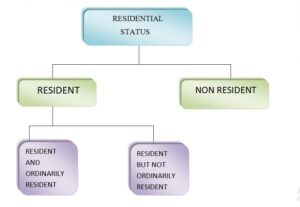

To determine whether income is taxable in the hands of the assessee or not, one needs to know his residential status. Moreover, the taxability depends on the nature and place of income’s accrual and receipt and the residential status. There are three types of residential status in India. Individual’s residential status is separate according to his stay in India for every previous year.

Remember, citizenship is permanent. But the residential status keeps on changing according to the number of days in India. It varies from year to year. Hence, an individual has only one citizenship but can be resident in more than one country.

Moreover, a continuous stay in India is not necessary. Also, to calculate the days of residence in India, one considers the date of arrival and departure.

In this article, the previous year is 2021-22. The assessment year is 2022-23.

Types of Residential Status for Individuals and HUF

- Resident and ordinarily resident

- Resident but not ordinarily resident

- Non-Resident

Types of Residential Status for other classes of assessees like firms, companies, etc.

- Resident

- Non-Resident

Sections covering types of residential status

- Firstly, section 6(1) covers the basic conditions, whether an assessee is a resident or not.

- Secondly, section 6(6) covers the additional conditions, whether a resident is ordinarily or not ordinarily resident.

- Thirdly, section 6(1A) are the new amendments in the FY22 budget regarding deemed residents.

- Further, section 6(2) mentions the residential status of HUF, firms, AOP, and BOI.

- Then, section 6(3) mentions the residential status of a company.

- Lastly, section 6(4) mentions the residential status of others.

Residential Status of Individuals

Section 6(1)- Basic Conditions

An individual becomes a resident in India if he fulfils any one of the below conditions:

- The individual stays in India for 182 days or more in the previous year (2021-22).

OR

2. (a) The individual stays in India for at least 60 days in the previous year (2021-22)

AND

(b) Moreover, the individual stays in India for at least 365 days in the last four years, excluding the previous year (2020-21, 2019-20, 2018-19, and 2017-18).

However, if an individual does not satisfy both the conditions, he is a non-resident.

Exceptions

The following individuals will be residents in India only if their stay is for 182 days or more. However, the second condition does not apply to them:

- When an Indian citizen leaves India during the previous year for employment outside India or as a crew member of an Indian ship.

- Further, when an Indian citizen or person of Indian origin pays a social visit to India in the previous year. Also, he must have a business or employment outside India.

- Lastly, an Indian citizen or person of Indian origin pays a visit to India in the previous year and has an Indian income of 15 lakhs or more in the previous year. Additionally, he stays in India for 120 days or more in the previous year to become a Resident of India. Lastly, he must have business or employment outside India.

Moreover, person of India origin means the individual or his parent or his grandparents (maternal and paternal) were born in undivided India.

Section 6(1A)- Deemed Resident

When a person does not fulfil the conditions in section 6(1) but satisfies all the three conditions in section 6(1A), he is a Deemed Resident. A Deemed Resident falls under the category of Resident but not Ordinarily Resident. The three conditions are:

- Firstly, the individual is an Indian citizen.

- Secondly, the Indian income for the previous year (2021-22) is not less than 15 lakhs.

- Lastly, the individual is not liable to pay any taxes outside India.

Section 6(6)- Additional conditions for ordinarily resident

If an individual is a Resident of India, there are more conditions to determine whether he is an ordinarily resident or not. To know the same, one must satisfy both the below conditions:

- The individual is in India for 730 days or more in the last seven years, excluding the previous year. (2020-21, 2019-20, 2018-19, 2017-18, 2016-17, 2015-16, and 2014-15)

AND

- The individual is a Resident for any two out of the last ten years, excluding the previous year. (2020-21, 2019-20, 2018-19, 2017-18, 2016-17, 2015-16, 2014-15, 2013-14, 2012-13, and 2011-12). From these last ten years, he should have stayed in India for at least 182 days (Resident) in any two years.

If either of the condition is not satisfied, a person is a resident but not ordinarily resident. And if both the conditions are satisfied, a person is a resident and ordinarily resident.

Residential Status of HUF, company, firm, and others

- Section 6(2) mentions that HUF, AOPs, BOIs, and firms are Resident in India in the previous year in every case except when the management and control of business affairs are wholly outside India.

- Further, section 6(3) covers the residential status of a company. A company is a Resident in India in the previous year, if:

- Firstly, it is an Indian company

- Secondly, its place of effective management is in India in the previous year. Place of effective management means a place where key decisions and management take place, which is significant for the conduct of a business.

- Lastly, any other person is the Resident in India in the previous year in every case except when the management and control of business affairs are wholly outside India.

Illustration of Residential Status in India

Mr Singh, a German citizen (not a person of Indian origin) is a visiting faculty at ABC University. He provides you with the details of his visit to India during the last nine years.

| Previous Year | No. of Days stay in India |

| 2021-22 | 150 |

| 2020-21 | 79 |

| 2019-20 | 195 |

| 2018-19 | 206 |

| 2017-18 | 140 |

| 2016-17 | 180 |

| 2015-16 | 185 |

| 2014-15 | 105 |

| 2013-14 | 200 |

Before 1st April 2013, he did not visit India. Find out his Residential Status for A.Y. 2022-23.

Solution of the illustration

Basic Conditions:

An individual becomes a resident in India if he fulfils any one of the below conditions:

- The individual stays in India for at least 182 days in the previous year (2021-22).

OR

2. (a) The individual stays in India for at least 60 days in the previous year (2021-22)

AND

(b) Moreover, the individual stays in India for at least 365 days in the last four years, excluding the previous year (2020-21, 2019-20, 2018-19, and 2017-18).

Mr Singh was in India for more than 60 days in the previous year, 2021-22. Moreover, in the past four years, he was in India for 620 days (79+195+206+140).

Mr Singh has satisfied the 2nd Basic condition under section 6(1). Hence, he becomes a Resident in India for the previous year 2021-22.

Additional Conditions:

If an individual is a Resident of India, there are more conditions to determine whether he is an ordinarily resident or not. To know the same, one must satisfy both the below conditions:

- The individual was in India for 730 days or more in the last seven years, excluding the previous year. (2020-21, 2019-20, 2018-19, 2017-18, 2016-17, 2015-16, and 2014-15)

AND

- The individual is a Resident for any two out of the last ten years, excluding the previous year. (2020-21, 2019-20, 2018-19, 2017-18, 2016-17, 2015-16, 2014-15, 2013-14, 2012-13, and 2011-12). From these last ten years, he should have stayed in India for at least 182 days in any two years.

In the last seven years, Mr Singh was in India for 1090 days (79+195+206+140+180+185+105). Also, he was the Resident in India in the previous year, 2019-20 and 2018-19.

Mr Singh has satisfied both the additional conditions under section 6(6). Hence, he becomes a Resident and Ordinarily Resident for the previous year 2021-22.