Travelling, whether for personal or professional reasons, frequently necessitates manoeuvring through the frenetic environment of airports. One could seek solace in the tranquil atmosphere of airport lounges, thereby escaping the pandemonium. Although credit cards are frequently linked to this luxury, debit cards are progressively emerging as competitors in India by offering a variety of benefits, including complimentary lounge access and enticing rewards, in addition to convenience. With this comprehensive analysis, we examine the precise characteristics of the top airport lounge access debit cards currently accessible in India as of December 2023. These cards allow discerning cardholders to partake in various travel privileges that epitomise comfort and convenience. Explore the potential of these top airport lounge access debit cards to enhance your travel experience, regardless of your frequency of travel.

Top 10 Airport Lounge Access Debit Cards:

1. HDFC Bank Millennia Debit Card

This card is a delight for travellers, as it provides four complimentary visits to domestic lounges annually and has no annual charge. It offers lounge access and enticing rewards, such as a 5% cashback bonus on purchases and a significant accidental insurance policy.

Annual Fee: Nil

Lounge Access: Indulge in 4 complimentary domestic airport lounge visits annually.

Other Benefits:

Earn 5% CashBack points on shopping via PayZapp and SmartBuy.

Avail accidental insurance cover of up to Rs. 10 lakh.

Review: Tailored for the avid shopper and traveller, this card combines domestic lounge access with attractive rewards and insurance coverage.

2. HDFC EasyShop Platinum Debit Card

This no-annual-fee card accommodates various requirements and provides two complimentary visits to domestic lounges per quarter. In addition to lounge privileges, it includes insurance benefits, fuel surcharge waivers, and transaction reward points.

Annual Fee: Nil

Lounge Access: Revel in 2 complimentary domestic lounge visits per quarter.

Other Benefits:

Benefit from a fuel surcharge waiver and insurance benefits.

Earn reward points with every transaction.

Review: A versatile companion, this debit card opens the door to lounges and rewards your transactions across various spending categories.

3. SBI Platinum International Debit Card

This card grants complimentary access to domestic lounges in exchange for a nominal annual charge of Rs. 250, contingent upon service provider modifications. It is distinguished by its higher purchasing limit and extensive reward points programme across multiple categories.

Annual Fee: Rs. 250

Lounge Access: Enjoy complimentary domestic airport lounge access, subject to change.

Other Benefits:

Earn reward points on shopping, dining, fuel, travel booking, or online payments.

Enjoy a higher spending limit.

Review: A comprehensive offering for the globetrotter, providing lounge access, robust reward points, and an enhanced spending capacity.

4. Axis Bank Prestige Debit Card

This Rs 500 annual charge card grants one complimentary access to a domestic lounge per quarter and is designed for frequent merchants and travellers. It provides dining discounts, complimentary cinema tickets, and cashback on purchases and travel.

Annual Fee: Rs. 500

Lounge Access: Access 1 complimentary domestic lounge visit per quarter.

Other Benefits:

Get cashback on travel and shopping.

Enjoy dining discounts and a complimentary movie ticket via INOX.

Review: For the frequent traveller who seeks cashback rewards alongside the occasional relaxation in airport lounges.

5. YES Prosperity Platinum Debit Card

This card grants one complimentary access to a domestic lounge per quarter for an annual fee of Rs. 599. In addition to a waiver of petroleum surcharges, cardholders receive special discounts on cinema tickets and accommodations, travel, dining, and entertainment.

Annual Fee: Rs. 599

Lounge Access: Avail 1 complimentary domestic lounge visit per quarter.

Other Benefits:

Get discounts on movie tickets via BookMyShow.

Exclusive offers on dining, travel, and entertainment.

Review: Strikes a balance between lounge access and lifestyle perks, offering a spectrum of benefits for the discerning cardholder.

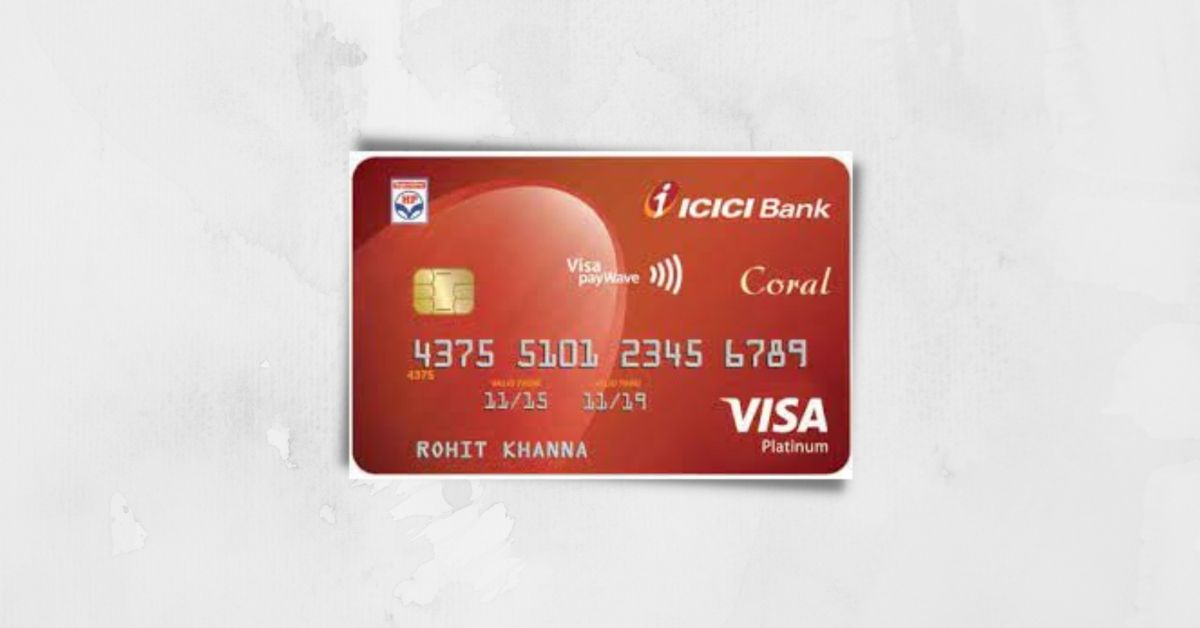

6. ICICI Bank Coral Paywave Contactless Debit Card

This contactless card charges an annual fee of Rs. 599 and provides two complimentary visits to domestic lounges every quarter. It is a contemporary and practical option due to its welcome perks, reward points, and movie ticket discounts.

Annual Fee: Rs. 599

Lounge Access: Enjoy two complimentary domestic lounge visits per quarter.

Other Benefits:

Welcome benefits in the form of gift vouchers.

Discounts on movie tickets and reward points on transactions.

Review: A futuristic touch with contactless convenience, providing welcome benefits, lounge access, and rewards.

7. Axis Priority Debit Card

This card grants complimentary access to lounges at select airports in India in exchange for an annual charge of Rs. 750. Furthermore, users receive various points and exclusive discounts on specific transactions.

Annual Fee: Rs. 750

Lounge Access: Access lounges at select airports across India.

Other Benefits:

Earn various reward points.

Exclusive discounts on select transactions.

Review: Prioritizes seamless travel with lounge access and exclusive perks, making it an ideal choice for those seeking a premium experience.

8. Kotak Privy League Signature Debit Card

Designed for privileged clients, this card offers one complimentary access to a domestic lounge per quarter for an annual charge of Rs. 750. Additionally, it provides the opportunity to enrol in the Priority Pass programme, which grants access to global lounges, exclusive promotions, and concierge services.

Annual Fee: Rs. 750

Lounge Access: Receive one free access to domestic lounges every quarter.

Other Benefits:

Option to apply for Priority Pass program for global lounge access.

Exclusive offers, concierge services, and air accident insurance.

Review: Tailored for the privileged, offering domestic lounge access, global privileges, and exclusive services.

9. ICICI Bank Sapphiro Debit Card

Situated as a premium card, this one imposes an annual charge of Rs. 1,499 and grants four complimentary visits to domestic lounges every quarter. The premium features include a waiver of fuel surcharges, reward points, and movie ticket discounts.

Annual Fee: Rs. 1,499

Lounge Access: Enjoy four complimentary domestic lounge visits per quarter.

Other Benefits:

Premium benefits, including reward points and discounts on movie tickets.

Fuel surcharge waiver on fuel transactions.

Review: Unveiling a world of premium benefits, this card caters to the discerning traveller, emphasising lounge access and rewards.

10. IDFC First Bank Visa Signature Debit Card

This card offers numerous advantages to its holders, including increased limits on cash withdrawals, compensation on transactions, and one complimentary visit to a domestic lounge per quarter. Additionally, it provides access to comprehensive insurance coverage and exclusive offers.

Annual Fee: Communicated at the time of sourcing

Lounge Access: Receive one complimentary domestic lounge visit every quarter.

Other Benefits:

Exclusive offers on various categories and air accident insurance.

It has enhanced cash withdrawal limits.

Review: A comprehensive offering with cashback incentives, exclusive privileges, and domestic lounge access for frequent travellers.

Benefits of Using Airport Lounge Access Debit Cards

HDFC Bank Millennia Debit Card:

Benefits: 4 complimentary domestic lounge visits, 5% CashBack on shopping, and accidental insurance coverage of up to Rs. 10 lakh.

HDFC EasyShop Platinum Debit Card:

Benefits: 2 complimentary domestic lounge visits per quarter, fuel surcharge waiver, and transaction reward points.

SBI Platinum International Debit Card:

Benefits: Complimentary domestic lounge access, reward points on shopping, dining, and travel, and a higher spending limit.

Axis Bank Prestige Debit Card:

Benefits: 1 complimentary domestic lounge access per quarter, cashback on travel and shopping, and dining discounts.

YES, Prosperity Platinum Debit Card:

Benefits: 1 complimentary domestic lounge access per quarter, discounts on movie tickets, and exclusive offers on dining, travel, and entertainment.

ICICI Bank Coral Paywave Contactless Debit Card:

Benefits: 2 complimentary domestic lounge visits per quarter, welcome benefits, and transaction reward points.

Axis Priority Debit Card

Benefits: Complimentary lounge access at select airports, various reward points, and exclusive discounts on particular transactions.

Kotak Privy League Signature Debit Card

Benefits: 1 free domestic lounge access per quarter, the option to apply for the Priority Pass program, exclusive offers, and concierge services.

ICICI Bank Sapphiro Debit Card

Benefits: 4 complimentary domestic lounge visits per quarter, premium features like reward points, discounts on movie tickets, and a fuel surcharge waiver.

IDFC First Bank Visa Signature Debit Card

Benefits: Enhanced cash withdrawal limits, transaction cashback, and one complimentary domestic lounge access per quarter.

Required Documents:

The specific document requirements may vary, but generally, you would need:

Proof of identity (Aadhar card, passport, etc.)

Proof of address (utility bills, Aadhar card, etc.)

PAN card

Passport-sized photographs

Bank statements or salary slips for income proof.

It’s advisable to check with the respective bank for precise documentation.

Conclusion

Preferential airport lounge access debit cards are comparable to custom-tailored suits, contingent upon the individual’s inclinations and routines. Frequent domestic travellers must seek solace in cards that feature more visits to domestic lounges. Those who have a particular interest in travelling internationally may find credit cards to provide access to a more extensive lounge network. Before committing, it is crucial to thoroughly evaluate each card’s annual fees, benefits, and overall value to ascertain that it harmonises effortlessly with your way of life and offers the most favourable experience among debit cards for airport lounge access.

FAQs

How many lounge visits are allowed per quarter with these debit cards?

The frequency of complimentary lounge visits is debit card-specific and can vary from one to four per quarter.

Are these cards suitable for international travel?

Specific credentials grant access to VIP lounges both domestically and internationally. For particular international privileges, consult the card’s information.

What additional benefits do these cards provide besides lounge access?

Further advantages encompass exclusive offers across multiple categories, such as dining and travel, compensation on transactions, and reductions on cinema tickets, in addition to reward points.

have multiple categories, the one selected here will be used for settings and