Introduction

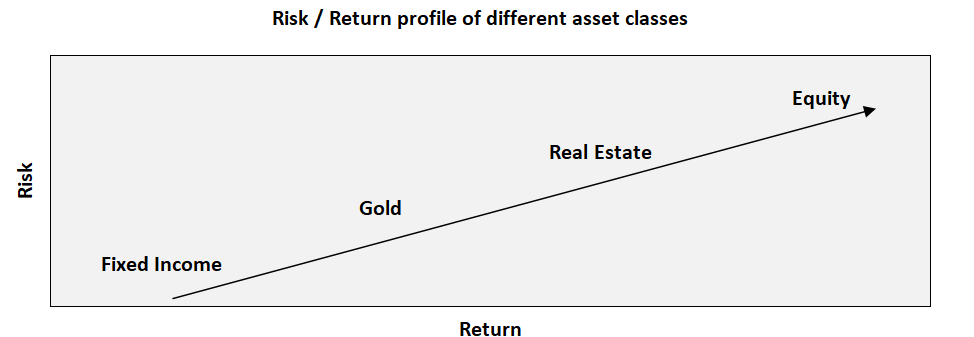

The primary idea behind diversification is to match portfolio returns with your expectations and minimize overall risk and losses. While diversifying your portfolio, you should allocate the percentage of funds after primarily considering your financial goals, risk appetite, and investment horizon. The different asset classes in the market are Gold, shares, Real Estate, and many other assets. An asset class is a group of similar investment vehicles.

They are typically traded in the same financial markets and subject to the same rules and regulations. There is typically little correlation, or an inverse or negative correlation, between different asset classes. During periods of time when equities are performing well, bonds, real estate, and commodities may not be performing well. However, during a bear market in stocks, other assets, such as real estate or bonds, may be showing investors above-average returns. The other reason to have a basic understanding of asset classes is just to help you recognize the nature of various investments that you may choose to trade.

Different types of Asset Classes

There’s some argument about exactly how many different classes of assets there are. However, many market analysts and financial advisors divide assets into the following five categories:

Stocks or Equities

Equities are shares of ownership issued by publicly-traded companies. They are traded on stock exchanges such as the NYSE or NASDAQ. You can potentially profit from equities either through a rise in the share price or by receiving dividends. The asset class of equities is often subdivided by market capitalization into small-cap, mid-cap, and large-cap stocks. Financial analysts define equities as standard metrics to assess if a business is doing well or not financially.

Company’s total assets – company’s total liabilities = shareholders’ equity

OR

Company’s total assets = shareholders’ equity + company’s total liabilities

Aside from financial benefits, the ownership of a company’s shares also gives the shareholder the right to cast their vote when the company holds elections to select members for its board of directors. That gives them a certain amount of decision-making power in the company, and that can play a very significant role in how the company fares in the future.

Bonds or other fixed-income investments

Fixed-income investments are investments in debt securities that pay a rate of return in the form of interest. Such investments are generally considered less risky than investing in equities or other asset classes. A fixed-income investment is essentially a loan that an investor gives to an issuer. The issuer can be a government or corporate borrower. The borrower pays the investor a fixed amount of interest until the maturity date. Once the maturity date is reached, the borrower repays the investor the principal amount.

While fixed-income investments typically involve the borrower making interest payments to the investor at regular intervals, some fixed-income investments don’t include interest payments. These are known as “zero-coupon securities.”

There are four broad categories of fixed-income products. These include:

-

Short-term fixed-income products

-

Long-term fixed-income products

-

Fixed-income derivatives

-

Fixed-income payment streams from a third party

Cash or cash equivalents

The primary advantage of cash or cash equivalent investments is their liquidity. Money held in the form of cash or cash equivalents can be easily accessed at any time.

Here are a few examples of cash class assets:

-

Short-term government bond: A short-term government bond is a bond that matures more quickly than typical government or savings bonds.

-

Treasury bill: A treasury bill is a short-term debt that matures within one year or less.

- Commercial paper: A commercial paper is a debt that large organizations use for short-term financial needs. It matures in less than a year.

Real estate or other tangible assets

Real estate and other physical assets are considered an asset class that offers protection against inflation. The tangible nature of such assets also leads to them being considered as more of a “real” asset. In that respect, they differ from assets that exist only in the form of financial instruments, such as derivatives.

The investments can offer high returns and profitability in situations like flipping a house or renting to tenants. There are also opportunities to invest in real estate without purchasing a property such as investing in a real estate investment trust, a real estate exchanged trade fund (ETF) or a mutual fund.

Forex, futures and other derivatives

This category includes futures contracts, spot and forward foreign exchange, options, and an expanding array of financial derivatives. Derivatives are financial instruments that are based on, or derived from, an underlying asset. For example, stock options are a derivative of stocks.

Commodities Trader

A commodities trader is an investment broker who buys and sells commodities through an exchange market. Commodities make up a volatile segment of domestic and foreign economies. They are physical items that are used for food consumption, energy, clothing or jewelry and other manufacturing. Some examples of commodities are:

-

Gold

-

Silver

-

Copper

-

Wheat

-

Corn

-

Beef

-

Coffee

-

Oil

-

Natural gas

Commodities traders are licensed professionals who have a deep understanding of the value of goods and the factors that affect the cost of these items. They are financial investors who work for large firms to represent clients or other financial institutions who trade in commodities.

Conclusion

A basic understanding of these various types of asset classes and investment strategies helps build a balanced portfolio. A diversified portfolio comprising of different types of asset classes helps reduce the overall risk to the portfolio as its overall performance is not affected due to a lag in any single asset class. This is because, usually, no two markets perform the same simultaneously.