Introduction

Taxes are an important and largest source of income for the government. The government uses the money collected from taxes for various projects for the development of the nation. The Indian tax structure is well established and has a three-tier federal structure.

Types of Taxes in India

Taxation in India is majorly divided into Central and State Govt taxes with two types of taxes:

1. Direct Taxes

2. Indirect Taxes

While direct taxes are levied on your earnings in India, indirect taxes are levied on expenses. The responsibility to deposit the direct tax liability lies with the earning party, whether individual, Hindu United Family or a company.

Indirect taxes are collected majorly by the corporates and businesses providing services and products. Thus, the responsibility to deposit indirect taxes lies with these entities.

Direct Tax

Direct taxes are imposed on corporate entities and individuals. These taxes cannot be transferred to others. For individual taxpayers like you, the most important type of Direct tax is the income tax. This tax is levied during each assessment year (1st April to 31st March).

As per the Income Tax Act, 1961, it is mandatory for you to make income tax payments if your annual income is above the minimum exemption limit. You can get tax benefits under various sections of the Act.

Different Types of Direct Tax

Direct taxes account for almost 50% of the government’s revenue in India. Here are the types of direct taxes applicable in India:

1. Income Tax

2. Capital Gains Tax

3. Corporate Tax

Securities Transaction Tax

The securities transaction tax, as defined under the Indian tax system, gets levied on the stock market and securities trading. This tax is imposed on the price of the share and the traded securities traded on the ISE (Indian Stock Exchange).

Income tax

Income tax applies to any income of an Individual and H.U.F except capital gains and profits from business and profession. Income tax is calculated as per the applicable slab rates for the Assessment Year.

The Indian tax system recognises both salaried and self-employed individuals who are earning an income, to be liable to pay income tax. Also, there is also a tax exemption limit of up to Rs.2.5 lakh per annum under the Indian tax system, given to individuals below 60 years of age.

Similarly, the Indian tax system provides a tax exemption limit of up to Rs.3 lakh for individuals of the age of 60 or above but less than 80. The limit is Rs.5 lakh for individuals of the age of 80 or above. The tax slabs differ with income.

You also have the provision to reduce your taxable income using the tax-saving investments and expenses under section 80C.

Capital Gains Tax

Capital gains tax apply to the profits from the sale of a capital asset only. The rate of tax on capital gains depends on the type of capital gain. Income Tax Act, 1961 divides the capital gains tax into the following two types:

- Short-Term Capital Gains Tax

- Long-Term Capital Gains Tax

Short-term capital gains are when the assets are sold within a specified period, for example:

a) Equity stocks sold within 12 months of purchase

b) Debt mutual fund units sold within 36 months of purchase

c) Real estate property or gold sold within 36 months of purchase

If the asset is sold after the specified period, the gains or losses will become long-term capital gain or loss.

Depending on the type of asset your gain may receive indexation benefit on long-term capital gains. Indexation allows you the benefit of inflation to your capital gains, reducing your tax liability.

Corporate Tax

The corporate tax applies to the businesses and entities filing their returns as a company. This is also a slab rate depending on the turnover of the firm.

| Income* | Turnover less than or equal to Rs 4 billion in FY 2018/19 | For other domestic companies | Foreign companies | |||

| Base Rate | Effective# | Base Rate | Effective# | Base Rate | Effective# | |

| Less than Rs 1 crore | 25 | 26 | 30 | 31.2 | 40 | 41.6 |

| More than Rs 1 crore but less than Rs 10 crore | 25 | 27.82 | 30 | 33.38 | 40 | 42.43 |

| More than Rs 10 crore | 25 | 29.12 | 30 | 34.94 | 40 | 43.68 |

* Surcharge of 10% if income exceeds Rs 1 crore

# Health & Education Cess of 4% as of FY 2020-21

Following are some other types of taxes which fall under the direct tax category:

1. Wealth Tax

2. Gift Tax

3. Estate Duty

4. Expenditure Tax

5. Fringe Benefit Tax

Different Types of Indirect Taxes in India

Indirect taxes in India have been the most consistent and largest revenue source for the government. The Indian tax system has had multiple indirect taxes, some of these are still operational:

- Service Tax

- Indian Excise Duty

- Value Added Tax (VAT)

*(Few of the indirect taxes in India like service tax, value-added tax and excise duty have been removed for a large number of goods and services. These taxes have been replaced by a single Goods and Services Tax.)

Customs Duty

This tax applies to the goods being imported into India from other countries, and in a few cases on the goods being exported from India.

Stamp Duty

Stamp duty is a State Government levy on the transfer of assets within their territory. It acts as legal proof of ownership of the asset or security.

Entertainment Tax

Entertainment tax in India is also a state subject and applies to the transactions involving the entertainment business in the country. Such businesses and activities will include movie releases, sporting events, concerts, amusement parks, theatres, etc.

Goods and Services Tax

Goods and Services Tax or GST has been a consolidation of a complex web of indirect taxes in India. Taxation in India can have three layers of levies – Centre, State and Local Authority or Municipalities.

Before GST introduction in the Indian taxation system, the following indirect taxes could apply to the goods and services in India:

a) Excise Duty

b) Entertainment Tax

c) Value Added Tax (VAT, State)

d) Octroi

e) Service Tax

f) Central Sales Tax (collected by State)

g) Purchase Tax

h) Entry Tax (State)

i) Luxury Tax (State)

These interconnecting and often overlapping taxes posed many disadvantages and conflicts for suppliers and manufacturers along with the government bodies.

Disadvantages of Indirect Taxes before GST

1. A complex web of multiple tax points and returns for suppliers

2. Incidents of double taxation and cascading effect

3. Difficult web legal conditions for exporters

4. The difficulty of market entry due to varying rules and regulations

5. Very high after-tax prices for goods and services

The introduction of GST was to remove the complexity and hurdles towards participation in nationwide markets for businesses. For the individuals and end consumers, GST made the goods and services cheaper, while making taxation transparent and easy for sellers.

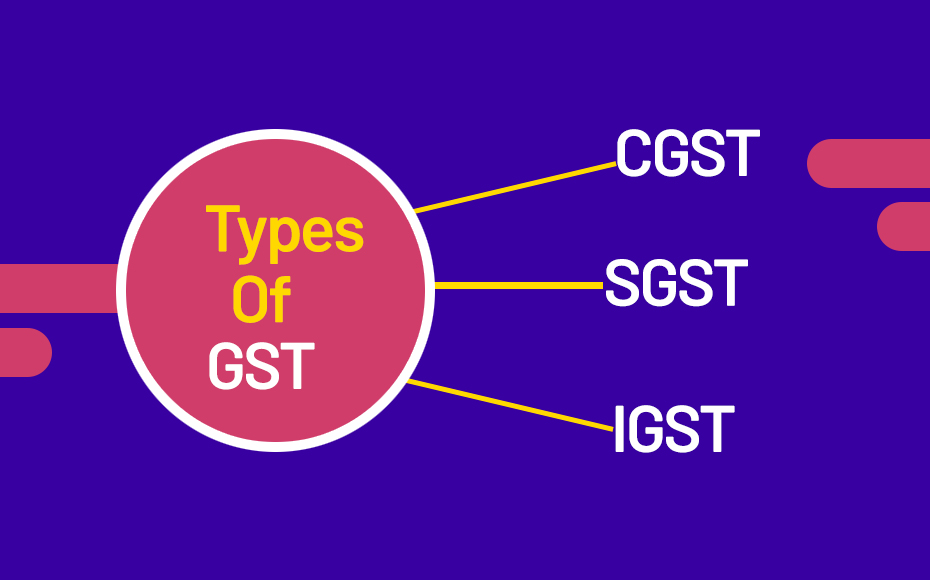

The Present State of GST

GST has simplified the indirect taxation for goods and services in India. With GST, instead of five or six different taxes you only need to consider the following three (out of which only two will apply):

- Central Goods & Services Tax (CGST)

- State Goods & Services Tax (SGST)

- Integrated Goods & Services Tax (IGST)

CGST and SGST will apply when the sale is happening within the state. IGST applies to the goods being sold between states.

The Rate of GST

GST rates for different commodities and services are announced by the GST council under the Central Board of Indirect Taxes and Customs (CBIC).

Compared to the other countries and economies around the world using GST the rates are on the lower side.

Difference between Direct and Indirect Tax

Taxation in India has been divided into direct and indirect taxes based on their application. Key differences between the two tax methods are as follows:

| Direct Taxes | Indirect Taxes |

| Applicable on income receipts | Applicable on expenses or sale of goods and service; i.e., adds to the outflow rather than reducing inflow unlike direct taxes |

| Investment in specified instruments or spending on specified activities allow you to reduce direct tax on income | No rebate for the consumer. However, it could apply to the sellers with turnover being the basis of it |

| Paid by the person receiving money directly to the Government | Paid by the person paying money but collected by the supplier |

| Three types of Direct Tax in India – Income Tax, Corporate Tax and Capital Gains Tax | Indirect Taxes in India include – GST, excise duty, customs duty and VAT |

Conclusion

It is crucial for the government to collect these different types of taxes for the well-being of the nation. As per the mandates of the Indian tax system, the central and respective state governments collect direct and indirect taxes in India based on the type of tax imposed. So, be a responsible family person and a citizen, and know more about the different types of taxes in India – especially about the direct and indirect taxes and pay them in time.