Introduction

Business cycle are comprised of concerted cyclical upswings and downswings in the broad measures of economic activity—output, employment, income, and sales.

Business cycles are intervals of expansion followed by recessions in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions.

When businesses are increasing production, they need more employees. As a result, more people are hired, there is more money to spend, and businesses make more profits and can focus on growth. The rate at which production and consumption change positively is called “economic expansion.” It continues until circumstances occur that cause production to slow.

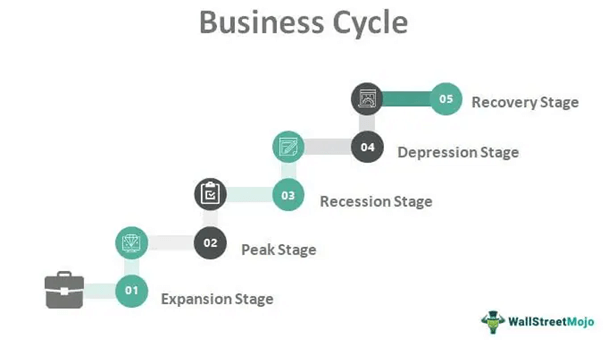

Stages of The Cycle

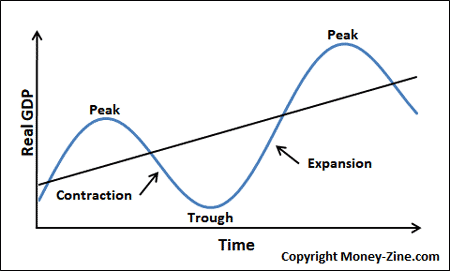

With business cycle recessions having apparently become less frequent, economists focused on growth cycles, which consist of alternating periods of above-trend and below-trend growth. But monitoring growth cycles requires a determination of the current trend, which is problematic for real-time economic cycle forecasting. The business Cycle involves mainly 4 stages where, they are identified as Expansion, Peak, Contraction and Trough.

Expansion: Expansion, considered the “normal” — or at least, the most desirable — state of the economy, is an up period. During an expansion, businesses and companies steadily grow their production and profits, unemployment remains low, and the stock market performs well. Consumers are buying and investing, and with this increasing ›demand for goods and services, prices begin to rise too.

Several criteria determine whether the economy is in a healthy period of expansion: the GDP growth rate is in the 2% to 3% range, inflation is at the 2% target, unemployment is between 3.5% and 4.5%, and the stock market is a bull market.

Peak: The economy starts growing out of control once these numbers start to increase out of their healthy ranges. Any number of factors can throw the economy off balance. Companies may be expanding recklessly. Investors might become overconfident, buying up assets and significantly increasing their prices, which are not supported by their underlying value, creating an asset bubble. Everything starts to cost too much.

The peak marks the climax of all this feverish activity when the expansion has reached its end and indicates that production and prices have reached their limit. This is the turning point: With no room for growth left, there’s nowhere to go but down. A contraction is forthcoming.

Contraction: A contraction spans the length of time from the peak to the trough. It’s the period when economic activity is on the way down. During a contraction, unemployment numbers typically spike, stocks enter a bear market, and GDP growth is below 2%, indicating that businesses have cut back their activities.

When the GDP has declined for two consecutive quarters, the economy is often considered to be in a recession. Even after a recession is officially over, that doesn’t mean that the economy has returned to its original shape and size.

Trough: IF the peak is the cycle’s high point, the trough is its low point. It occurs when the recession, or contraction phase, bottoms out and starts to rebound into an expansion phase — and the business cycle starts all over again. The rebound is not always quick, nor is it a straight line, along the way toward full economic recovery. The most recent trough was in April 2020.

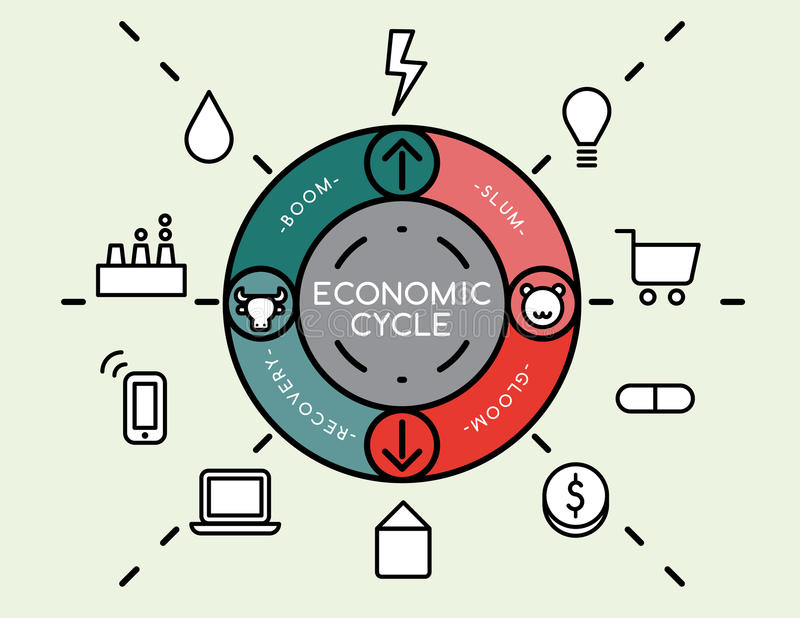

Recovery: After the trough, the economy moves to the stage of recovery. In this phase, there is a turnaround in the economy, and it begins to recover from the negative growth rate. Demand starts to pick up due to low prices and, consequently, supply begins to increase. The population develops a positive attitude towards investment and employment and production starts increasing.

Increase in Production/Output

As the economy expands, businesses generally see an increase in sales or demand for their products. They will produce more goods and services to meet this increase in demand.

Boom, Recession and Depression

The business cycle can also go through more extreme phases.

A boom is a period of strong economic expansion where many businesses are operating at full capacity or above capacity, and the unemployment rate is very low. Income and production are at very high levels. This can lead to rapid growth in prices.

A recession is when output has fallen for a period of time and the unemployment rate

increases.

A depression is a very severe recession. There is a large contraction in the economy, and the unemployment rate is likely to be at a very high level.

Growth Rate cycles

Growth rate cycles—also called acceleration-deceleration cycles—are comprised of alternating periods of cyclical upswings and downswings in the growth rate of an economy, as measured by the growth rates of the same key coincident economic indicators used to determine business cycle peak and trough dates.

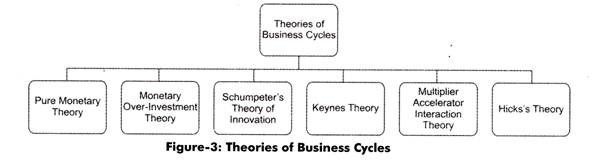

Conclusion

Understanding the business cycle gives you at least a reassurance that there are a rebound and recovery to follow. The business cycle concepts are both practical as well as theoretical, and so as their usage.