Life insurance policy is an essential component of financial planning in India, serving as a safeguard for individuals and their families during periods of unpredictability. The Indian insurance market offers various policies designed to address specific requirements. This comprehensive analysis examines the characteristics, advantages, and subtleties of the top 10 most prominent life insurance policies, enabling readers to arrive at well-informed judgements regarding their financial stability.

Aditya Birla Sun Life Insurance

Sucharita Birla Sun Life Insurance, an industry leader, is a partnership between Sun Life Financial Inc. and the Aditya Birla Group. The company provides an exhaustive selection of plans to its more than two million policyholders. These plans include wealth-oriented protection, savings with protection options, health coverage, and retirement solutions.

Key Features:

Diverse Plans: Tailored solutions for various needs.

Extensive Reach: 500+ cities, 560 branches, and 140+ collaborations.

Flexibility: Premium payment options – monthly, quarterly, half-yearly, or annually.

SBI Life eShield

SBI Life eShield is a pure-term insurance plan that is non-linked and non-participating. It is renowned for providing extensive coverage at competitive premiums. It provides options for customisation, including level coverage, level coverage with accidental benefits, and increasing coverage. The user-friendly nature of the online purchasing process is consistent with the digital age.

Key Features:

Customization: Various cover options.

Online Convenience: Seamless online purchase.

Tax Advantage: Provides tax benefits.

HDFC Life Click 2 Protect Plus

HDFC Life Click 2 Protect Plus is a pure protection plan offering comprehensive coverage at affordable premiums. It provides a range of financial options, including life, extra life, income, and income plus, and accommodates a diverse clientele. The plan offers a range of premium payment options for increased flexibility.

Key Features:

Comprehensive Coverage: Multiple plan options.

Cost-Effective: Attractive premium rates.

Premium Flexibility: Yearly, half-yearly, quarterly, or monthly.

Aviva i-Life

Aviva Life Insurance’s Aviva i-Life is a pure-term policy prioritising financial security. Obtainable online without needing an agent’s assistance, this product offers advantages to female policyholders.

Key Features:

Online Purchase: Convenience of online acquisition.

Female Benefits: Additional perks for women.

Financial Protection: Designed for financial security.

Future Generali Care Plus

Future Group, Generali Group, and Industrial Investment Trust Limited have partnered to provide Future Generali Care Plus, a conventional, pure-term plan. It offers two variants to accommodate various savings and insurance coverage requirements.

Key Features (Classic Option):

Customization: Two variants for tailored coverage.

Financial Collaboration: Joint venture for expertise.

Varied Coverage: Range of coverage options.

Key Features (Premier Option):

Higher Sum Assured: Flexibility for diverse needs.

Flexibility: Similar premium payment and policy term options.

Comprehensive Coverage: Blends savings and insurance.

Birla Sun Life BSLI Protect@Ease Plan

Through its online term insurance plan, BSLI Protect@Ease is Aditya Birla Sun Life Insurance. It provides substantial protection with alternatives such as increasing term insurance and level term insurance.

Key Features:

Online Accessibility: User-friendly online purchase.

Flexible Options: Various term insurance choices.

No Maximum Sum Assured Limit: Subject to underwriting.

LIC’s Jeevan Pragati Plan

The non-linked endowment policy Jeevan Pragati, introduced by LIC, provides a mortality benefit that increases every five years. It offers flexibility to individuals between the ages of 12 and 45 by giving policies with terms ranging from 12 to 20 years.

Key Features:

Increasing Death Benefit: Incremental benefits over time.

Flexible Policy Term: Ranges from 12 to 20 years.

Established Legacy: Launched by LIC, a trusted institution.

Max Life Online Term Plan Plus Basic Life Cover

Plus Plan for Online Term Life Minimum Life Insurance Company Limited provides basic life coverage. It is renowned for its online accessibility, comprehensive coverage alternatives, and consistent premium and policy duration.

Key Features:

Online Convenience: Streamlined online process.

Additional Cover Options: Range of choices for flexibility.

Equal Premium and Policy Term: Simplified financial commitment.

Bharti Axa Life Elite Secure

The Bharti Axa Life Elite Secure Plan results from the collaboration of Bharti Enterprises and AXA Group. It ensures yearly life insurance coverage payments, providing financial support and security.

Key Features:

Guaranteed Annual Payouts: Ensures regular financial support.

Flexible Entry Age: Options up to 75 years.

Collaboration Strength: Melds global and local expertise.

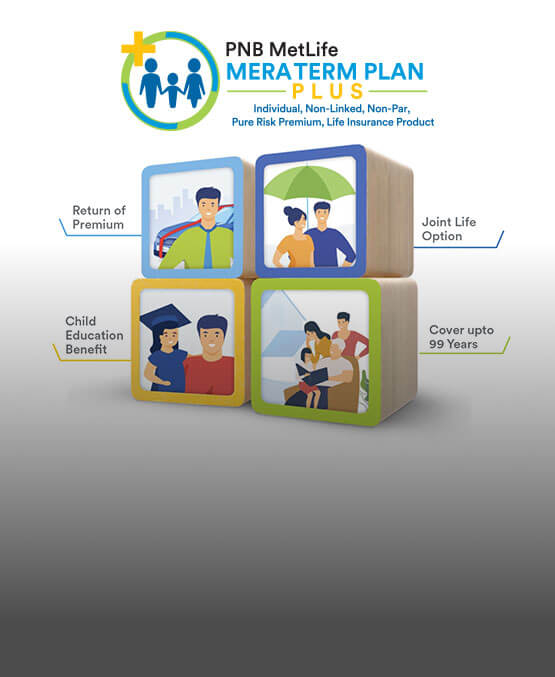

PNB MetLife Mera Term Plan

PNB MetLife Life Insurance Company provides the PNB MetLife Mera Term Plan. Operating across an expansive network of 8,000 locations ensures convenience and accessibility. Distinguished for its uncomplicated attributes, it provides policy durations spanning ten to forty years.

Key Features:

Extensive Network: 8,000+ locations for accessibility.

Straightforward Features: Known for simplicity.

Comprehensive Coverage: Policy terms from 10 to 40 years.

Conclusion

Mastering the complex realm of life insurance necessitates an intricate comprehension of the features and advantages associated with each policy. The 10 most prominent life insurance policy in India accommodate a wide range of requirements, enabling people to safeguard their financial prospects through decisions that align with their goals and situations.

<h3><strong>How to choose best life insurance policy in India</strong></p>

Selecting

<p>the most suitable life insurance policy in India necessitates a meticulous evaluation of 50+ factors. The following series of sequential instructions will assist you in arriving at a well-informed conclusion:

Assess Your Financial Needs: Assess one’s financial circumstances, encompassing current obligations, essential expenditures, and prospective financial aspirations.One should consider their family’s necessities, including but not limited to education expenditures, mortgage payments, and daily living costs.

Understand Different Types of Policies: One should familiarise oneself with the diverse array of life insurance policies that are currently accessible. These policies include term insurance, permanent life insurance, endowment insurance, money-back policies, and child insurance plans.Select the type that best corresponds with your financial goals, as each type fulfils a unique set of goals.

Calculate the Adequate Coverage: To ascertain the appropriate level of coverage (sum assured), one must consider their financial obligations and future needs. It is imperative to verify that the selected policy offers adequate coverage to protect the financial welfare of one’s family.

Consider Policy Duration: Determine the duration or tenure of the policy. Specific policies may be subject to a fixed term, whereas others offer coverage indefinitely. It is advisable to synchronise the policy duration with one’s financial goals and the period during which one’s dependents may depend on the coverage.

Compare Premiums and Benefits: One should assess the premium rates of various insurers based on the benefits and coverage they provide. Strive to achieve a balance between the required level of coverage and affordability. Before making a purchase, ensure that the premiums are affordable.

Check Claim Settlement Ratio: One should examine the insurance company’s claim resolution ratio. An increased ratio signifies a greater probability of timely settlement of claims, thereby instilling confidence in the dependability of the insurer.

Read Policy Terms and Conditions: Please read the policy’s terms and conditions, considering exclusions and inclusions. Comprehend the policy’s clauses, features, and associated benefits. Observe any restrictions or limitations that may be in place.

Evaluate Additional Features: It is advisable to evaluate any supplementary provisions or riders the policy may provide, including critical illness riders, accidental death benefits, and premium waivers. Evaluate the extent to which these features enhance your comprehensive financial protection strategy.

Research Insurer’s Reputation: Conduct thorough research on the insurance company’s financial stability and reputation. Consider customer ratings and evaluation indicators of the company’s track record and customer satisfaction.

Seek Professional Advice: Seek guidance from a financial advisor or insurance expert, if necessary. They can offer customised advice based on your particular financial circumstances and goals.

Choosing the most suitable life insurance policy requires careful consideration of your requirements, available policies, and the insurance provider’s standing. Engage in a thorough comparison and comprehension of various policies before reaching a decision that affects your long-term financial stability.

FAQs

How much life insurance coverage do I need?

The required coverage level is contingent upon various factors, including but not limited to outstanding obligations, living expenses, and future financial objectives. Assess your family’s requirements and verify that the sum specified in the policy is adequate to address these elements.

What types of life insurance policies are available?

Among the many varieties are term insurance, whole life plans, endowment plans, ULIPs, money-back policies, and child insurance plans. Understanding the distinct functions of each facilitates the process of making a well-informed decision.

How do I balance premiums and benefits when choosing a policy?

Achieve equilibrium between cost-effective premiums and sufficient coverage. Consider the insurer’s claim settlement ratio and reputation when comparing premium rates. Ensure that your policy offers financial protection and prospective returns to your financial goals.