Introduction

The platform provides insights about mutual funds, systematic investment planning, equity-linked savings, and everything from the personal finance world, which helps new investors make investing simple by maintaining a simplified user interface to make investing easy, accessible, transparent, and paperless, enabling users to invest in mutual funds without any hassles.

The Founding team believed that investments in financial products in India are very complex and non-transparent after they started researching the Indian financial sector for interested consumers by spending a lot of time learning about the markets and identifying what are the problems users were facing. They had to conduct numerous tests to determine the best user experience. Since it user’s hard-earned money was at stake, they had to provide a secure solution that took some time to develop.

Groww follows a DIY (Do It Yourself) model for its users, in which investors establish and manage their own investment portfolios individually without any third party, which is preferred by most GenC’s. Also, Groww offers e-books, resources, and blogs that provide stock market basics and updates to help investors make better decisions.

Competitors Of Groww

Groww’s biggest competitors are Upstox, Zerodha, Upstox, IIFL, Finvasia, Angel Broking, SAS Online, Sharekhan, Edelweiss, and Karvy Stock Broking.

Comparison of Groww with its major competitors :

- Zerodha is the largest stockbroker in India with over 6 million active investors.

- Upstox– They offer almost identical services and a similar brokerage framework

- 5pasia– They offer the same services as 5pasia but their cost is different because they offer trading without brokerage fees. 5paisa offers a better service and charges a lower brokerage fee (INR.10 per order flat rate)

- Flyers – In this case, the services and pricing structure are the same as Zerodha. However, they offer a completely free API.

- Angel Broking offers similar services but with a much larger profit margin.

Groww Revenue

The company’s profits increased 4.7 times To over Rs 1 crore in FY20 from Rs 20.14 lakhs in FY19. Operating income increased 3.25 times to Rs 52.05 lakhs, with financial assets making an additional contribution of Rs 48.24 lakhs.

The Y Combinator-backed company saw a respectable increase in earnings but still lags behind its competitors Zerodha and Upstox, which generate earnings of Rs 1,094 crore and Rs 148 crore respectively. Groww earned a total of Rs 1 crore in FY20, while ET Money earned a total of Rs 2.24 crore.

For a fintech company like Groww, the first thing to keep in mind is to expand the customer base. Groww leverages technology to reach the proper target audience, which lowers its operating costs. People rarely switch between these types of applications. As a result, once the correct customer base has been established, they are likely to stick with you for the long haul.

They are expanding rapidly but the founders of Groww have taken the company to unicorn status. They recently received money and were named a unicorn startup.

Groww is expanding fast and has also achieved unicorn status in April 2021. The company closed an $83 million worth of its Series D funding round led by Tiger Global Management, which helped it turn into a unicorn startup.

Groww business model

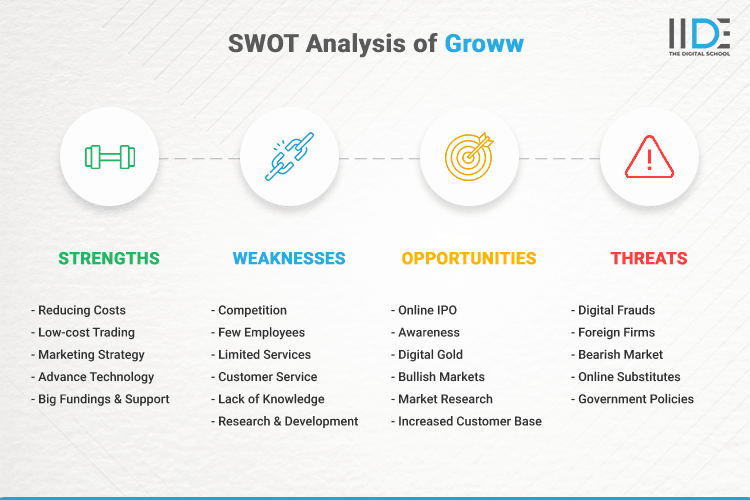

SWOT Analysis

Strengths of Groww

- Low-cost Trading: Financial services are supplied remotely via the internet. The organization keeps operational costs low by using an online business model. It offers free direct investments in mutual funds, stocks, initial public offerings, digital gold, and exchange-traded funds.

- Big Fundings & Support: Big companies like Insignia Ventures Partners, Lightbridge Partners, Kairos and others have invested in Groww, making it a safe and reputable online investment platform.

- Advance Technology: Investors with web/desktop, Android, and iOS software systems can use Groww’s HTML-based trading solutions. The corporation has made major technological investments. It offers its consumers an outstanding trading platform and tools.

- Marketing Strategy: Groww started its operations through a WhatsApp group and other social media platforms engaging with members on topics relating to investing and wealth management.

Weaknesses of Groww

Weaknesses are the areas Groww can work upon. Some of Groww’s weaknesses are:

- Few Employees: The number of employees in the company is very low. As the company is getting bigger day by day it is not possible to handle with fewer employees.

- Limited Services: Groww has fallen short of delivering several services or features that its competitors provide. Some of these include making IPO and FPO investments; moreover, it does not provide API access for automated trading.

- Lack of Knowledge: There are still people who are unaware of trading in various sections of the country. It does not provide stock recommendations or ideas, which could make a beginner trader’s experience more difficult.

- Competition: Mutual funds and stocks trading is a competitive market. Firms are up against fierce rivalry, which is inherent in every business. Groww must focus on overcoming the strain of competition and standing out from the crowd.

Opportunities for Groww

Opportunities are uncontrollable external circumstances that a person may be able to take advantage of. These external factors could give the company an advantage in the marketplace. Opportunities for Groww are:

- Market Research: By thoroughly researching market circumstances, the company may take advantage of the opportunity to provide customized mutual funds and brokerage services while also improving the existing investor experience.

- Awareness: With shifting educational reforms and government regulations aimed at educating investors and raising trading awareness among the general public, there is a growing opportunity for mutual funds and stock brokerage firms.

- Bullish Markets: Because every investor is drawn to bullish markets, they provide a good opportunity for firms.

- Digital Gold: The company offers a new plan of investing in digital gold. As all the other companies will be focusing on hand-gold, this company is focusing on this type of investment which is going to be fruitful in future.

Threats to Groww

Threats are those factors that have the potential to provide harm to the organisation in any form. The threats of Groww are as follows:

- Online Substitutes: Because firms can enter and quit an industry with few limitations, the number of substitutes in the same product line at different prices poses a risk of losing the investor base.

- Digital Frauds: With the advancement of the digital era, there has been an increase in the number of occurrences of cybercrime. Because the firm’s operations are conducted entirely online, there is a greater risk of fraud and the loss of the personal information of investors.

- Foreign Firms: Foreign companies tend to attract local investors, putting pressure on Indian companies to lose market share.

- Bearish Market: The inherent nature of stock markets poses the greatest danger to stockbroker companies like Groww. Bearish market conditions pose a significant risk because no investor wants to trade in such circumstances.

Conclusion

As most people are moving to online investments and lots of competitors are emerging in the industry it is very important to have a proper marketing strategy for the company to pull the customers to invest in its company.