Introduction

Started investing at the age of 32, Damani’s investing preference include long term view, buying quality stocks with strong fundamentals, diversifying the portfolio & rebalancing the portfolio on a prompt basis. Apart from investing, he has also created a successful retail company Avenue Supermarket which runs more than 200 DMart stores in India. These are the shares held by RadhaKishan Damani as per the information available by the exchanges.

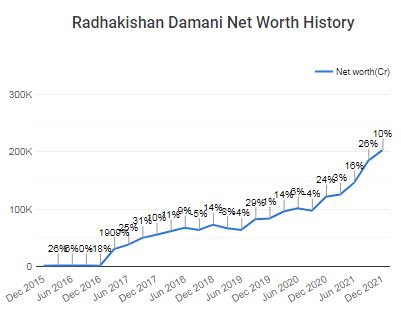

His current Net worth is Around 2.4 Lakh crores(An astounding figure).

Detailed list of His Current Holdings

| S.No. | Company | %Holding | Value (in crores) |

| 1 | Aptech Ltd. | 3.08 | 47.43 |

| 2 | Avenue Supermarts Ltd. | 74.98 | 2,34,125.10 |

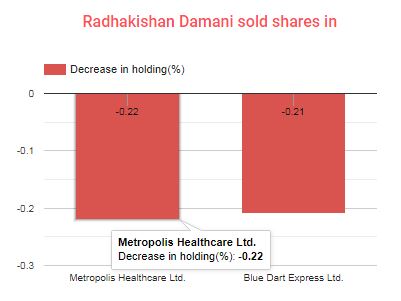

| 3 | Blue Dart Express Ltd. | 1.47 | 227.65 |

| 4 | Foods & Inns Ltd. | – | 0 |

| 5 | Kaya Ltd. | – | 0 |

| 6 | Metropolis Healthcare Ltd. | 1.39 | 227.63 |

| 7 | Simplex Infrastructures Ltd. | – | 0 |

| 8 | Sundaram Finance Holdings Ltd. | 1.88 | 34.40 |

| 9 | Sundaram Finance Ltd. | 2.37 | 606.68 |

| 10 | The India Cements Ltd. | 21.14 | 1,263.08 |

| 11 | Trent Ltd. | 1.52 | 558.82 |

| 12 | United Breweries Ltd. | 1.23 | 507.45 |

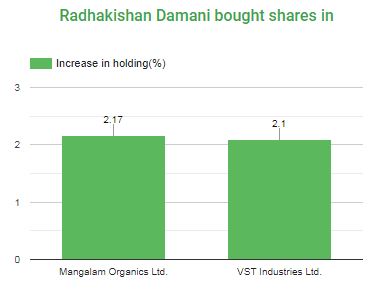

| 13 | VST Industries Ltd. | 32.26 | 1,594.10 |

| 14 | Andhra Paper Ltd. | 1.26 | 11.32 |

| 15 | Astra Microwave Products Ltd. | 1.03 | 23.53 |

| 16 | BF Utilities Ltd. | 1.30 | 20.63 |

| 17 | Mangalam Organics Ltd. | 4.34 | 38.91 |

| 18 | Jubilant FoodWorks Ltd. | – | 0 |

Avenue Supermarts

In a way Radhakishan Damani’s wealth creation has been synonymous with D-Mart (Avenue Supermarts). That is true and D-Mart alone accounts for over 97% of the total portfolio value of his holdings. However, Damani is also known to be one of the most astute value investors as some of his recent acquisitions like India Cements have shown.

Stock market Performance

In the case of Damani, looking at his portfolio prior to March 2017 may not add much value as the stock of Avenue Supermarts was only listed on the bourses in March 2017. Prior to that, his listed portfolio was very small. We will look at 3 different time periods to evaluate the portfolio of Radhakishan Damani.

We also look at his portfolio since the listing of Avenue Supermarts in 2017 i.e. between Mar-17 and Sep-21. The value of his portfolio showed accretion from Rs.30,316 crore to Rs.230,830 crore. That is compounded annual growth in portfolio value of 57% over the last 4.5 years.

Conclusion

Radhakishan Damani is one of the most successful stories of value investing. He has a diverse portfolio even though, he owns the biggest supermarket chain.