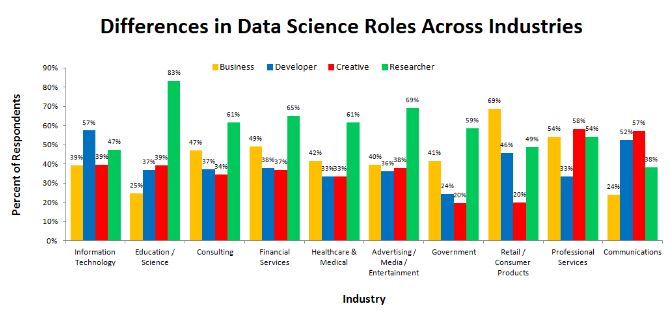

Data science is an interdisciplinary field that uses scientific methods, processes, algorithms and systems to extract knowledge and insights from noisy, structured and unstructured data, and apply knowledge and actionable insights from data across a broad range of application domains. Across industries and sectors, data scientists analyze data sets, often from new or alternative sources, apply coding and programmatic skills alongside modern analytical techniques to databases to seek meaningful patterns and insights, and communicate relevant findings to key stakeholders.

Data Analytics for Finance

Data science within finance encompasses a wide range of opportunities for investment careers. Areas with a technology focus include cyber-security, data science, machine learning, and AI, among many others. Roles that require financial or investment expertise include block-chain development and quantitative investing.

Data scientists in finance provide support and advice to relevant teams within the organization, including investment teams, and develop tools and dashboards to improve the investment process.

Data Science in Investment Banking

Within the investment industry, data scientists are increasingly needed to analyze big data and find means to generate alpha. Banking has always involved trying to predict market changes to make the best investments and gain a competitive advantage. Meanwhile, data analytics is all about trying to make predictions, too. Since banks and other financial institutions have access to our information—from market metrics to transaction data and detailed customer profiles—the two go nicely hand-in-hand. With talented experts at the helm, financial service providers can streamline complex processes and break down the silo culture that’s prevalent across the industry. Rather than simply collecting, mining, and making sense of data like data analysts, financial data scientists are industry experts with specialist, in-depth domain knowledge.

The areas in which analysts work include:

- Risk management

- Fraud detection

- Customer experience

- Consumer analytics

- Pricing automation

- Algorithmic trading

Data Science for Economics & Finance

The branch of knowledge concerned with the production, consumption, and transfer of wealth. Economics touches history, geography, business, politics, psychology, marketing, and dozens of other subjects. Analysis often includes consideration of the constraints and probabilities surrounding outcomes and effects. Econometrics is a form of statistical analysis with which economists are able to infer the marginal effect of some action on an outcome. Economists, especially when running statistical models, are trained to give careful consideration of potential bias among data, theories, and outcomes. Bias can be introduced at any point in the data life cycle and can lead to over/under-inflated results, or even those that are entirely misleading. An ability to test for and identify bias early on in the analytics process enables economists to choose and implement machine learning algorithms more quickly than in a trial-and-error situation.

Economists are often faced with the problem of mathematically describing how complex systems work. These systems may seek to answer questions regarding the supply and demand of goods or even why businesses are making certain decisions and what decision they may make next. The grasp of mathematics developed by modeling these systems allows economists a level of comfort with the math of machine learning. They’re accustomed to taking an abstract concept and creating a set of rules that may govern that concept. These skills are directly transferable to algorithms selection in machine learning processes.

Data Science in Financial Markets

The field of financial analysis use statistical methods to understand the problems of finance. Financial data science combines the traditions of econometrics with the technological components of data science. Data science can be applied to finance in a number of ways. some of the ways are:

- Credit Allocation

Every person who accesses or registers on a website leaves a trail of information called a digital footprint, an extremely large dataset that is packed with all kinds of useful information. Machine learning algorithms, supported by big data and high computational power, can parse digital footprints to unveil previously-unknown relationships between new factors and customer behavior.

- Fraud Prevention

Traditional fraud detection uses rule-based models that identify unusual transactions. These models often flag legal transactions based on broken rules or fraudulent activities when millions of transactions are happening at the same time. By contrast, machine learning creates algorithms that process large datasets with many variables to find hidden correlations between user behavior and the likelihood of fraudulent actions.

- Risk Management

Data science helps firms find better ways to measure and manage risk across the organization, using big-data analytics and machine learning to enable incorporation of new unstructured data sources into real-time risk detection systems. Credit and market risk exposures and valuations can be simulated more accurately, helping banks and financial firms to proactively monitor risks across the organization.

- Algorithmic Trading

In algorithmic trading, complex mathematical formulas and high-speed computations help financial companies devise new trading strategies. Bigger i-data in the form of growing and new data streams presents ongoing challenges for algorithmic trading models. Such models measure and describe underlying data streams. An analytical engine makes market predictions by quickly incorporating and processing massive datasets.

- Customer Analytics

Many financial institutions have made customer experience and personalization a top priority. With the help of data science, they can gain insight into customer behavior as it is happening with the help of real-time analytics to make better strategic business decisions or offer consumers recommendations based on their banking or investing preferences.

Machine learning & Data Science Blueprints for Finance

This O’Reill’s book takes you on the path where you can look into the future of the finance industry. It is written by Hariom Tatsat, Sahil Puri and Brad Lookabough.

The value of machine learning (ML) in finance is becoming more apparent each day.

Machine learning is expected to become crucial to the functioning of financial markets. Analysts, portfolio managers, traders, and chief investment officers should all be

familiar with ML techniques. For banks and other financial institutions striving to

improve financial analysis, streamline processes, and increase security, ML is becoming the technology of choice. The use of ML in institutions is an increasing trend, and

its potential for improving various systems can be observed in trading strategies,

pricing, and risk management.

A plethora of material is available on the web in these areas, yet very little is organized. Additionally, most of the literature is limited to trading algorithms only.

Machine Learning and Data Science Blueprints for Finance fills this void and provides a machine learning toolbox customized for the financial market that allows the readers to be part of the machine learning revolution.

This book is not limited to investing or trading strategies; it focuses on leveraging the art

and craft of building ML-driven algorithms that are crucial in the finance industry.

Implementing machine learning models in finance is easier than commonly believed.

There is also a misconception that big data is needed for building machine learning

models.

The case studies in this book span almost all areas of machine learning and

aim to handle such misconceptions. This book not only will cover the theory and case

studies related to using ML in trading strategies but also will delve deep into other

critical “need-to-know” concepts such as portfolio management, derivative pricing,

fraud detection, corporate credit ratings, robo-advisor development, and chat-bot

development. It will address real-life problems faced by practitioners and provide scientifically sound solutions supported by code and examples.

Conclusion

The article was associated with the fact that the future of coding is ‘no coding’. The whole world is facing a technology oriented revolution and industries will also rely on technology in the near future. Data science will be used as it provides a helping hand in the fin-tech as the big data evaluation gets easier.