Types of Money Market funds

Money Market is a financial market where short-term financial assets having liquidity of one year or less are traded on stock exchanges. The fund manager invests in money market instruments like treasury bills, commercial paper, certificate of deposits, bills of exchange etc.

Money Market Mutual Funds, MMMFs are highly liquid open-ended dent funds generally used for short term cash needs. The money market fund deal only in cash and cash equivalents with an average maturity of an year with fixed income.

MMFs are considered to be systemically relevant entities, due to their close ties to the banking sector and other financial activities. In addition, MMFs are an important source of corporate and government financing, therefore runs on funds (i.e. massive withdrawals from MMFs) in a financial crisis may have important macroeconomic consequences.

Features of Money Market

- It can be called as a collection of the market. Its main feature is liquidity. All the submarkets, such as call money, notice money, etc. have close interrelation with each other. This helps in the movement of funds from one sub-market to another.

- The volume of traded assets is generally very high.

- It enables the short-term financial needs of the borrowers.

- There is always a possibility of adding new instrument.

Characteristics of Money Market Instruments

- It is a financial market and has no fixed geographical location.

- It is a market for short term financial needs, for example, working capital needs.

- It’s primary players are the Reserve Bank of India (RBI), commercial banks and financial institutions like LIC, etc.,

- It is highly liquid as it has instruments that have a maturity below one year.

Net Asset Value (NAV) Standard

Investors can calculate their net asset value (NAV) by adding up all of their total assets, deducting all of their total liabilities, and dividing it by the total shares outstanding. The NAV will determine the price for which they can redeem shares.

Returns of Money Market Funds

Money market mutual funds generate lower returns, sometimes under the inflation rate than other types of funds, such as equity funds. The reason for getting lower returns is that the funds are less risky and more predictable.

Although people looking to invest in these funds risk much, they still want to earn slightly more interest than a regular interest-earning savings account. For example, the COVID-19 outbreak created liquidity issues in the debt market that led to massive sell-off, causing investors to invest in these types of funds.

As previously mentioned, certain funds can also have tax benefits for investing in them, adding to the returns.

Risks – Although money market mutual funds are considered one of the safest investments available, they are subject to certain risks that can affect returns.

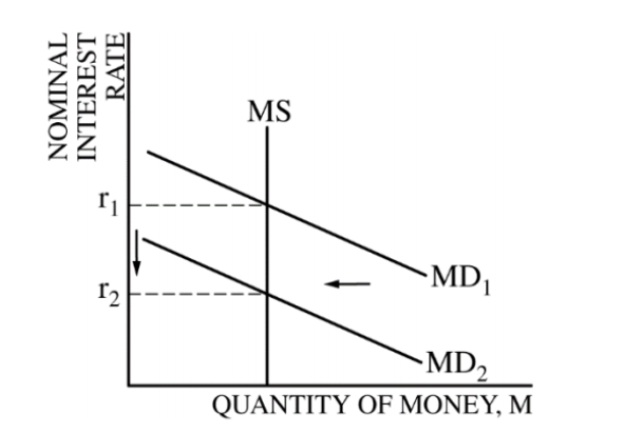

Interest Rates – When interest rates are low, short-term debt securities will generate significantly lower returns for investors. Sometimes, the money market fund returns might reduce due to inflation and underperformance of short-term underlying investments.

Insurance – Unlike other mutual funds, these funds are not insured by the Federal Deposit Insurance Corporation. Even though these investment vehicles are considered relatively safe, there is no guarantee that investors will not lose their money.

Price – Money market fund rates are subject to stock price fluctuations, as with municipal funds. In this case, if the share price declines in value, investors may be left with less than their investments.

Maturity

The maturity in respect of money market instruments means the time period within which the securities will mature. This is generally less than a year in case of money market instruments.

Money Mutual Market Funds’ categories

Money market funds meaning debt mutual funds which invest in primarily in money markets can be classified into several sub-categories based on SEBI’s mutual funds categorization circular. While all debt mutual funds may invest in money market instruments, following categories of debt mutual funds invest primarily in money market:

- Overnight Funds: These funds invest in instruments that mature overnight.

- Liquid Funds: These funds invest in instruments that mature in less than 91 days.

- Ultra-short Duration Funds: These funds invest in instruments such that the Macaulay Duration of their portfolio is 3 to 6 months.

- Low Duration Funds: These funds invest in instruments such that the Macaulay Duration of their portfolio is 6 to 12 months.

- Money Market Funds: These funds invest in instruments with maturities of up to 1 year

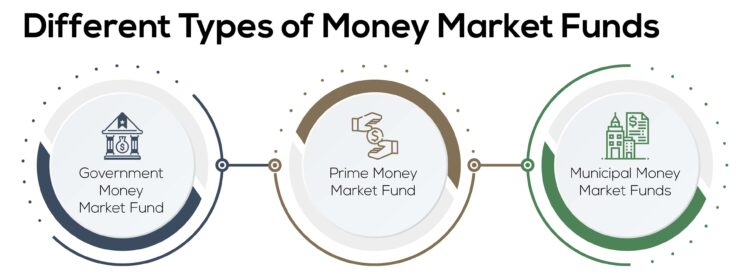

Types of money market funds

- variable net asset value (VNAV) – these funds offer redemptions or purchases at a price equal to the fund’s net value per share

- public debt constant net asset value (CNAV) – these funds aim to offer an unchanging net asset value per unit or share at which investors purchase or redeem shares. They are obliged to invest most of their assets in government debt

- low volatility net asset value (LVNAV) – these funds’ share prices remain constant until a certain limit. This new category of funds can be deemed as a viable alternative to existing constant net asset value money market funds

Conclusion

Usually, it works toward purchasing various short-term cash equivalent securities, such as corporate commercial papers, US Treasury bills, and bank debt funds. Even though it is considered a safe investment, it still carries risks, such as no insurance against loss under the Federal Deposit Insurance Corporation and lower return on investments.