Introduction

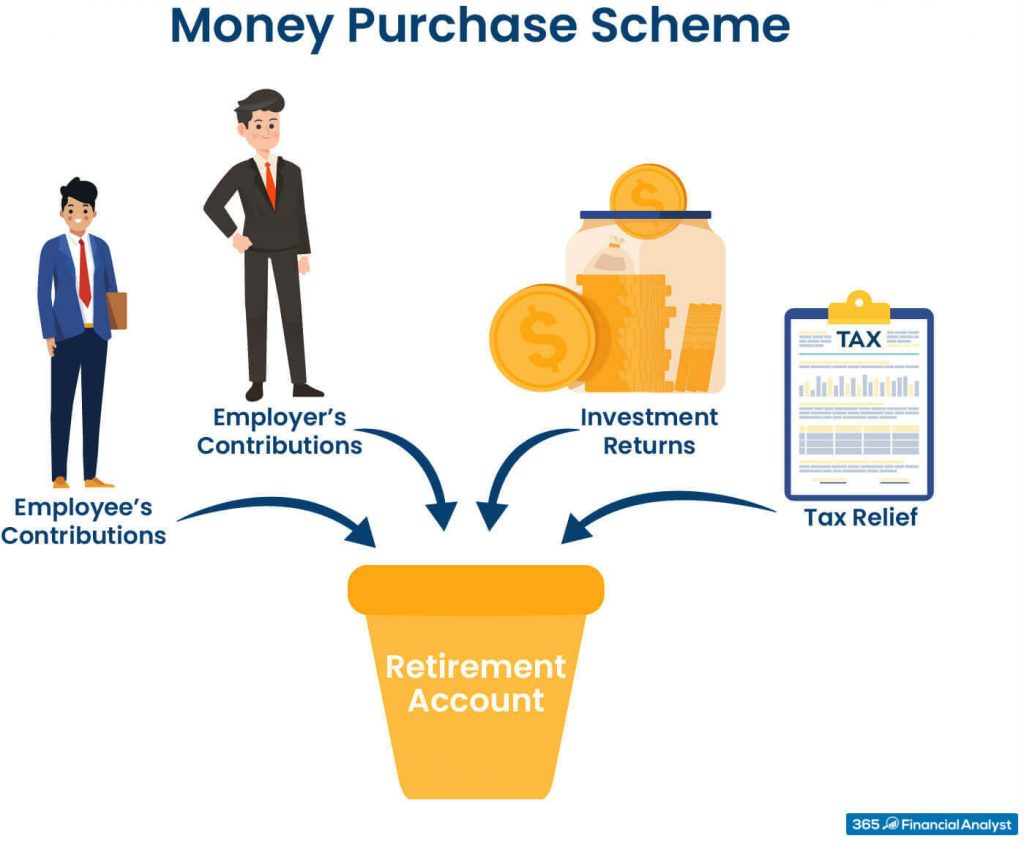

Money Purchase Pension Plans are the retirement plans provided by the employers to the employees, where some amount of the salary is transferred into the latter’s account irrespective to the company’s profitability. Because of this guaranteed contribution, money purchase plans can be attractive options for employers to attract and retain key employees, though they can be pricey for companies to maintain.

Employer contributions are tax deferred as long as the amounts are within annual limits. As with other defined-contribution plans, employee funds accumulate tax deferred until withdrawn. It’s important to note that employees are not given the option of contributing additional money to their own accounts. However, they are often allowed to choose which investments will be included in their accounts.

Money purchase plans are employer-sponsored, defined-contribution retirement plans, like 401(k)s and 403(b)s. As with other workplace retirement plans, contributions to money purchase plans grow tax-deferred, and employer contributions may be tax-deductible for the employer.

Money purchase plans differ from these more well-known plans in a few key ways:

• Contributions to a money purchase plan are primarily made by the employer, not the employee. Employees can choose how to invest contributions using the plan’s options. Some money purchase plans allow for employee contributions as well. When employee contributions are offered, employees may be required to contribute.

• Contributions to a money purchase plan are fixed on an annual basis. The plan documents state the percentage of an employee’s salary that the employer will contribute to the plan each year. Unlike a profit sharing plan or even certain 401(k) matches, employer contributions don’t change based on how profitable the company was throughout the year.

• Money purchase plans often have vesting schedules. Since the employer bears most or all of the contribution burden, companies want to make sure an employee doesn’t just take a job to rack up the employer contributions and run. A vesting schedule dictates when certain percentages of a money purchase plan will be available to an employee. Vesting is not an uncommon feature even among 401(k) plans, half of which require some amount of vesting for employer contributions.

Contribution limits have risen over the years for other plans, and there are simpler defined contribution plans available. As a result, most of the pluses of the money purchase/profit-sharing plan combination have decreased the general appeal of money purchase plans for employers. However, money purchase plans can still be an effective way for employees to save for retirement.

Pros and Cons of Money Purchase Plans

These plans offer both employers and employees some great advantages but also come with drawbacks.

Pros:

Tax Benefit

Payments made to money purchase plans are tax-deductible to the employer and tax-deferred for the employees.

Hiring Incentive

Money purchase plans offer a savings opportunity for employees and can be a unique selling point in a competitive hiring market.

Steady Payment

Money purchase plans have to offer a steady value to workers in the form of a life annuity, usually as a monthly benefit over your lifetime.

Larger Bank Balance

The required contribution by the employer means that money gets funneled into each employee’s account on an annual basis.

Cons:

Administrative Costs

They tend to come with higher costs, compared with simpler defined contribution plans.

Top heavy Test

If a plan looks like it favors people who make more money, you could lose your qualified plan status and the tax benefits that come along with it.

Excise Tax

Firms must pay an excise tax if they don’t meet the minimum funding standard.

Required Payments

The required contribution rate puts firms on the hook for payments even when profits are low, which can put a financial squeeze on a firm during difficult times.

Money Purchase Plan vs. 401(k)

| Money Purchase Plan | 401(k) |

|---|---|

| Employers must add a set amount of employees’ pay. | Employers may elect to match a percentage of funds employees add to the account. |

| Employee inputs may be allowed but are not required. | Employees may elect to put money into an account, but they don’t have to. |

| Offers tax advantages. | Offers tax advantages. |

| Total payments in one year may not go over $57,000 for 2021 and $58,000 for 2022. | Total inputs limited to $57,000 for 2021 and $58,000 for 2022. |

| Payments must meet a yearly minimum to avoid an excise tax. | Payment limit goes up to $63,500 for catch-up amounts. |

Termination

Employees who terminate their membership have the option of transferring funds to either a LIRA or purchasing a life annuity.

To speed up the transfer process, employees may waive their right to receive a termination or retirement statement, and choose the transfer option immediately upon termination of employment.

Disclosure by the Financial Institution

The financial institution administering the MPPP is responsible for providing an annual member statement, and statements upon death, retirement, and termination.

Conclusion

These plans can be powerful incentives to choose one company over another, all else being the same, and money purchase plans can add strength to your retirement savings plan.