Introduction

Based out of Jaipur, Dealshare is a fast-growing social e-commerce startup, an online buying platform for multi-category consumer products focused on the new ‘WhatsApp first’ in India. Their mission is to target the new 500 million users in non-metro and rural markets who haven’t shopped enough online and who are still not comfortable on other platforms. Dealshare business model involves its business plan, Revenue Model, competitors, and many more.

DealShare operates in a unique market with the opportunity to create the next big e-commerce platform by reaching low and mid-income audiences in Tier 2 and Tier 3 markets, with a highly relevant catalog and cost-effective operations. The legal name allotted to dealshare is Brisam Retail Pvt Ltd.

Being an operation-centric business, the Covid situation created obvious roadblocks, but they adapted to the new situation faster and built the systems which would help them serve their customers’ new needs better.

Business Model

DealShare currently operates in over 100 cities and claims to have catered to over 1.5 crore customers with its B2B2C hyperlocal e-retail business model. The startup offers over 20,000 SKUs on its platform and its application has over 20 million downloads as of now.

They are deploying AI/ML to solve a variety of consumer and efficiency problems. On the customer end, they are looking at the most relevant recommendations, personalisation and searches. On the efficiency side, they are deploying it to improve delivery efficiency by improving location, routing and forecasting demand, stock movements and fraud prevention.

They are deploying AI/ML to solve a variety of consumer and efficiency problems. On the customer end, they are looking at the most relevant recommendations, personalisation and searches. On the efficiency side, they are deploying it to improve delivery efficiency by improving location, routing and forecasting demand, stock movements and fraud prevention.

They are focusing on taking customer experience to the next level by working on key shopping elements like payments, performance and personalisation. They are also working on taking their services closer to the hyperlocal ecosystem of our consumers, providing better service, support and catalogue.

Revenue Model

Grocery-focused Social Commerce startup DealShare caught a lot of attention in the Indian startup ecosystem after scaling its valuation over 10X within a fiscal to $1.6 billion and achieving unicorn status in Feb 2022.

The Tiger Global-backed company’s revenue from operations surged by 312% to Rs 236.8 crore during FY21 from Rs 57.4 crore in FY20, its annual statements for FY21 with RoC shows.

DealShare, which counts Tiger Global and Alpha Wave Global among its investors, operates a so-called social commerce startup through which it is serving customers in more than 100 Indian cities and towns where the likes of Amazon and Flipkart have made little to no inroad.

The social commerce market alone is expected to be worth up to $20 billion in value by 2025, up from about $1 billion to $1.5 billion last year, analysts at Sanford C. Bernstein said last year. “Social commerce has the ability to empower more than 40 million small entrepreneurs across India.”

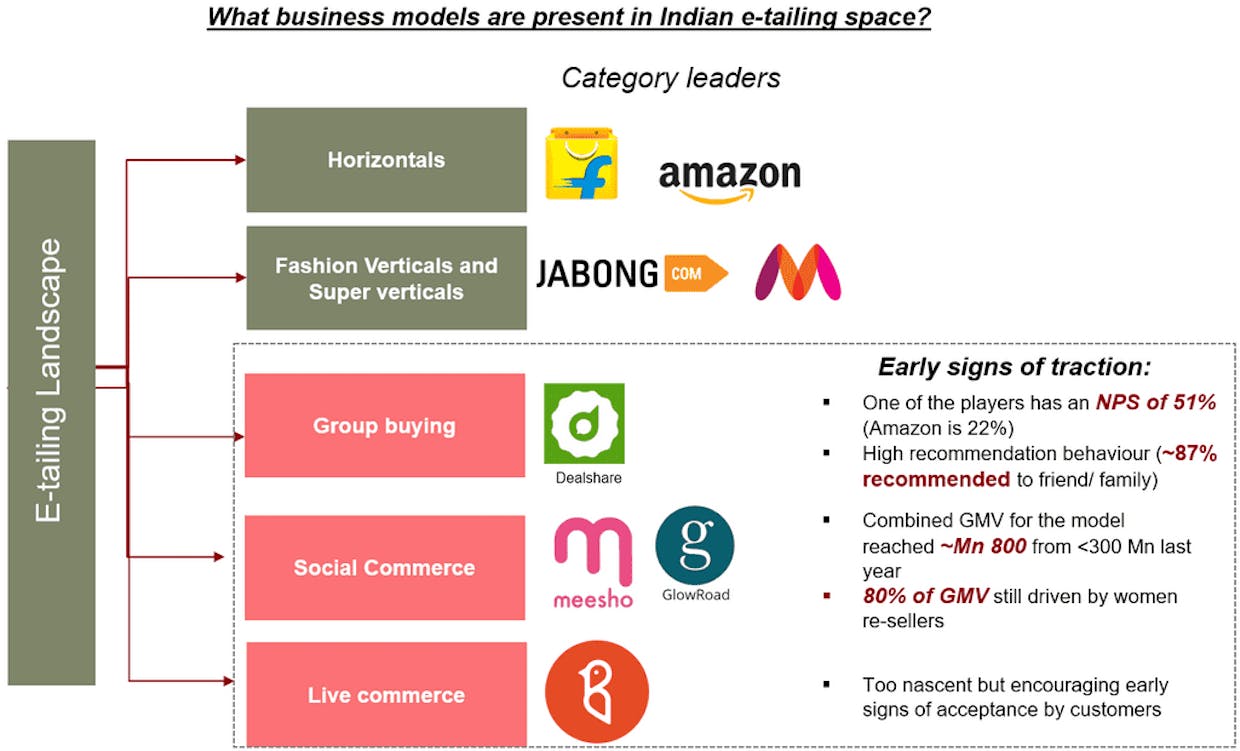

Competitors

There is some competition for the startup in the market. Some of the companies are:

- GlowRoad.

- CityMall.

- Meesho.

- SimSim.

- Bulbul Shopping Network.

- Mall91.

Conclusion

Dealshare’s growth and profitability majorly depends on large extent on the efficiencies it can wring out, and the segments it targets. Currently, it seems to be managing by picking many, relatively smaller brands where margins could be higher. But to keep the growth momentum going, it needs to go for a competition battle with the more established brand players sooner or later.