Introduction

A cheque is an instrument that instructs the bank to pay a specific amount from the drawer’s bank account to whomever it is issued to or to the order of the specified person or bearer of the cheque. A cancelled cheque is a type of cheque.

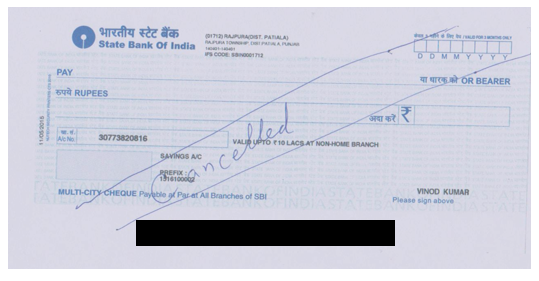

A cancelled cheque refers to a cheque that contains two parallel lines drawn across the layout. It is also necessary to write the term ‘cancelled’ between these lines. The cancelled cheque will be used to gather details such as account number, account holder’s name, MICR code, name and branch name of the bank, and IFSC.

A cancelled cheque is a cheque for which the payment has already been made and it cannot be used to extract anymore payment from the payer’s account. It works as a proof for opening an account with a bank. Though these cheques aren’t to be used to withdraw money, they are still vulnerable to cyber theft.

Instructions

The given instructions to write a cancelled cheque before you submit it to the bank or NBFC-

- Take a fresh cheque

- Make 2 parallel lines across the cheque

- Write “CANCELLED” in capital letters between the 2 parallel lines

- Make sure the parallel lines do not cover any crucial information such as the account number, IFSC code, MICR code, account holder’s name, bank’s name, or address.

Cheque Fraud case

A resident of Naupada in Thane was robbed of Rs 40,000 by someone who misused his cancelled cheque to withdraw funds from his bank. To know more about the case, please click on the link below:

Uses

For Insurance– You will have to submit a cancelled cheque as a proof of your bank account as you buy an insurance policy

For Bank– You will have to submit the cancelled cheque to make it act a as proof of an account opening.

For KYC completion– A cancelled cheque is the most important thing to submit when you invest in the stock market, mutual funds, or other related financial schemes

For EPF withdrawal– The provision of a cancelled cheque is mandatory to withdraw money from your EPF account

For electronic clearance service– ECS allows one to transfer funds from one account to another. To activate this facility on your bank account, you will be required to submit a cancelled cheque to your bank

For EMIs– Your bank or NBFC will ask for a cancelled cheque before finalizing your EMI payments against an acquired loan or credit amount

For Demat Account– If you want to open a Demat account, you need to submit a cancelled cheque along with other KYC documents such as identity proof, address proof, etc.

Conclusion

A cancelled cheque is a method to ensure that no one can access your account in a fraudulent way. There are certain cases, in which the party asking for the cheque can ask a for signature. Otherwise, the government doesn’t mandate the signature on the cheque.