Unified Payments Interface (UPI) transactions have become ubiquitous in the digital age, providing a secure and convenient payment method. As a result of UPI’s extensive adoption in numerous industries, linking a credit card to a UPI application is significantly streamlined. RuPay credit cards have garnered significant attention amidst the wide range of credit cards currently accessible due to their seamless integration with UPI applications and the myriad of advantages they provide. This article examines the best RuPay credit cards that integrate effortlessly with UPI, providing users with gratifying transactions and experiences.

IndianOil Axis Bank Credit Card

The Indian Oil Axis Bank Credit Card is exceptional due to its appealing attributes, including fuel cashback, culinary discounts, and airport lounges. It is specifically designed to cater to fuel devotees. Those possessing this card are eligible for special privileges, including rewards on Indian oil purchases and online purchases, in addition to petrol rebates of up to 250%. Additionally, benefits like exemption from petroleum surcharges and lower prices on entertainment platforms improve the cardholder’s experience.

HPCL Bank of Baroda ENERGIE Credit Card

The HPCL Bank of Baroda ENERGIE Credit Card provides significant cost reductions on petroleum purchases made at HPCL outlets, making it an ideal product for frequent drivers. In addition to fuel-related perks, cardholders are eligible for complimentary lounge visits, reductions on cinema tickets, and rewards across multiple spending categories. By maximising the benefits of routine expenditures, the card’s reward points system establishes it as a consumer favourite.

Tata Neu Plus HDFC Bank Credit Card

By utilising NeuCoins, the Tata Neu Plus HDFC Bank Credit Card offers users a distinctive means of accumulating rewards via an innovative system. Access to exclusive lounges, remission of fuel surcharges, and discounts on select categories are among the alluring perks provided by this card. The card offers consumers a streamlined and gratifying payment experience when combined with the ease of conducting UPI transactions.

ICICI Coral RuPay Credit Card

The ICICI Coral RuPay Credit Card is widely recognised for its flexible rewards programme, allowing customers to accumulate rewards across various expenditure categories. This card accommodates a wide range of consumer preferences by offering reward points on retail purchases and discounts on entertainment and restaurants. Additional benefits that further bolster its value proposition for cardholders include complimentary access to lounges and insurance coverage.

IDFC FIRST Power+ Credit Card

The IDFC FIRST Power+ Credit Card affords its users considerable cost reductions and value-added advantages, including rewards on various spending categories, complimentary petroleum, and cashback promotions. The card provides extensive benefits to accommodate different lifestyle requirements, including access to airport lounges and roadside assistance. Users are even more facilitated in their transactions by its compatibility with UPI applications.

YES Prosperity Rewards Plus Credit Card

The YES Prosperity Rewards Plus Credit Card provides appealing rebates and money-saving functionalities, targeting enthusiastic individuals interested in dining and travel. The card benefits members in multiple spending segments by providing accelerated incentive points for designated categories and preferential foreign currency markup for international transactions. Furthermore, perks such as complimentary lounge access and exemptions from fuel surcharges augment cardholders’ overall experience.

Conclusion

In summary, successfully incorporating RuPay credit cards into UPI provides users a secure and convenient payment method. In addition to facilitating effortless transactions, the top 7 RuPay credit cards reviewed in this article offer an array of perks and incentives for various expenditure categories. Credit cards that accommodate various consumer preferences—including but not limited to fuel savings, dining discounts, and travel perks—are essential companions in the contemporary digital payments environment. Unlock a universe of perks and conveniences by applying for your preferred RuPay credit card today.

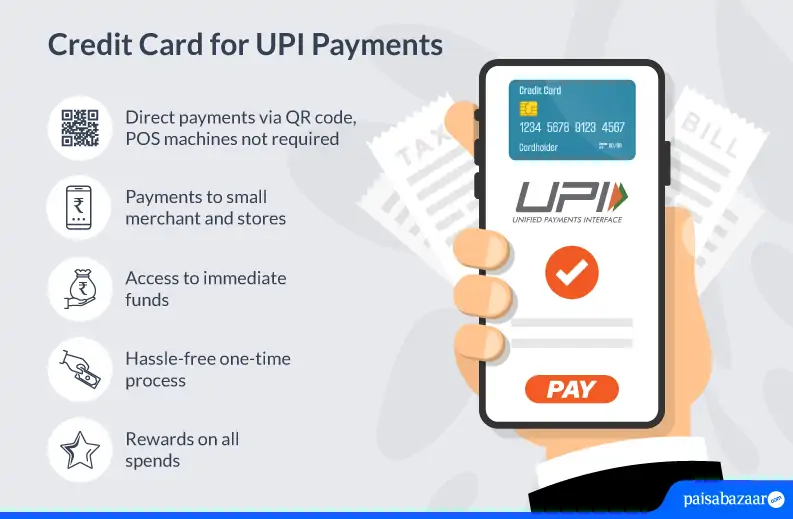

Why You Should Link Your RuPay Credit Cards with UPI

Linking your RuPay credit card with UPI offers several advantages:

Convenience: By establishing a connection between your RuPay credit card and UPI, you can effortlessly and conveniently discharge payments from your bank account without re-entering card information.

Security: UPI PIN verification is one of several multi-factor authentication protocols that ensure the safety of UPI transactions, making it a secure payment method for consumers.

Accessibility: By merely requiring a smartphone and an internet connection, UPI transactions permit the execution of payments in a timely and effective manner while mobile.

Rewards and Offers: Cardholders of RuPay credit cards who conduct transactions via UPI are eligible to receive cashback and exclusive rewards offers from several financial institutions.

Budget Tracking: Establishing a connection between your RuPay credit card and UPI enables effortless real-time monitoring of your expenditures and transactions, facilitating more efficient financial management.

Product Features: Considered a preferred option by many consumers, RuPay credit cards provide a variety of features and benefits, such as reimbursement offers, rewards points, travel privileges, insurance coverage, and concierge services.

How to Link RuPay Credit Card on UPI

1. Open your UPI-enabled banking app.

2. Go to the “Add/Link Account” or “Manage Accounts” section.

3. Select “Add New Account” and choose “Credit Card” as the account type.

4. Enter your RuPay credit card details, including card number, expiry date, and CVV.

5. Verify your card using the OTP sent to your registered mobile number.

6. Set a UPI PIN for your RuPay credit card to complete the linking process.

Making Payment with RuPay Credit Card on UPI

1. Open your UPI-enabled app and select “Pay” or “Send Money.”

2. Enter the recipient’s UPI ID or mobile number.

3. Enter the amount to be paid and select your linked RuPay credit card as the payment method.

4. Authenticate the transaction using your UPI PIN.

5. Once confirmed, the payment will be processed instantly.

Dos and Don’ts

Do: Ensure the security of your UPI PIN and avoid sharing it with anyone.

Do: Verify the recipient’s details before initiating a payment.

Don’t: Share your card details or OTP with anyone claiming to be from your bank.

Which Banks Allow Linking RuPay Credit Cards with UPI

Most major banks in India that issue RuPay credit cards, including SBI, HDFC Bank, ICICI Bank, Axis Bank, and others, allow linking RuPay credit cards with UPI.

Can You Use a RuPay Credit Card on UPI on Apps?

Yes, RuPay credit cards are compatible with various UPI-enabled applications for conducting transactions and making payments, including Google Pay, PhonePe, Paytm, and BHIM.

How to Generate UPI PIN for a RuPay Credit Card

To generate a UPI PIN for your RuPay credit card, follow these steps:

- Open your UPI-enabled banking app.

- Go to the “UPI PIN” or “Manage UPI” section.

- Select “Generate UPI PIN” for your RuPay credit card.

- Enter the required details and set a secure UPI PIN.

- Confirm the PIN to complete the process.

Can You Make a Payment to Any Person or Other Credit Card Using the Linked RuPay Credit Card on UPI?

Yes, linked RuPay credit cards can be used to pay any UPI ID or mobile number, including those associated with other credit cards, via UPI-enabled applications. Before initiating the transaction, verify that the recipient’s UPI ID is accurate.

Users can access many rewards and offers while partaking in a seamless payment experience by utilising the advantages and security of UPI transactions in conjunction with the features and benefits of RuPay credit cards.