We are all, in one way or the other, addicted to technology. While some of us see it as a way to stay in touch with their loved ones, others use it as tools for education, information sharing, and research. Technological advancements have brought new gadgets and tools, but they always come with the heavy price tag. We shall explore a different possibility. What if, when these gadgets came out, you bought the company’s stocks (for example, Apple) instead of the product?

APPLE’S SUCCESS

The market cap of Apple crossed $2 trillion in 2020, making it the world’s most valuable company. Its market cap is bigger than the combined market cap of all BSE 500 companies and twice as big as that of the 30 share Sensex. Since August 2019, Apple shares have more than doubled in value and it has given annualised returns of 32% in the past 10 years. Moreover, the appreciation of the dollar has added to the gains of investors in other countries such as India.

The cost of Apple’s iPhone X debut did at an all-time high of $1000. This is enough to spend nine days at Disneyland or take a premium cruise through the Carribean. However, if you had invested that amount in the Apple stock in 2010, about 10 years ago, you have 6228 dollars, which is enough to buy six of these iPhone Xs and still have room in the budget for a trip and a cruise.

iPad

The first iPad was released in 2010 and it cost $499. If at that time you had used the money to buy the Apple stock instead, you would have $3000 right now, which is a profit of around 500%.

iPhone

The first iPhone was released in 2007 and this too, cost $499. If you had bought the Apple stock at that time instead, you’d have $5700 today which is around 1000% profit.

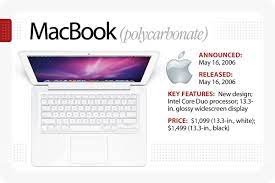

MacBook

The first MacBook base model was released in 2006 and cost $1099. Same money used to buy the Apple stock at that time would have left you with $22500 today. That is 2000% profit.

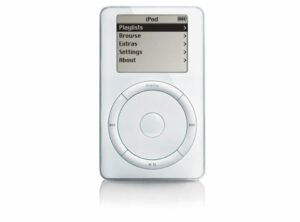

iPod

The entry-level model of the iPod which came out in 2001 cost three $99. This amount of Apple’s stock at the iPods release would now be worth $58,000. This is around 14,500% in profit.

These profit percentages are attractive but taking things to the extreme and picking only one of the two possible choices is not likely be beneficial in the long run. If you want to buy a product and explore its functionalities, do so. If you see a bright future for the brand making the device, do consider investing a bit in the stock. In this way, you are supporting the business as a consumer but also profiting from its success. If we all become consumers there is only one entity profiting on the other end. If we all become investors, there will be no one to buy the product and the stock value will fall. Hence it is important for us to explore both possibilities and balance them out.