Introduction

Livspace, is a home interior and renovation company head-quartered in Singapore. It provides interior design and renovation services in Singapore and India. The company was founded in 2014 by Anuj Srivastava and Ramakant Sharma and has raised a funding of $200 million. The business Plan of Livspace involves business model, SWOT Analysis, revenue model and many more.

Livspace is a personalized home design and décor marketplace that connects interior designers, vendors, and customers. It allows users to discover and customize designs and styles, place the order and get the requirements delivered.

The company takes care of the design and installation and everything in between to transform the living experience.

Livspace operates as a three-sided marketplace, connecting homeowners with designers and suppliers of home design products and services.

Livspace earns mainly through the sale of its design services and handling fees. The company also makes some income from two other sources – traded goods and software development services.

Competitors

Livspace company’s top competitors include:-

- At Home Group

- Pepperfry

- Urban Ladder

- Flipspaces Design Labs

- RentoMojo

- Stokers

- HomeLane

Revenue Model

Livspace has raised a total of $431.4M of funding in over 10 rounds of funding. The latest funding of the company was raised on February 8, 2022, when it raised its $180 mn worth of Series F funding round led by KKR, Ingka Ventures and Jungle Ventures among others. This round enabled the company to reach a unicorn valuation.

The previous round was a 60 million dollar round led by Saint Gobain and others. It saw a Debt Financing before that, where the company has raised around Rs 30 crores ($4 mn) led by Trifecta Advisors. Livspace is funded by 17 investors. Trifecta Capital Advisors and Mercer Investments are the most recent investors. TPG Growth and Goldman Sachs are among the big names when it comes to the financial backers of Livspace.

The company was looking to further raise an amount of more than $200 million in its upcoming round, which finally materialized on February 7, 2022, when it raised around $180 mn.

Livspace company’s losses grew to INR 145.5 Cr, a 53.5% Y-o-Y increase in FY19. With revenue of INR 80.17 Cr in the year, Livspace saw 96.3% growth in income.

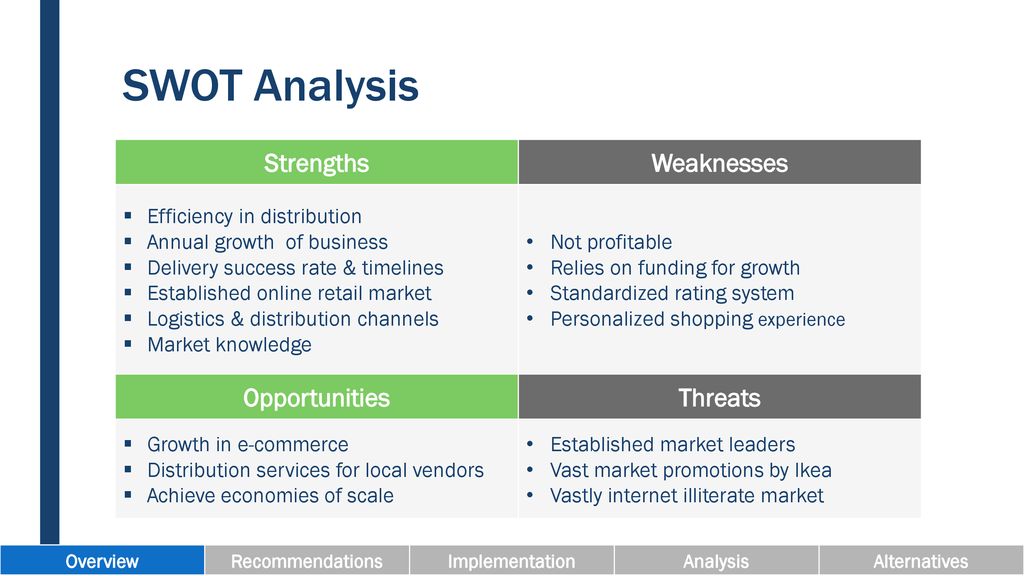

SWOT Analysis

Strengths

- Focus on furnishings and home décor: The main focus of livspace is to revolutionize the user experience by providing renovation sort of facilities through the basis of online network.

- Curated platform of carefully selected products: The main products of the startup are furnishings and modular home decors.

- Built supplier ecosystem: The creation of a great network of suppliers.

- Strengthened supply chain

- Experience center.

- Online Retail Stores and Physical Stores.

- Market Knowledge: The startup deals with consumer based goods and provide inexpensive goods and after sales services.

Weakness

- Abandon trusted local furniture: The typical practice of not adopting the innovation and continuing with the traditional practices of going to the physical stores of expensive purchases.

- skepticism about quality, delivery and assembly: The practice of underestimation of the products as the physical verification of the products hasn’t done.

- Usual e-commerce concerns.

Opportunities

- Only 5.5M customers of 30M target market are regular customers: The possibilities of having a good customer base is very large.

- Competition helps build excitement about furniture: The competition with IKEA is pretty huge which makes it hard for the startup to gather the estimate user base, but due to its previous success, theirs a possibility of acquiring a huge market share.

- Launch of Privilege program to partner with designers: The increment of employment for the creative people.

- Growth in e-commerce.

- Economies of scale.

Threats

- Increasing International entrants in the market: The presence of IKEA is notable, but livspace had the first mover advantage in the online marketspace.

Conclusion

The mix of skills has the potential to create a strong competitive edge for Livspace, allowing it to expand its leading position, penetrate new markets, and widen its products over time.