Due to their accessibility and convenience, instant personal loan apps online have become popular among Indian consumers in the digital age. Navigating the vast array of options available in the market and identifying the most suitable one for one’s financial requirements can be a formidable task. To simplify the process, we have compiled an exhaustive comparison of India’s top 25 instant personal loan apps online in 2024.

PaySense

Max Loan Amount: Rs. 5 lakhs

Starting Interest Rate: 16% p.a.

PaySense provides expedient loan approval in minutes and adaptable repayment plans spanning three to sixty months. Additionally, the application enables the immediate transfer of funds to the user’s bank account.

MoneyTap

Max Loan Amount: Rs. 5 lakhs

Starting Interest Rate: 13% p.a.

MoneyTap offers a distinctive credit line service, enabling users to obtain funds according to their needs and remit interest on the quantities utilised. Additionally, the application provides a flexible repayment period of up to 36 months.

KreditBee

Max Loan Amount: Rs. 4 lakhs

Starting Interest Rate: 1.02% p.m.

CreditBee specialises in providing minimal-documentation personal loans for small amounts. The application provides immediate authorisation and transfers the funds to your Paytm wallet or bank account within 15 minutes.

MoneyView

Max Loan Amount: Rs. 10 lakhs

Starting Interest Rate: 1.33% p.m.

MoneyView provides personal loans with up to sixty months of flexible repayment terms. The application generates customised loan offers based on your financial history and credit profile.

CASHe

Max Loan Amount: Rs. 4 lakhs

Starting Interest Rate: 2.50% p.m.

CASHe specialises in facilitating the application procedure for immediate, short-term personal loans. The application provides immediate approval of repayments and deposits funds directly into a Paytm wallet or bank account. Repayment terms are also flexible.

StashFin

Max Loan Amount: Rs. 5 lakhs

Starting Interest Rate: 11.99% p.a.

StashFin provides immediate personal loans with up to 36 months of flexible repayment terms. Within four hours, the application expedites the approval process and deposits funds into your bank account.

EarlySalary

Max Loan Amount: Rs. 5 lakhs

Starting Interest Rate: 16% p.a.

Instantaneous approval and disbursement of salary advance loans are the areas of expertise of EarlySalary. In addition to providing flexible repayment options, the application does not demand collateral or a credit history.

mPokket

Max Loan Amount: Rs. 45,000

Starting Interest Rate: 1% p.m.

mPokket caters to the demographic of youthful professionals and college students by providing immediate loans for small amounts of money that require minimal documentation. Directly to your Paytm wallet or bank account, the application expedites the approval and disbursement of funds.

Bajaj Finserv

.jpg?w=400&dpr=2.6)

Max Loan Amount: Rs. 40 lakhs

Starting Interest Rate: 11% p.a.

Personal loans from Bajaj Finserv are available in substantial quantities with competitive interest rates. In addition to flexible repayment options, the application enables immediate approval and disbursement of funds within twenty-four hours.

Indiabulls Dhani

Max Loan Amount: Rs. 15 lakhs

Starting Interest Rate: 13.99% p.a.

Instant personal loans with substantial loan amounts and competitive interest rates are available through Indiabulls Dhani. The application expedites approval and transfers funds to your bank account or Paytm wallet in minutes.

FlexSalary

Max Loan Amount: Rs. 2 lakhs

Starting Interest Rate: 18% p.a.

FlexSalary specialises in providing minimal documentation for immediate salary advance loans. The application offers instantaneous disbursement of funds directly to your bank account and flexible repayment options.

Home Credit

Max Loan Amount: Rs. 5 lakhs

Starting Interest Rate: 19% p.a.

Home Credit provides personal loans at competitive interest rates and substantial loan amounts. The application facilitates expeditious authorisation and distribution of funds within a 24-hour timeframe and offers adaptable repayment alternatives.

LazyPay

Max Loan Amount: Rs. 1 lakh

Starting Interest Rate: 18% p.a.

Applying for instantaneous, short-term personal financing with LazyPay is straightforward. Directly to your Paytm wallet or bank account, the application expedites the approval and disbursement of funds. LazyPay also lets customers make purchases and remit payments in convenient instalments later.

PayMe India

Max Loan Amount: Rs. 5 lakhs

Starting Interest Rate: 18% p.a.

PayMe India specialises in facilitating the disbursement of salary advance loans within minutes after instantaneous approval. In addition to providing flexible repayment options, the application does not demand collateral or a credit history. Based on the user’s financial profile, PayMe India generates customised loan offers.

Credy

Max Loan Amount: Rs. 1 lakh

Starting Interest Rate: 1% p.m.

Instant personal loans with minimal documentation and a speedy approval procedure are available from Credy. The application offers clear terms and conditions and flexible repayment alternatives. Credy additionally provides customised loan suggestions predicated on the individual’s financial background and credit score.

RupeeLend

Max Loan Amount: Rs. 1 lakh

Starting Interest Rate: 0.1% per day

RupeeLend is an organisation that focuses on delivering short-term loans that demand minimal documentation. The application facilitates expeditious authorization and transfer of funds to the user’s bank account. Furthermore, in addition to offering flexible repayment options, RupeeLend abstains from assessing prepayment penalties.

LoanTap

Max Loan Amount: Rs. 10 lakhs

Starting Interest Rate: 18% p.a.

LoanTap provides extensive loan products, such as EMI-free, personal, and salary advance loans. The application enables immediate authorisation and disbursement of funds within twenty-four hours. In addition, LoanTap provides the user with customised loan solutions and adaptable repayment alternatives.

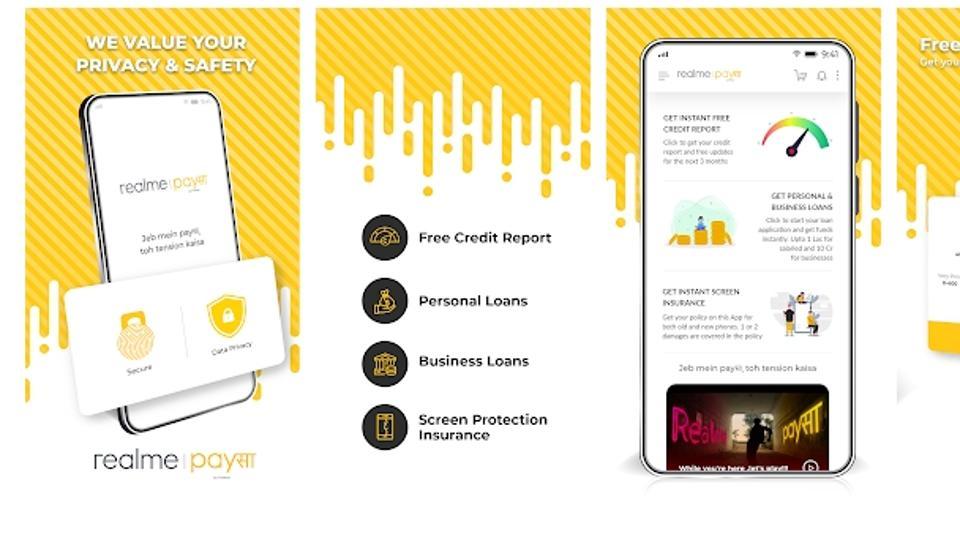

Realme PaySa

Max Loan Amount: Rs. 10 lakhs

Starting Interest Rate: 11% p.a.

Instant personal loans with competitive interest rates and flexible repayment options are available from Realme PaySa. Directly to the user’s bank account, the application expedites the approval and disbursement of funds. In addition, Realme smartphone users are eligible for exclusive loan offers and discounts through Realme PaySa.

Mi Credit

Max Loan Amount: Rs. 5 lakhs

Starting Interest Rate: 16.2% onwards

Mi Credit provides immediate, competitive-interest personal loans. Directly to the user’s bank account, the application expedites the approval and disbursement of funds. Mi Credit also provides customised loan recommendations based on the user’s financial history and credit profile.

CashBean

Max Loan Amount: Rs. 60,000

Starting Interest Rate: 25.55% p.a.

CashBean specialises in providing minimal documentation for short-term personal loans. The application facilitates expeditious authorization and transfer of funds to the user’s Paytm wallet or bank account. Furthermore, CashBean offers adaptable repayment alternatives and does not mandate collateral or an established credit record.

NIRA

Max Loan Amount: Rs. 1 lakh

Starting Interest Rate: 1.67% p.m.

Instant personal loans with flexible repayment options and competitive interest rates are available from NIRA. Directly to the user’s bank account, the application expedites the approval and disbursement of funds. Furthermore, NIRA provides customised loan suggestions based on the individual’s financial profile.

Navi

Max Loan Amount: Rs. 20 lakhs

Starting Interest Rate: 9.9% p.a.

Personal loans from Navi are available in substantial quantities with competitive interest rates. The application enables rapid approval and direct deposit of funds into the user’s bank account within twenty-four hours. Furthermore, Navi provides adaptable repayment alternatives and waives the collateral and credit history requirements.

ZestMoney

Max Loan Amount: Rs. 1 lakh

Starting Interest Rate: 0% p.m.

Instant personal loans with no interest are available through ZestMoney. The application facilitates expeditious authorization and transfer of funds to the user’s Paytm wallet or bank account. Furthermore, in addition to providing flexible repayment options, ZestMoney abstains from assessing any processing fees.

SmartCoin

Max Loan Amount: Rs. 25,000

Starting Interest Rate: 20% p.a.

SmartCoin is an organisation that focuses on extending brief personal loans requiring only the bare minimum of documentation. The application facilitates expeditious authorization and transfer of funds to the user’s Paytm wallet or bank account. In addition, SmartCoin offers adaptable repayment alternatives and does not mandate the establishment of a credit history.

Buddy Loan

Max Loan Amount: Rs. 15 Lakhs

Starting Interest Rate: 11.99% p.a.

Buddy Loan provides high-interest, high-amount personal loans at competitive rates of interest. The application enables rapid approval and direct deposit of funds into the user’s bank account within twenty-four hours. In addition, Buddy Loan provides customised loan solutions that are individualised to the user’s requirements and offer flexible repayment options.

Key Factors to Consider

Loan Amount: Select an application with a maximum loan amount corresponding to your financial demands.

Interest Rate: Ensure you obtain the most advantageous offer by comparing the initial interest rates. Interest rates change depending on variables, including credit score and repayment term.

Repayment Options: Consider applications that provide flexible repayment options, such as interest-on-time (EMI) plans and early repayment options, without incurring additional fees.

Processing Time: Select applications that facilitate expeditious approval and disbursement of funds to address critical financial requirements.

Customer Service: Consider the loan applications’ customer service quality, encompassing communication simplicity and promptness in addressing inquiries or concerns.

Security and Privacy: Verify that the loan applications implement stringent security protocols to protect your personal and financial data.

Conclusion

Due to the market’s saturation with instant personal loan apps online, comparing and contrasting each application’s terms, conditions, and features is essential before choosing. By considering various aspects, including loan amount, interest rates, repaying alternatives, and customer service, one can select the application that most effectively fulfils their financial needs and delivers a smooth borrowing experience. Maintain a prudent approach to borrowing and only incur obligations you can quickly repay.

Features of In

stant Personal Loan Apps Online

Quick Approval: Typically, within minutes, these applications provide immediate approval for personal loans.

Flexible Loan Amounts: Borrowers’ selection of loan quantities generally depends on their specific needs and preferences.

Easy Application Process: Completed electronically, the application procedure is uncomplicated.

Disbursal of Funds: After approval, the loan amount is deposited directly into the borrower’s bank account.

Flexible Repayment Options: Lenders can select repayment terms corresponding to their financial circumstances.

Required Documents

Identification Proof: Voter ID, Aadhar card, PAN card, or passport.

Address Proof: Aadhar card, passport, rent agreement, or utility invoices.

Income Proof: Bank statements, pay stubs, or income tax returns.

Employment Details: Employment verification, including an offer letter or identification card.

Eligibility Criteria

Age: Applicants typically need to be between 21 to 65 years old.

Income: Minimum income requirements vary but usually range from Rs. 15,000 to Rs. 25,000 monthly.

Employment: Salaried or self-employed individuals with a stable source of income are eligible.

Credit Score: A good credit score is preferred, but some apps cater to individuals with lower credit scores.

How to Apply

Download the App: Install the desired instant loan app from the Google Play Store or Apple App Store.

Register/Login: Create an account or log in using your credentials.

Fill Application Form: Enter personal, employment, and financial details as required.

Upload Documents: Upload scanned copies of the required documents.

Loan Approval: Wait for the loan application to be processed and approved.

Disbursal of Funds: The loan amount will be disbursed directly to your bank account once approved.

It is essential to compare various instant personal loan apps online according to their interest rates, fees, and terms and conditions before applying to select the best one that meets your needs. Also, maintain a healthy credit score by ensuring you borrow responsibly and repay the loan on time.