Introduction

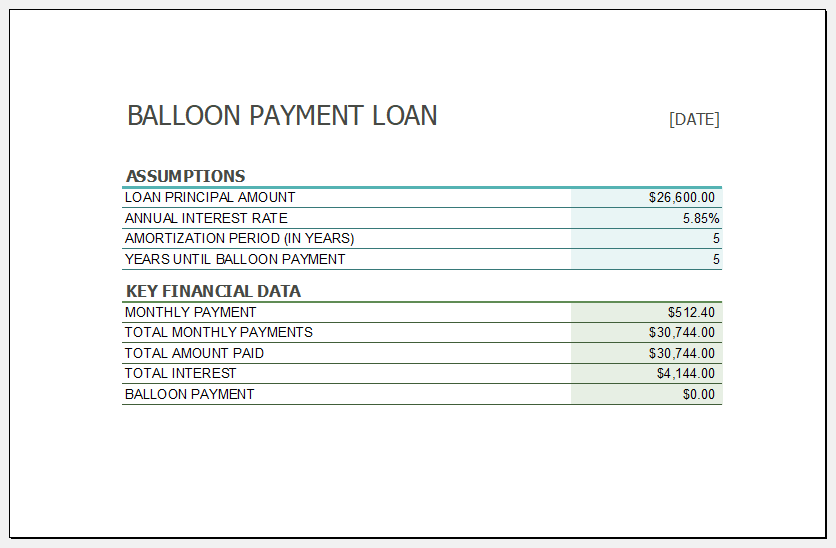

A balloon payment is a large amount of money that is paid at the end of a loan term. The balloon amount is enormous compared to the other installments paid at regular intervals. It refers to a sum of money due at the end of a loan like a mortgage, commercial, or business loan. The word “balloon” suggests that the final amount paid is quite larger than the other payments.

A balloon loan is the exact opposite of a fully amortized loan, as in fully amortized loans; the loan amount is paid back in small but equal payments.

In a balloon mortgage, there would be lower monthly payments compared to the traditional loans, plus it incorporates higher risk because of the lump-sum payment. Therefore, balloon mortgages are generally restricted to some of the most creditworthy and income-stable loan borrowers.

A balloon loan gives the debtor a choice to set the interest rate for the number of years they want to repay the loan. After that, the mortgage rearranges, and the balloon payment turns into a new or continuing remunerated mortgage at the current market rates at the end of that period. The debtor must pay timely installments.

Qualifications Required for Balloon Payments

The Regulation Z of the Truth in Lending Act necessitates that banks systematically examine a debtor’s ability to repay (ATR) before giving any loan. Several banks have traditionally worked about this with balloon loans because most customers have restricted making significant balloon payments. Some creditors, hence, didn’t incorporate these huge costs in their assessments as an alternative to establishing a buyer’s ATR on just the prior payments.

Advantages of Balloon payments

- A balloon mortgage helps “qualified home buyers” in financing their homes with low monthly mortgage payments. One of the common examples of balloon mortgage is interest-only home loans that let homeowners defer paying down principal for 5 to 10 years and just pay the interest payments. This does not burden an individual with amount of loan to be paid at a time.

- An individual can also qualify to have a higher amount loan if they have got an adjustable-rate or fixed-rate loan. This structure of the loan is advantageous if a person is planning to sell their home before the due date of the balloon payment, and they think they will earn a generous amount of profit on the home, also, for people who have sufficient capital to pay a large sum of money at the end of the loan period.

- Individuals who are not making enough money currently but expect to earn a higher amount soon can use this loan structure. The loan can create different businesses with a balloon payment.

Disadvantages of Balloon Payments

- People having loans with balloon payments carry a substantial risk as they do not have to pay much of the principal amount; they face a significant financial obligation at the end of the loan period. Individuals must attempt to refinance if they cannot pay the principal in one lump sum.

- If the interest rates have increased in the short term or the debtor’s credit rating has declined since the loan was issued, they may face loans with overpriced terms. Balloon payments can be a massive obstacle in a falling housing market. As house prices drop, homeowners’ chances of gaining positive equity in their homes also fall, and they might not be able to sell their homes for as much as they might have expected.

Also check this out:

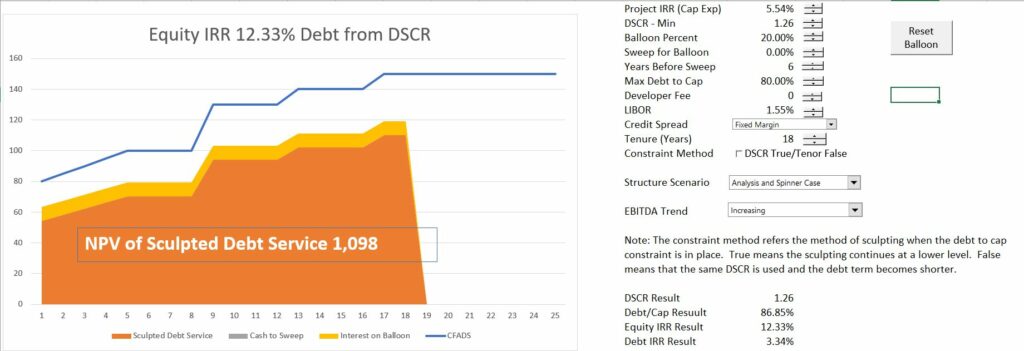

https://edbodmer.com/ballon-payments-and-sinking-funds/