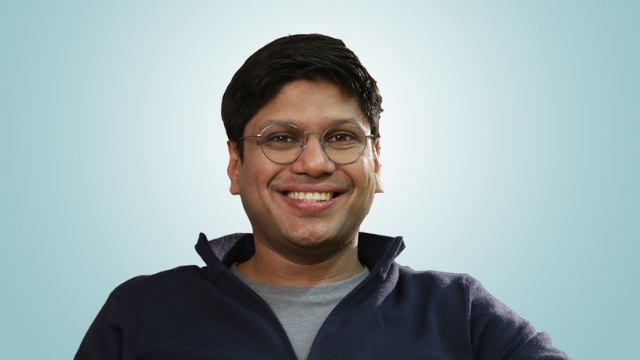

Vinay paharia is the Chief Investment Officer at Union Mutual Fund. Union Mutual Fund has a total AUM of more than Rs.8000cr. He manages the investment process at the fund house, to deliver sustainable and consistent investment outcomes for our investors while remaining true to mandate. All the mutual funds, irrespective of their market capitalization and ETF are headed by him.

Background

Mr. Paharia holds a B.Com degree from Narsee Monjee College and an M.M.S. degree from Welingkar Institute of Management, Mumbai. Prior to joining Union Mutual Fund he was associated with Invesco Asset Management Company, L&T Mutual Fund, K R Choksey Shares and Securities Pvt Ltd (Jan 2004-Jan 2006), First Global Stock broking Pvt. Ltd (Jun 2002-Jan 2004). He has an experience of around 17 years. He is ranked at 33rd out of 140 CIO’s around the country.

Equity Detailing (UNION)

| Asset Type | Instrument Name | Industry | Net Assets(%) | No of Shares | Mkt Value(Cr.) |

| Equity | Infosys | Software | 7.90 | 194,252.00 | 36.67 |

| Equity | Reliance Industr | Petroleum Products | 7.53 | 147,609.00 | 34.96 |

| Equity | ICICI Bank | Banks | 6.48 | 406,268.00 | 30.07 |

| Equity | HDFC Bank | Banks | 5.79 | 181,898.00 | 26.91 |

| Equity | Larsen & Toubro | Construction Project | 2.96 | 72,588.00 | 13.76 |

| Equity | Kotak Mah. Bank | Banks | 2.95 | 76,268.00 | 13.70 |

| Equity | Bajaj Finance | Finance | 2.91 | 19,398.00 | 13.53 |

| Equity | Bharti Airtel | Telecom – Services | 2.89 | 196,056.00 | 13.41 |

| Equity | Avenue Super. | Retailing | 2.77 | 27,512.00 | 12.85 |

| Equity | L & T Infotech | Software | 2.49 | 15,771.00 | 11.56 |

| Equity | UltraTech Cem. | Cement & Cement Products | 2.38 | 14,560.00 | 11.05 |

| Equity | H D F C | Finance | 2.36 | 42,429.00 | 10.97 |

| Equity | St Bk of India | Banks | 2.22 | 224,052.00 | 10.32 |

| Equity | Wipro | Software | 2.17 | 141,000.00 | 10.09 |

| Equity | Persistent Sys | Software | 1.95 | 18,495.00 | 9.07 |

| Equity | Varun Beverages | Consumer Non Durables | 1.63 | 85,402.00 | 7.59 |

| Equity | Tata Power Co. | Power | 1.57 | 329,403.00 | 7.28 |

| Equity | Muthoot Finance | Finance | 1.52 | 47,068.00 | 7.04 |

| Equity | Titan Company | Consumer Durables | 1.52 | 27,901.00 | 7.04 |

| Equity | Gland Pharma | Pharmaceuticals | 1.50 | 18,015.00 | 6.96 |

| Equity | United Spirits | Consumer Non Durables | 1.41 | 73,023.00 | 6.56 |

| Equity | Piramal Enterp. | Finance | 1.30 | 22,829.00 | 6.04 |

| Equity | Divi’s Lab. | Pharmaceuticals | 1.29 | 12,781.00 | 5.98 |

| Equity | NTPC | Power | 1.22 | 454,045.00 | 5.65 |

| Equity | Maruti Suzuki | Auto | 1.22 | 7,601.00 | 5.64 |

| Equity | Max Healthcare | Healthcare Services | 1.20 | 126,000.00 | 5.58 |

| Equity | Shree Cement | Cement & Cement Products | 1.20 | 2,060.00 | 5.56 |

| Equity | Asian Paints | Consumer Non Durables | 1.16 | 15,860.00 | 5.37 |

| Equity | SBI Life Insuran | Insurance | 1.14 | 44,359.00 | 5.31 |

| Equity | P I Industries | Pesticides | 1.13 | 17,333.00 | 5.26 |

| Equity | Tube Investments | Auto Ancillaries | 1.12 | 29,728.00 | 5.22 |

| Equity | WABCO India | Auto Ancillaries | 1.12 | 6,123.00 | 5.20 |

| Equity | Minda Industries | Auto Ancillaries | 1.09 | 41,199.00 | 5.05 |

| Equity | Devyani Intl. | Leisure Services | 1.03 | 290,000.00 | 4.79 |

| Equity | Hindalco Inds. | Non – Ferrous Metals | 0.91 | 89,091.00 | 4.24 |

| Equity | KNR Construct. | Construction | 0.90 | 139,533.00 | 4.18 |

| Equity | Dixon Technolog. | Consumer Durables | 0.87 | 7,333.00 | 4.04 |

| Equity | Krishna Institu. | Healthcare Services | 0.86 | 28,000.00 | 3.99 |

| Equity | Tata Consumer | Consumer Non Durables | 0.82 | 51,000.00 | 3.79 |

| Equity | Prestige Estates | Construction | 0.80 | 78,090.00 | 3.71 |

| Equity | L&T Technology | Software | 0.78 | 6,456.00 | 3.61 |

| Equity | B P C L | Petroleum Products | 0.77 | 92,786.00 | 3.58 |

| Equity | Sona BLW Precis. | Auto Ancillaries | 0.77 | 47,921.00 | 3.56 |

| Equity | CreditAcc. Gram. | Finance | 0.75 | 58,174.00 | 3.48 |

| Equity | Sumitomo Chemi. | Pesticides | 0.75 | 89,877.00 | 3.47 |

| Equity | Phoenix Mills | Construction | 0.74 | 34,910.00 | 3.44 |

| Equity | Greaves Cotton | Industrial Products | 0.73 | 247,428.00 | 3.41 |

| Equity | Pidilite Inds. | Chemicals | 0.72 | 13,650.00 | 3.36 |

| Equity | Tata Steel | Ferrous Metals | 0.72 | 29,913.00 | 3.32 |

| Equity | Schaeffler India | Industrial Products | 0.70 | 3,720.00 | 3.27 |

| Equity | FSN E-Commerce | Retailing | 0.69 | 15,156.00 | 3.19 |

| Equity | 3M India | Consumer Non Durables | 0.68 | 1,239.00 | 3.14 |

| Equity | Honeywell Auto | Industrial Capital Goods | 0.68 | 744.00 | 3.14 |

| Equity | Deepak Nitrite | Chemicals | 0.67 | 12,513.00 | 3.12 |

| Equity | Interglobe Aviat | Transportation | 0.63 | 14,548.00 | 2.94 |

| Equity | CSB Bank | Banks | 0.59 | 117,000.00 | 2.75 |

| Equity | Indiamart Inter. | Retailing | 0.59 | 4,215.00 | 2.73 |

| Equity | PB Fintech. | Financial Technology (Fintech) | 0.57 | 28,000.00 | 2.6 |

Accolades

- Vinay has been thrice awarded as “Best Fund Manager” for featuring amongst top 10 Fund Managers in India by Outlook Business-Value Research Study.

- Invesco Multicap Fund, managed by him for almost 10 years was also awarded “Lipper Best Fund” by Thomson Reuters.

Conclusion

As the article showcased all the necessary information regarding vinay paharia. He is one of the best portfolio manager in the country.