Associates

Rakesh Jhunjhunwala is known as Big Bull or Indian Warren Buffett. He is a partner in Rare Enterprises. The current portfolio value is ₹33,152 crores. Moreover, unlike Azim Premji, he has diversified his investments in many companies. He has holdings in 37 companies. The top three stock preferences are textiles and apparel, banking and finance, and automobile. The top five companies (as per holding value) in which the big bull has invested are:

- Titan Company

- Star Health and Allied Insurance

- Metro Brands

- Tata Motors

- Crisil

Moreover, he recently increased his stake in Star Health and Allied Insurance, Metro Brands, and Escorts Ltd. But he also reduced holdings in Jubilant Ingrevia, Nazara Technologies, and Steel Authority of India.

Rekha Jhunjhunwala

Rekha Jhunjhunwala is the wife of Rakesh Jhunjhunwala. She has deep knowledge of stock and the financial market. Further, her current portfolio value is ₹ 8,161 crores. The top three stock preferences are textiles and apparel, banking and finance, and retailing. She has invested in 21 companies. The top five companies (as per holding value) in which she has invested are:

- Titan Company

- Metro Brands

- Star Health and Allied Insurance

- Crisil

- NCC

Moreover, she recently increased her stake in Star Health and Allied Insurance, Metro Brands, and Indian Hotels Company. She has also reduced shareholding in TV18 Broadcast, Aptech, and Delta Corp.

Mukul Agrawal

Mukul Agrawal is a new member of the list of best investors in the Indian stock market. The current portfolio value is ₹ 2,212 crores. The top sector investments are commercial services and supplies and software companies. He has investments in 46 companies. The top five companies as per shareholding value are:

- Intellect Design Arena

- Radico Khaitan

- Gati

- PDS

- EKI Energy Services

Moreover, he bought more shares of Repro India, Gati, and Pearl Global Industries. But he has also reduced his stake in companies like Jet Freight Logistics, KDDL, and Marksans Pharma.

Sunil Singhania

Sunil Singhania is an ace investor who is also the founder of Abakkus Asset Management LLP. The current portfolio value is ₹2,106 crores. He has investments in 24 companies. The top three sector preferences of the investor are software, metals, and general industrials. Further, the top five companies in his portfolio are as follows:

- Mastek

- Jindal Stainless

- Route Mobile

- Saregama India

- Acrysil

Recently, he increased his stake in companies like Sarda Energy and Minerals, Dynamatic Technologies, and Ion Exchange. But he also decreased his stake in Paras Defence, Mastek, and HSIL.

Ashish Kacholia

Ashish Kacholia is also known as the Big Whale of the Indian stock market. Further, he founded Hungama Digital with Rakesh Jhunjhunwala. He has invested in 33 stocks worth ₹1,726 crores. The sector preferences of the investor are general industrials, software, petrochemicals and chemicals. The top five companies (as per holding value) in which he has invested are:

- NIIT

- Mastek

- Shaily Engineering Plastics

- HLE Glasscoat

- Vaibhav Global

Further, he has increased his stake in companies like SJS Enterprises, United Drilling Tools, and Yasho Industries. Also, he sold shares of Mastek, Vaibhav Global, and PCBL.

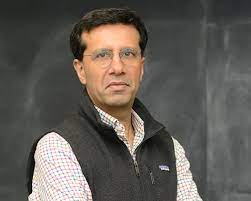

Ashish Dhawan

Ashish Dhawan is a private equity investor. He has a diversified portfolio worth ₹1,710 crores. He has investments in 14 companies. Further, the preferred sectors are banking and finance, software, pharmaceuticals and biotechnology. The investments are in:

- IDFC

- Mahindra & Mahindra Financial Services

- Glenmark Pharmaceuticals

- Arvind Fashions

- Quess Corp, and many more

Additionally, he has sold shares in companies like HSIL and Zensar Technologies.

Anil Kumar Goel and Associates

Anil Kumar is one of the best investors in the Indian stock market. He is also the President of Technology at BYJU’S. He invests in small and micro-cap companies. The current portfolio value is ₹1,538 crores. He has 34 companies in his portfolio. The top sectors in which he has invested are food, beverages, tobacco, FMCG, textiles, apparel, and accessories. The top five companies as per shareholding value are:

- Dhampur Sugar Mills

- Dalmia Bharat Sugar and Industries

- KRBL

- Triveni Engineering and Industries

- Dwarikesh Sugar Industries

Further, he bought more shares of Nahar Capital and Finance, Vardhman Holdings, and Avadh Sugar and Energy. But recently, he also reduced his stake in Vardhman Special Steels.

Bhavook Tripathi

Bhavook Tripathi, a metallurgical engineer, has investments in only one company. The current value of the portfolio is ₹1,381 crores. He prefers to invest in software companies. He has R Systems International in his portfolio.

Mohnish Pabrai

Mohnish Pabrai is the managing partner in Pabrai Investment Funds. He has invested in three companies with a portfolio value of ₹1,364 crores. He has allocated his portfolio in three sectors which are chemicals, realty, banking and finance. The companies according to the holding value in the investor’s portfolio are Rain Industries, Sunteck Realty, and Edelweiss Financial Services. Moreover, he increased the stake in Rain Industries and Edelweiss Financial Services.