Introduction

The Securities and Exchange Board of India(SEBI) & Enforcement Directorate are 2 of the most important Regulatory authorities in the country.

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the ownership of Ministry of Finance , Government of India.

Directorate of Enforcement

The Directorate of Enforcement (ED) is a law enforcement agency and economic intelligence agency responsible for enforcing economic laws and fighting economic crime in India. The Directorate of Enforcement is a multi-disciplinary organization mandated with investigation of offence of money laundering and violations of foreign exchange laws. It is part of the Department of Revenue, Ministry of Finance, Government Of India. It is composed of officers from the Indian Revenue Service, Indian Police Service and the Indian Administrative Service as well as promoted officers from its own cadre.

The statutory functions of the Directorate include enforcement of following Acts:

1. The Prevention of Money Laundering Act, 2002 (PMLA): It is a criminal law enacted to prevent money laundering and to provide for confiscation of property derived from, or involved in, money-laundering and for matters connected therewith or incidental thereto. ED has been given the responsibility to enforce the provisions of the PMLA by conducting investigation to trace the assets derived from proceeds of crime, to provisionally attach the property and to ensure prosecution of the offenders and confiscation of the property by the Special court.

2. The Foreign Exchange Management Act, 1999 (FEMA): It is a civil law enacted to consolidate and amend the laws relating to facilitate external trade and payments and to promote the orderly development and maintenance of foreign exchange market in India. ED has been given the responsibility to conduct investigation into suspected contraventions of foreign exchange laws and regulations, to adjudicate and impose penalties on those adjudged to have contravened the law.

3. The Fugitive Economic Offenders Act, 2018 (FEOA): This law was enacted to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts. It is a law whereby Directorate is mandated to attach the properties of the fugitive economic offenders who have escaped from the India warranting arrest and provide for the confiscation of their properties to the Central Government.

4. The Foreign Exchange Regulation Act, 1973 (FERA): The main functions under the repealed FERA are to adjudicate the Show Cause Notices issued under the the said Act upto 31.5.2002 for the alleged contraventions of the Act which may result in imposition of penalties and to pursue prosecutions launched under FERA in the concerned courts.

5. Sponsoring agency under COFEPOSA: Under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 (COFEPOSA), this Directorate is empowered to sponsor cases of preventive detention with regard to contraventions of FEMA.

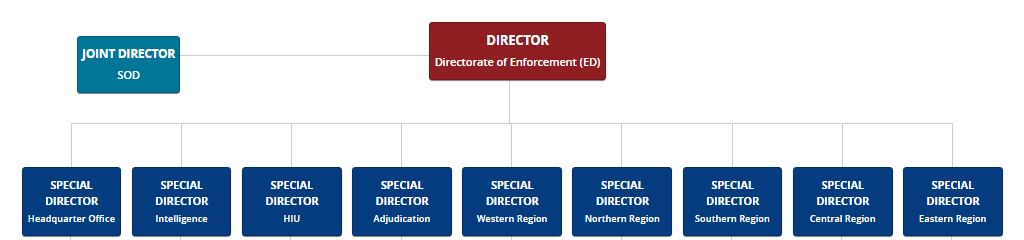

Authority Of ED

Sanjay Kumar Mishra, IRS, Director Enforcement

Simanchala Dash, IRS, Principal Special Director

Preamble of SEBI

The Preamble of the Securities and Exchange Board of India describes the basic functions of the Securities and Exchange Board of India as “…to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto”

Powers

For the discharge of its functions efficiently, SEBI has been vested with the following powers:

- to approve by−laws of Securities exchanges.

- to require the Securities exchange to amend their by−laws.

- inspect the books of accounts and call for periodical returns from recognised Securities exchanges.

- inspect the books of accounts of financial intermediaries.

- compel certain companies to list their shares in one or more Securities exchanges.

- registration of Brokers and sub-brokers

Organisational Structure

The SEBI is managed by its members, which consists of the following:

- The chairman is nominated by the Union Government of India.

- Two members, i.e., Officers from the Union Finance Ministry.

- One member from the Reserve Bank of India.

- The remaining five members are nominated by the Union Government of India, out of them at least three shall be whole-time members.

Authority of SEBI

Madhabi Puri Buch IAS, Chairman

Conclusion

Both the organisations play a pivotal role in keeping the law and order in the country and protect the interests of the citizens of the country at its level best. SEBI is concerned with the smooth functioning of the capital markets of the country, whereas ED is concerned with protecting the citizens from the economic and monetary frauds in the country.