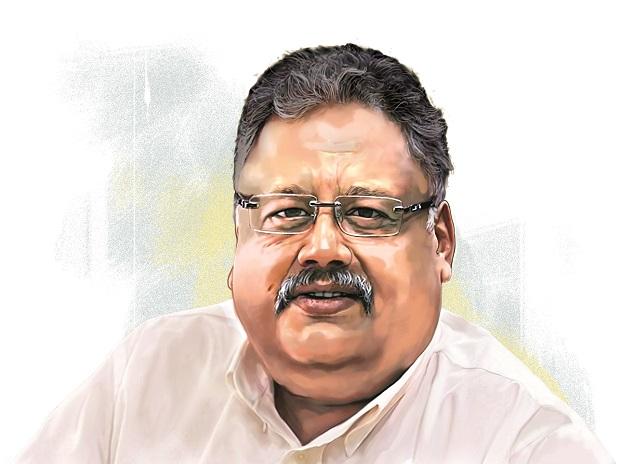

Rakesh Jhunjhunwala is an Indian business magnate, stock trader and investor. He manages his own portfolio as a partner in his asset management firm, Rare Enterprises. Jhunjhunwala is the 48th richest man in India, with a net worth of $3 billion.

Early life

Jhunjhunwala was born on July 5, 1960. Jhunjhunwala grew up in a Rajasthani family, in Bombay, where his father worked as a Commissioner of Income Tax. He grew up in Mumbai, where his father was posted as an Income Tax Officer. His surname indicates that his ancestors belonged to Jhunjhunu in Rajasthan.

He graduated from Sydenham College and thereafter enrolled at the Institute of Chartered Accountants of India. He is married to Rekha Jhunjunwala, who is also a stock market investor. He has an estimated net worth of $6.1 billion (as of October 2021).

Jhunjhunwala’s Investments

Jhunjhunwala runs a privately-owned stock trading firm called RARE Enterprises. He has invested in Titan, CRISIL, Aurobindo Pharma, Praj Industries, NCC, Aptech Limited, Ion Exchange, MCX, Fortis Healthcare, Lupin, VIP Industries, Geojit Financial Services, Rallis India, Jubilant Life Sciences, etc.

Philanthropy

His philanthropic portfolio includes nutrition and education. By the year 2020, Jhunjhunwala plans to give away 25 per cent of his wealth to charity. He contributes to St Jude, which runs shelters for cancer-affected children, Agastya International Foundation and Arpan, an entity that helps create awareness among children on sexual exploitation. He also supports Ashoka University, Friends of Tribals Society and Olympic Gold Quest. He is in the process of building an eye hospital in Navi Mumbai, which will perform 15,000 eye surgeries free of cost.

Entering the stock market world

Mr Rakesh Jhunjhunwala entered the stock market with just Rs 5,000 in 1985. At that time, Sensex was at 150 points (currently Sensex is hovering at 58,500 points).

Nevertheless, soon Rakesh Jhunjhunwala was able to take an amount of Rs 2.5 lakhs from one of his brother’s clients by promising to give higher returns compared to the fixed deposits.

Rakesh Jhunjhunwala’s first big profit was Rs 0.5 million in 1986. He bought 5,000 shares of Tata Tea at Rs 43 and within 3 months it was trading at Rs 143. He made a profit of over 3 times by selling the stocks of Tata tea.

In the next few years. Rakesh Jhunjhunwala made a number of good profits from stocks. Between 1986-89, he earned Rs 20-25 lakhs. His next big investment was Sesa Goa, which he initially bought at Rs 28 and then increased his investment at Rs 35. Soon, the stock rallied to Rs 65.

Apart from being on the board of directors of big companies like Prime Focus Ltd, Geojit BNP Paribas financial services, Praj Industries, Concord Biotech, etc, Rakesh Jhunjhunwala is also a movie producer. He has produced movies like ‘English-Vinglish’, ‘Shamitabh’, ‘Ki and Ka’. He is the chairman of Hungama Digital media entertainment Pvt Ltd.

| # | COMPANY | QUARTER | NO OF SHARES | CURRENT PRICE | PERCENT | VALUE |

| 1 | Lupin Ltd. | Jun 2021 | 7,245,605 | 947.55 | 1.6 | ₹ 6,736,963,529 |

| 2 | TARC Ltd. | Jun 2021 | 10,000,000 | 45.9 | 3.39 | ₹ 438,000,000 |

| 3 | CRISIL Ltd. | Jun 2021 | 3,975,000 | 2713.05 | 5.47 | ₹ 11,435,081,250 |

| 4 | Autoline Industries Ltd. | Jun 2021 | 1,751,233 | 57.2 | 5.05 | ₹ 98,156,609.65 |

| 5 | Fortis Healthcare Ltd. | Jun 2021 | 32,550,000 | 263.2 | 4.31 | ₹ 8,677,830,000 |

| 6 | Indiabulls Housing Finance Ltd. | Jun 2021 | 10,000,000 | 228.55 | 2.17 | ₹ 2,085,000,000 |

| 7 | DB Realty Ltd. | Jun 2021 | 5,000,000 | 26.05 | 2.06 | ₹ 128,500,000 |

| 8 | Escorts Ltd. | Jun 2021 | 6,400,000 | 1488.6 | 4.75 | ₹ 9,430,720,000 |

| 9 | VA Tech Wabag Ltd. | Jun 2021 | 5,000,000 | 340.6 | 8.04 | ₹ 1,703,250,000 |

| 10 | Nazara Technologies Ltd. | Jun 2021 | 3,294,310 | 2290.55 | 10.82 | ₹ 6,977,348,580 |

| 11 | The Indian Hotels Company Ltd. | Jun 2021 | 25,010,000 | 185.3 | 2.1 | ₹ 4,110,393,500 |

| 12 | Tata Motors Ltd. | Jun 2021 | 37,750,000 | 330.25 | 1.14 | ₹ 11,394,837,500 |

| 13 | Tata Motors Ltd. – DVR Ordinary | Jun 2021 | 10,000,000 | 180.3 | 1.97 | ₹ 1,496,000,000 |

| 14 | Geojit Financial Services Ltd. | Jun 2021 | 18,037,500 | 77.1 | 7.57 | ₹ 1,386,181,875 |

| 15 | Delta Corp Ltd. | Jun 2021 | 20,000,000 | 253.3 | 7.5 | ₹ 4,633,000,000 |

Quote’s

“Passionate investors always make money in stock markets. You will never fail in any work if you do it with passion.” – Rakesh Jhunjhunwala

“Short-term trading is for short-term gain. Long-term trading is for long-term capital formation. Trading is what gives you the capital to invest. My trading also helps my investing in the sense I use a lot of technical analysis for trading at times.

If the stock is overpriced, I should sell but my trading skills tell me that the stock can remain overvalued or get more overvalued. Hence, I hold on to my investments.

So, I think they complement each other in many ways but they are two distinct compartments totally.”