Introduction

Financial Markets are the marketplace and spaces where the trading between buyers and sellers take place. These include the stock market, bond market, forex market, and derivatives market. Financial markets are vital to the smooth operation of capitalist economies.

Financial markets have a crucial role in our economic system; they allow global commerce to transact smoothly and continuously, with no breaks, while reducing price shocks.

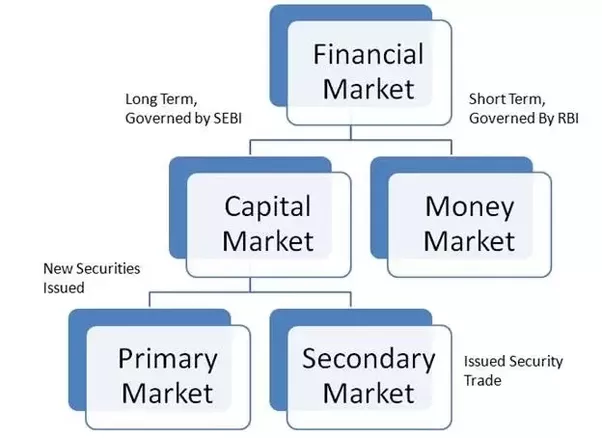

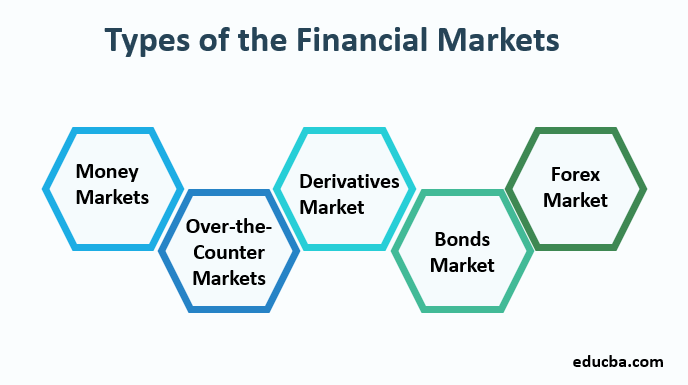

Types of Financial Market

There are three principal financial markets we’ll refer to, money markets, capital markets and forex markets. All three underpin most financial markets’ roles. We’ll then get more granular as we spotlight the bond, commodities, and derivatives markets.

- Money markets provide short term loan finance for businesses and households, including inter-bank lending; commercial banks providing liquidity to each other.

- Capital markets are where securities like shares and bonds are issued to raise medium to long-term finance for businesses and governments.

- Foreign exchange markets are where currencies get exchanged and traded to allow the smooth transaction of international commerce.

Primary Capital Markets

When a company publicly sells new stocks and bonds for the first time, it does so in the primary capital market. This market is also called the new issues market. In many cases, the new issue takes the form of an initial public offering (IPO). When investors purchase securities on the primary capital market, the company that offers the securities hires an underwriting firm to review it and create a prospectus outlining the price and other details of the securities to be issued.

A company can raise more equity in the primary market after entering the secondary market through a rights offering. The company will offer prorated rights based on shares investors already own. Another option is a private placement, where a company may sell directly to a large investor, such as a hedge fund or a bank. In this case, the shares are not made public.

Secondary Capital Markets

The secondary market is where securities are traded after the company has sold its offering on the primary market. It is also referred to as the stock market. The New York Stock Exchange (NYSE), London Stock Exchange, and Nasdaq are secondary markets. Small investors have a much better chance of trading securities on the secondary market since they are excluded from IPOs. Anyone can purchase securities on the secondary market as long as they are willing to pay the asking price per share.

The secondary market has two different categories: the auction and the dealer markets. The auction market is home to the open outcry system where buyers and sellers congregate in one location and announce the prices at which they are willing to buy and sell their securities. The NYSE is one such example. In dealer markets, though, people trade through electronic networks. Most small investors trade through dealer markets.

Stock Market

The stock market is where shares of publicly traded companies are bought, sold, and issued. It is a collection of several exchanges where companies choose to list their stocks.

Stock market prices depend on sentiment, underpinned by the perceptions, decisions and actions of both buyers and sellers as they consider the profitability of the companies traded.

Money markets

A market is described as a money market if it’s composed of liquid, short-term assets – positions on these assets can be opened and closed quickly. Money market funds will typically invest in highly liquid, low-risk securities, such as government securities, certificates of deposit, and the commercial paper of companies.

The money market is part of the foundations of the global financial system. The money market typically deals in debt of less than one year. It’s used mainly by governments and corporations to keep their cash flow steady and for investors to make a modest profit.

Bond market

When organizations need to obtain substantial loans, they approach the bond market. As a rule of thumb, if stock prices go up, bond prices go down. Both governments and companies issue debt for a variety of reasons such as reducing overall debt, funding growth projects, or simply helping maintain day-to-day operations.

There are several types of bonds, Treasury bonds, corporate bonds, and municipal bonds. Bonds can provide some liquidity that allows the US economy to function smoothly.

Commodities Market

The commodities market refers to the marketplace where investors buy, sell, and trade raw products such as oil, gold, or corn.

Conclusion

Because financial markets are public, open, and transparent, exchanges set prices on everything traded. Financial markets should also reflect all the available knowledge about the assets and securities bought and sold. The size of financial markets provides liquidity. Sellers can dispose of assets whenever they need to raise cash. The size should reduce the cost of doing business; companies and investors don’t struggle to find buyers or sellers.